What is a Beneficial Owner and How to Declare It in Romania

What is a Beneficial Owner and How to Declare It in Romania

A recent study found that many of Romanian companies don’t follow beneficial ownership rules.

Romania is working hard to fight money laundering and terrorist financing.

Knowing who the beneficial owner is and how to declare it is key for businesses there.

The beneficial owner, or ultimate beneficial owner (UBO), is the person who really owns or controls a company.

In Romania, Law No. 129/2019 requires companies to reveal their beneficial owners.

This is to boost corporate transparency and follow anti-money laundering (AML) rules.

If a company doesn’t declare its beneficial owner correctly, it could face big fines or even be shut down.

So, it’s vital for business leaders to grasp the rules about declaring beneficial owners in Romania.

They must follow these steps to stay in line.

Key Takeaways

- Beneficial owner refers to the individual who ultimately owns or controls a company;

- Romanian law requires companies to declare their beneficial owners for transparency;

- Non-compliance with beneficial ownership declaration can lead to hefty fines and company dissolution;

- Understanding the legal framework is key for businesses in Romania;

- Proper declaration of beneficial owners ensures AML compliance and prevents sanctions.

Understanding Beneficial Ownership in Romania

Understanding beneficial ownership is key in fighting financial crimes and boosting corporate transparency.

Romania has joined many countries in making companies reveal who really owns them.

This part will explain what a beneficial owner is and why knowing who they are matters in Romania.

Definition of Beneficial Owner

A beneficial owner is the person who really controls a company, even if they don’t own it directly.

They might have a big share of the company or decide who runs it.

This person can hide behind complex structures like shell companies or trusts.

Importance of Beneficial Ownership Transparency

Knowing who owns a company is vital to stop crimes like money laundering and tax evasion.

By making companies reveal their owners, governments can keep an eye on money flows.

This also makes sure all businesses compete fairly.

Transparency is even more critical for offshore companies, where true owners are often hidden.

Romania’s goal is to create a registry that shows who really owns these companies.

This move aims to cut down on financial crimes and increase economic openness.

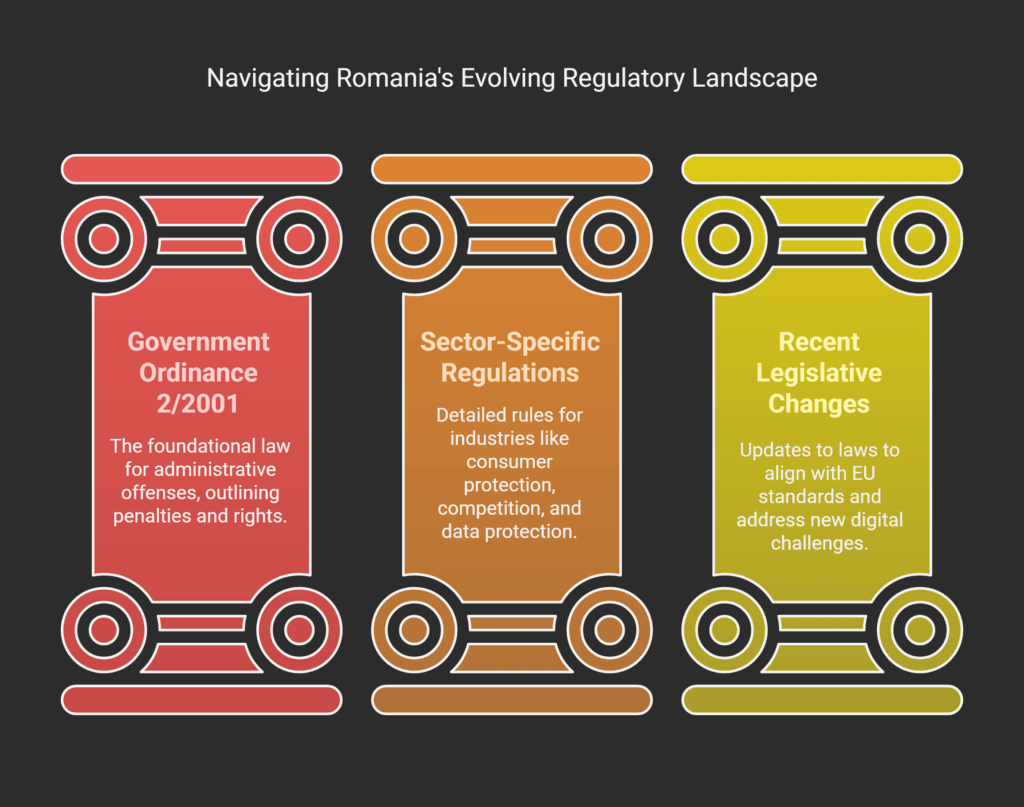

Legal Framework for Beneficial Ownership Declaration in Romania

Romania has a strong legal framework to fight money laundering and ensure transparency.

Law No. 129/2019 is the main law for this. It has been updated by Law No. 315/2021.

Law No. 129/2019 on Preventing and Combating Money Laundering

Law No. 129/2019 is key for beneficial ownership in Romania.

It requires all legal entities to tell the Trade Register who owns them.

This includes anyone with more than 25% of the company’s shares or voting rights.

Companies must report their beneficial owners when they start and when ownership changes.

Not doing this can lead to big fines or even closing the company.

Amendments Introduced by Law No. 315/2021

In 2021, Romania updated its laws on beneficial ownership.

Law No. 315/2021 made these changes to meet EU standards.

Now, companies with shareholders from high-risk countries must report their beneficial owners every year.

This helps fight money laundering.

The new law also made it clear what information must be in the beneficial ownership report.

This includes names, dates of birth, and ID details.

These changes help authorities check who really owns a company.

Obligations for Legal Entities Registered with the Trade Register

Legal entities in Romania must follow rules to ensure financial transparency.

They need to declare who really owns them.

This is key for keeping accurate records and following “know your customer” rules.

Submitting the Beneficial Owner Statement upon Incorporation

When a new Romanian legal entity is formed, it must submit a beneficial owner statement.

This statement should have certain details:

- Name, date of birth, and personal identification number of the beneficial owner(s);

- Citizenship and country of residence of the beneficial owner(s);

- Nature and extent of the beneficial interest held.

Or, this info can be in the entity’s founding documents.

Updating the Statement Whenever Changes Occur

Legal entities must update their beneficial owner statement within 15 days of any changes.

This keeps the ownership records up to date.

Changes that need an update include:

- Transfer of shares or ownership interests;

- Appointment or removal of beneficial owners;

- Changes in the personal details of beneficial owners.

Annual Statement Requirements for Entities with Shareholders from Specific Jurisdictions

Entities with shareholders from high-risk areas must report annually.

This is even if there are no changes in the year.

This annual report helps keep things transparent.

It also helps fight financial crimes by tracking entities linked to risky places.

By meeting these requirements, legal entities in Romania help keep the beneficial ownership register strong.

This supports the country’s fight against financial crimes and boosts transparency.

Jurisdictions with Fiscal and Money Laundering Risks

When it comes to setting up a company in Romania, some places are seen as high-risk.

This is because they don’t cooperate well with tax laws or are linked to money laundering.

The Financial Action Task Force (FATF) watches these places closely.

They set rules to fight money laundering worldwide.

Companies with owners from these risky places have to report more under Romanian laws.

This is to make things clearer and stop bad uses of companies.

Trusts and other setups from these places also get checked more often.

This is to make sure they follow rules about who really owns them.

The table below lists some of the jurisdictions that are currently considered high-risk from a fiscal or money laundering perspective:

| Jurisdiction | Risk Category |

|---|---|

| Panama | Tax haven, money laundering |

| British Virgin Islands | Tax haven, money laundering |

| Cayman Islands | Tax haven, money laundering |

| Iran | Terrorist financing |

| North Korea | Money laundering, terrorist financing |

Companies with owners from these places must follow stricter rules in Romania.

Not following these rules can lead to big fines and harm to their reputation.

Getting help from a lawyer in Romania is a good idea to understand the rules about who owns a company.

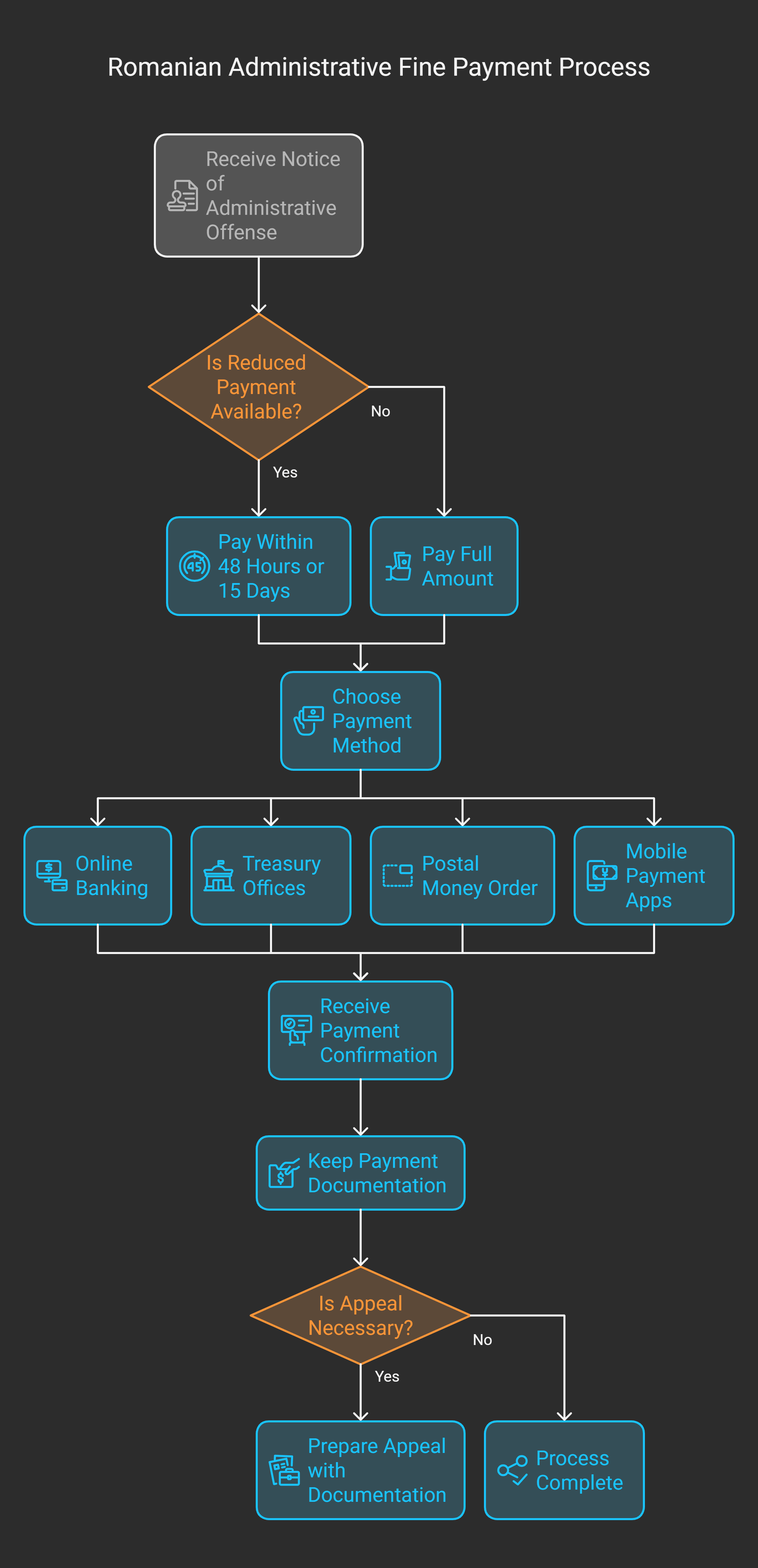

Deadline for Submitting the Annual Beneficial Owner Statement

In Romania, companies must follow strict deadlines for their annual beneficial owner statements.

This is key for keeping corporate information transparent and following know your customer (KYC) rules.

If they miss these deadlines, the company could face big problems.

By law, companies in Romania have to send in their annual beneficial owner statement after they approve their financial statements.

This keeps the transparency register current and shows who really owns the company.

15 Days after Approval of Annual Financial Statements

Companies have 15 days after their financial statements are approved to send in their beneficial owner statement.

This is a tight window, as they have to gather and verify information on who owns the company.

This short time frame highlights the need for accurate records of who owns the company.

This includes details on nominee shareholders and any offshore companies.

Companies need to have systems ready to collect and check this information quickly to avoid missing the deadline.

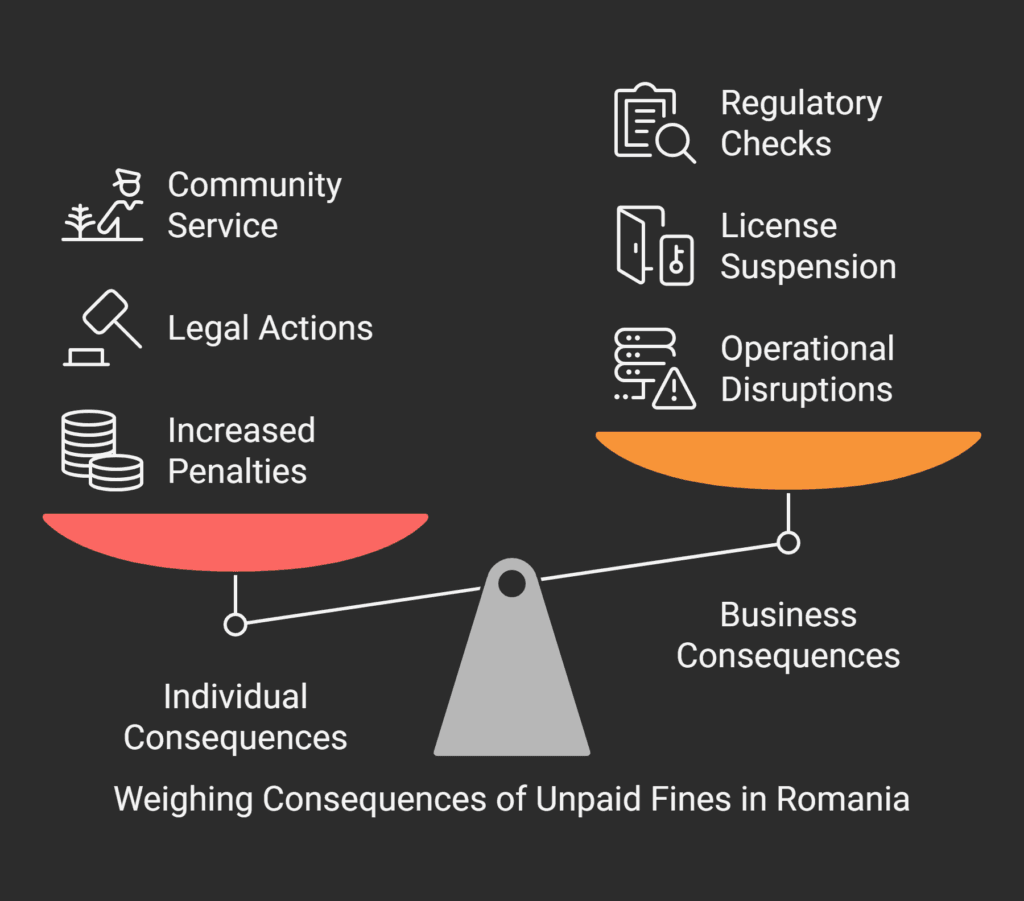

Consequences of Non-Compliance

If a company doesn’t send in its beneficial owner statement on time, it could face serious penalties.

Not following this rule is a big deal and can lead to big fines and other penalties.

| Offense | Fine Range | Additional Penalties |

|---|---|---|

| Late submission of annual statement | 5,000 to 10,000 lei | – |

| Failure to submit annual statement | 10,000 to 20,000 lei | Potential dissolution of the company |

| Providing false or incomplete information | 20,000 to 50,000 lei | Potential criminal charges |

The table shows that not following the rules can lead to big fines, from 5,000 to 50,000 lei.

In the worst cases, not following the rules can even mean the company gets shut down.

To avoid these problems, companies need to make sure they send in their annual statements on time.

They must keep detailed records of who owns the company, including any nominee shareholders or offshore companies.

They also need to keep up with any changes in who owns the company.

Penalties for Failing to Comply with Beneficial Owner Declaration

Not following the beneficial owner declaration rules in Romania can cause big problems for businesses.

Romanian companies that ignore these laws might get fined a lot or even shut down.

It’s very important for companies, including those offshore, to follow tax laws and protect their assets.

They must correctly state who owns them, as the law requires.

The penalties for not following the beneficial owner declaration rules are:

Fines Ranging from 5,000 to 10,000 Lei

Companies that don’t file or update their beneficial owner statement on time face fines.

These fines can be between 5,000 to 10,000 lei.

They are meant to make companies be more open and follow the law about who owns them.

Potential Dissolution of the Company

If a company keeps not following the rules, the Trade Register can shut it down.

This shows how serious it is to follow the beneficial owner declaration rules.

Shutting down a company affects its owners and everyone involved, showing why companies must take these rules seriously.

To avoid these problems and stay in good shape, companies should get help from legal experts.

They should know a lot about Romania’s company laws.

With the right advice, companies can deal with the beneficial owner declaration rules, reduce risks, and run smoothly in Romania.

Beneficial Owner and How to Declare It in Romania

Declaring who really owns a company is key in Romania.

This is to keep things transparent and follow the law.

Companies must give out a beneficial owner statement with certain details and follow specific steps to submit it.

The beneficial owner statement needs to have some important information for each owner:

- Full name;

- Date and place of birth;

- Personal identification number;

- Nationality;

- Residential address.

The statement also has to say how each owner controls the company.

This could be through shares, voting rights, or other ways.

This info helps meet due diligence needs and lets authorities know who really owns the company.

Signing and Submission Options

Companies have a few ways to sign and send in the beneficial owner statement:

| Signing Method | Submission Channel |

|---|---|

| Private signature | Trade Register portal |

| In the presence of a notary | Postal mail |

| Certified by a lawyer | Courier service |

The choice of signing and sending method depends on what the company prefers and who can sign.

It’s important to make sure the statement is right, complete, and sent on time.

This avoids fines under Romanian law.

By properly declaring who owns a company and keeping records up to date, businesses show they are serious about being transparent.

This helps avoid money laundering and other financial crimes.

It also builds trust and makes doing business in Romania easier.

Importance of Compliance with Beneficial Ownership Regulations

Following beneficial ownership rules is key for companies in Romania.

It keeps things transparent and avoids penalties.

By following the law on beneficial ownership identification and sharing this info, businesses show they care about being responsible.

This also helps stop bad activities like money laundering.

It’s important for companies to check themselves often to stay in line with reporting obligations.

They need to watch for changes in who owns the company.

Then, they must tell the right people about these changes right away.

Not doing this can lead to big fines and harm to their reputation.

Preventing Sanctions and Ensuring Transparency

Companies in Romania can avoid big problems by following beneficial ownership disclosure rules.

Here are some sanctions they might face if they don’t:

| Sanction | Description |

|---|---|

| Fines | Ranging from 5,000 to 10,000 lei for non-compliance |

| Dissolution | Potential dissolution of the company in severe cases |

| Reputational damage | Negative impact on the company’s image and credibility |

Being open about who really controls a company is not just the law.

It’s also a way to gain trust from everyone involved.

By sharing who benefits from the company, businesses show they are honest and follow ethical rules.

Periodic Verification of Compliance

To keep up with Romanian corporate compliance, companies should check themselves often.

They might need help from experts sometimes.

This makes sure all info about who owns the company is correct and shared as needed.

By focusing on following beneficial ownership rules, companies in Romania can work with confidence.

They know they are doing the right thing and helping make business more open.

Getting help from legal and corporate experts can be very useful in dealing with these rules and staying compliant.

Legal Advisory and Corporate Consultancy Services for Beneficial Owner Declaration

Understanding beneficial owner identification and declaration in Romania can be tough.

Companies want to be clear about who owns them.

Legal advisors and corporate consultants can help a lot.

They make sure companies follow anti-money laundering rules in Romania.

Legal experts in Romania help companies find their ultimate beneficial owners.

This is key to meeting legal needs.

They help gather documents, check information, and make sure the beneficial owner statement is right and on time.

Legal advisors also help with ongoing compliance.

They watch for changes in ownership and update the registry as needed.

They offer advice on keeping company operations transparent.

Working with legal and corporate consultants shows a company’s commitment to transparency.

It helps avoid risks and supports a fair business environment in Romania.

Getting professional help gives companies peace of mind.

It lets them focus on their main work while following legal rules on beneficial ownership.

Conclusion

It’s very important for companies in Romania to follow beneficial ownership reporting rules.

By revealing who really owns them, businesses show they care about being open.

This helps fight money laundering too.

Law No. 129/2019 and its updates set out how to report beneficial owners.

Companies need to know their duties.

This includes filing statements when they start, update them when things change, and report yearly if needed.

If they don’t follow these rules, companies could face big fines or even shut down.

Getting help from legal experts and corporate consultants is a good idea.

They can help understand the rules, make sure statements are right, and keep up with changes.

This way, companies can stay safe, avoid trouble, and help make business more open in Romania.

FAQ

What is a beneficial owner?

Why is it important to declare the beneficial owner in Romania?

What is the primary law governing beneficial ownership declaration in Romania?

When must legal entities submit the beneficial owner statement?

What are the additional requirements for entities with shareholders from specific jurisdictions?

What is the deadline for submitting the annual beneficial owner statement?

What are the penalties for non-compliance with beneficial owner declaration?

What information must be included in the beneficial owner statement?

How can legal entities ensure compliance with beneficial ownership regulations?

What services can assist with beneficial owner declaration?

What is a beneficial owner in Romania?

A beneficial owner refers to any natural person who ultimately owns or controls a legal entity through direct or indirect ownership.

In Romania, according to Law no. 129/2019 on preventing and combating money laundering and terrorist financing, the ultimate beneficial owner (UBO) is the individual who ultimately owns or controls at least 25% of the shares or voting rights of a legal person, or who exercises control through other means.

If no such person can be identified based on ownership percentage, the beneficial owner is considered to be the person(s) holding the position of senior managing official.

Romanian legislation aligns with EU directives aimed at ensuring transparency of beneficial ownership structures and preventing financial crimes.

How do I declare a beneficial owner in Romania?

Declaring a beneficial owner in Romania involves submitting a declaration to the Trade Register Office.

This can be done either during company incorporation or through a separate filing for existing companies.

The declaration must be submitted by the legal representative of the company and must contain the identification data of the beneficial owner(s).

The declaration form can be obtained from the National Trade Register Office website or in person at any Trade Register Office.

The completed form, along with supporting documentation proving the beneficial ownership structure, must be submitted to the Trade Register Office.

After verification, the information will be entered into the Register of Beneficial Owners maintained by the National Trade Register.

What information is required when declaring an ultimate beneficial owner in Romania?

When declaring an ultimate beneficial owner in Romania, you must provide comprehensive data of the beneficial owner, including: full name, date and place of birth, Personal Numerical Code (CNP) for Romanian citizens or passport details for foreign nationals, citizenship, country of residence, complete residential address, the nature of the relationship that created the beneficial owner status, and the