Corporate Documentation Requirements in Romania

Corporate Documentation Requirements in Romania

Did you know Romania lets companies be fully owned by foreigners?

This shows how welcoming Romania is to businesses.

Knowing the legal documents and rules is key for any company wanting to start here.

Getting through Romania’s business laws needs careful focus.

The process includes setting up a company and following rules.

Your success relies on knowing all the details of doing business here.

Whether you’re new or already big, learning the law is vital.

Romania has great chances for those willing to learn its business rules.

Key Takeaways

- Romania supports 100% foreign company ownership;

- Company incorporation typically takes 5-10 working days;

- Minimum share capital varies by company type;

- All companies must have a registered Romanian office;

- Comprehensive documentation is critical for legal compliance.

Understanding Legal Entity Types in Romania

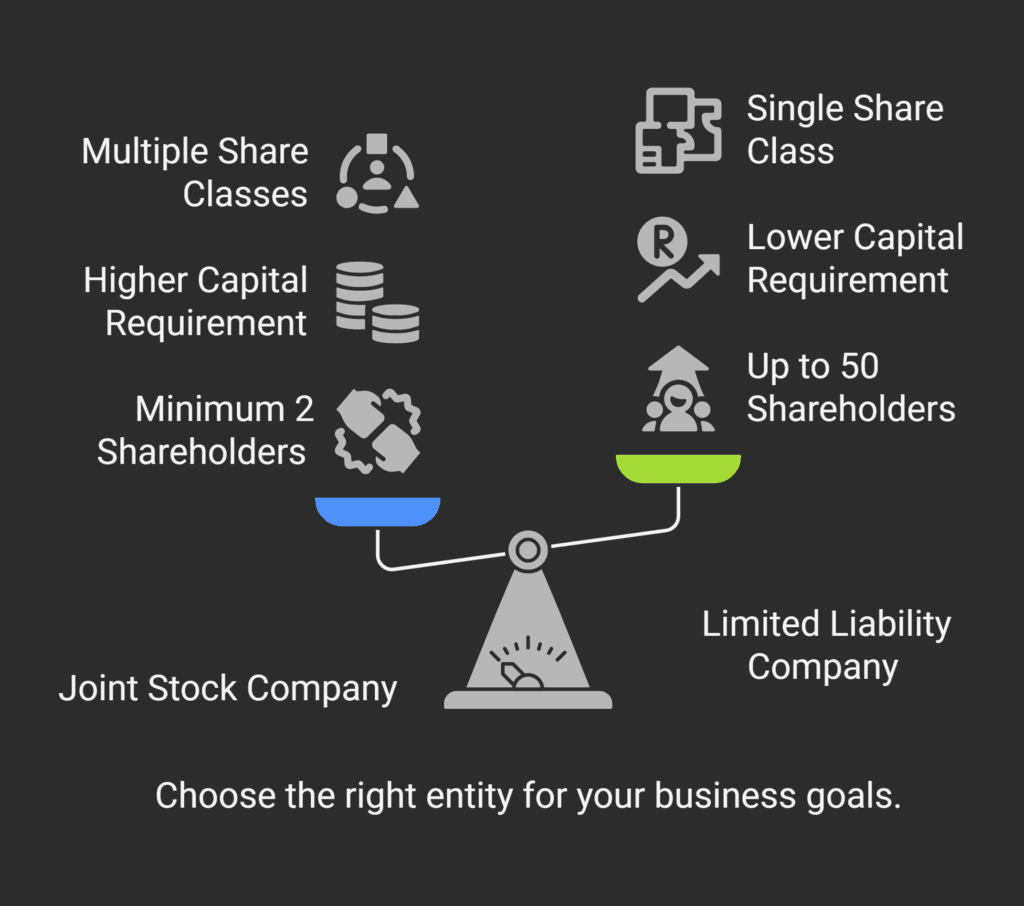

In Romania, you’ll find two main types of legal entities for starting a business:

Joint Stock Companies (JSC) and Limited Liability Companies (LLC).

These options differ in how they handle corporate governance.

They also offer flexibility for those setting up businesses in Romania.

Romania’s business scene is diverse, with JSCs and LLCs being the top choices for investors.

Knowing what each offers is key to choosing the right structure for your business.

Joint Stock Companies (JSC)

Joint Stock Companies are known for their strength and several important features:

- Minimum of 2 shareholders with no maximum limit;

- Limited personal liability for shareholders;

- Fiscal registration through the Trade Registry;

- Potential for public trading of shares.

Limited Liability Companies (LLC)

Limited Liability Companies are known for their simplicity and benefits:

- Up to 50 shareholders possible;

- Simplified management structure;

- Lower minimum capital requirements;

- Faster incorporation process.

Key Differences Between Entity Types

| Characteristic | Joint Stock Company | Limited Liability Company |

|---|---|---|

| Minimum Shareholders | 2 shareholders | 1 shareholder |

| Minimum Capital | RON 90,000 | RON 200 |

| Maximum Shareholders | Unlimited | 50 |

| Share Classes | Multiple possible | Single class only |

Choosing between a JSC and LLC depends on your business goals, available capital, and future plans.

Each type has its own advantages for managing documents and corporate governance in Romania.

Corporate Documentation Requirements Under Romanian Law

Understanding corporate law in Romania is key.

You must know the legal rules to follow.

When starting a business in Romania, you’ll need to gather important documents that follow Romanian laws.

The process of getting these documents involves several steps.

These steps make sure your company follows all the rules.

Romanian law has specific rules for different types of businesses.

It’s important to know these rules well.

- Prepare detailed company formation documents;

- Get the needed registration certificates;

- Follow local legal rules;

- Keep your corporate records up to date.

Foreign investors need to grasp legal rules in Romania.

The process includes at least six important documents.

These include articles of association and financial statements.

Each document must be carefully made to meet Romanian rules.

Key documentation needs change based on your business type and goals.

Here are some specific documents you’ll need:

- Company incorporation papers;

- Tax identification documents;

- VAT registration forms;

- Records of shareholder information.

The Law No. 265/2022 on the Trade Registry has brought changes.

From November 26, 2022, companies must follow new rules.

These include easier ways to start and updated business registration rules.

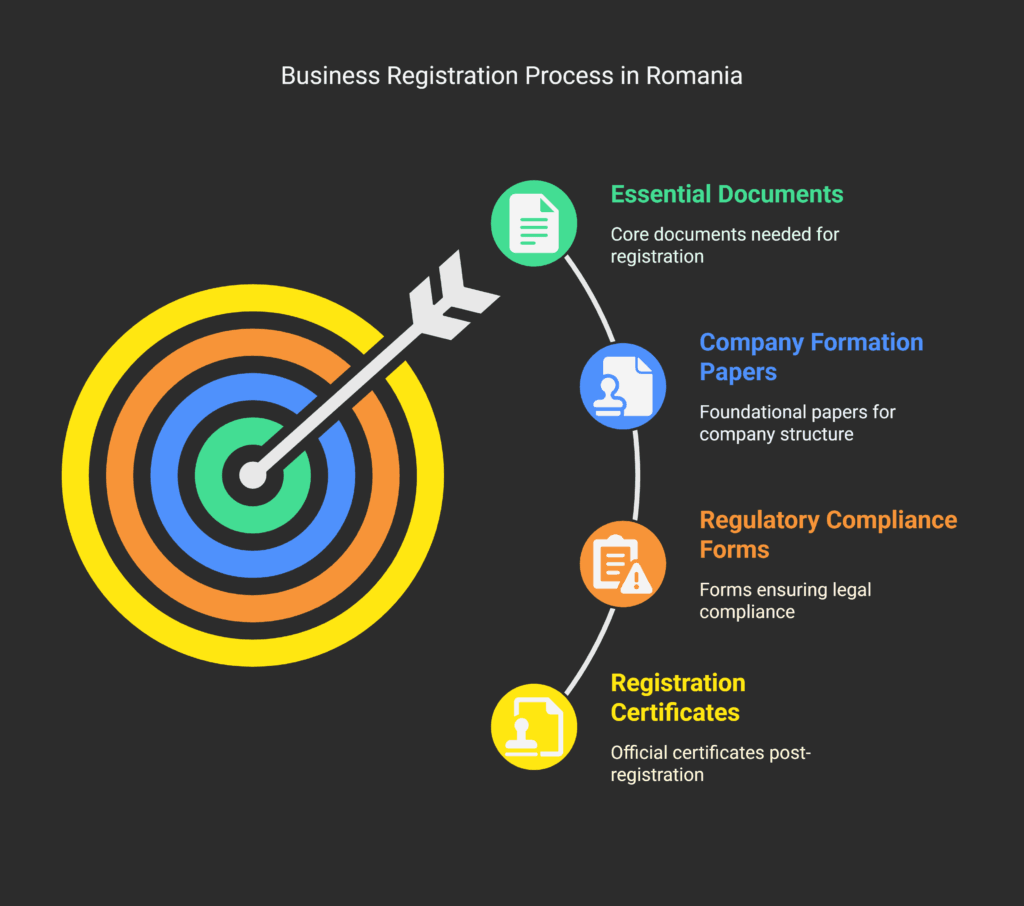

Essential Business Registration Documents

Starting a business in Romania is complex.

You need to know a lot about company formation paperwork and corporate rules.

You’ll have to prepare important documents to follow the law and start your business smoothly.

Registering your business means filling out several key documents.

These documents are the base of your company’s policies and structure.

Company Formation Papers

Here are the documents you’ll need for your business registration:

- Articles of Incorporation;

- Shareholder Agreement;

- Proof of Initial Capital Deposit;

- Company Bylaws.

Regulatory Compliance Forms

You’ll also need to fill out important compliance forms:

- Trade Registry Registration Form;

- Tax Registration Application;

- Social Security and Health Insurance Registration;

- Employment Documentation.

Registration Certificates

Once you’ve submitted your documents, you’ll get important certificates:

| Certificate Type | Purpose | Processing Time |

|---|---|---|

| Trade Registry Certificate | Official Business Registration | 5-7 Business Days |

| Tax Identification Number | Tax Authority Registration | 3-5 Business Days |

| VAT Registration | Enable Legal Business Transactions | 2-4 Business Days |

It’s important to keep these documents in order.

Getting help from a professional can make this process easier.

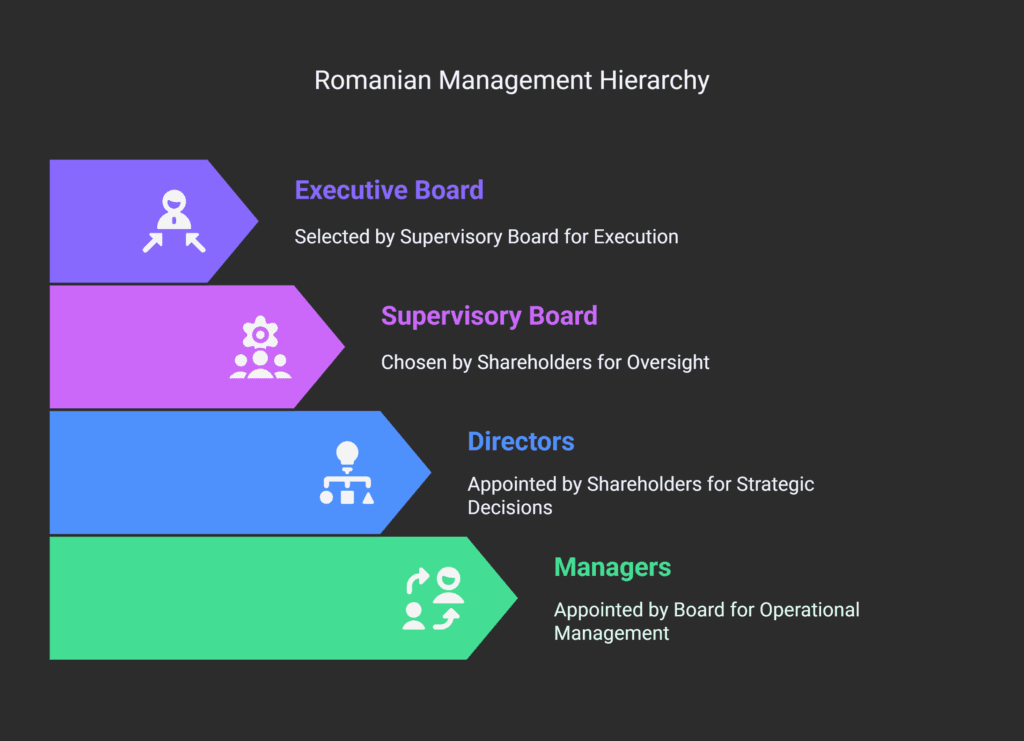

Management Structure Documentation

Starting a company in Romania means you need to know about management structure documents.

These are key for following the law and keeping your business in order.

Romanian company law is strict about how your business is set up.

Romanian companies usually have one of two main management systems:

- One-Tier Management System;

- Two-Tier Management System.

The one-tier system has one board that does everything.

This board is chosen by the shareholders.

They can also pass on some tasks to others.

One-Tier Management Structure Characteristics

| Component | Appointment Method | Key Responsibilities |

|---|---|---|

| Directors | Appointed by Shareholders | Strategic Decision Making |

| Managers | Appointed by Board of Directors | Operational Management |

The two-tier system splits the work into two boards.

The supervisory board, chosen by shareholders, watches over the executive board.

This board is picked by the supervisory board.

It adds more control and balance in how the company is run.

Proper documentation of management structures is essential for ensuring Romanian corporate compliance and maintaining transparent business operations.

Your legal papers in Romania must clearly show who does what in each management level.

This is a big part of following the law and keeping your business clear.

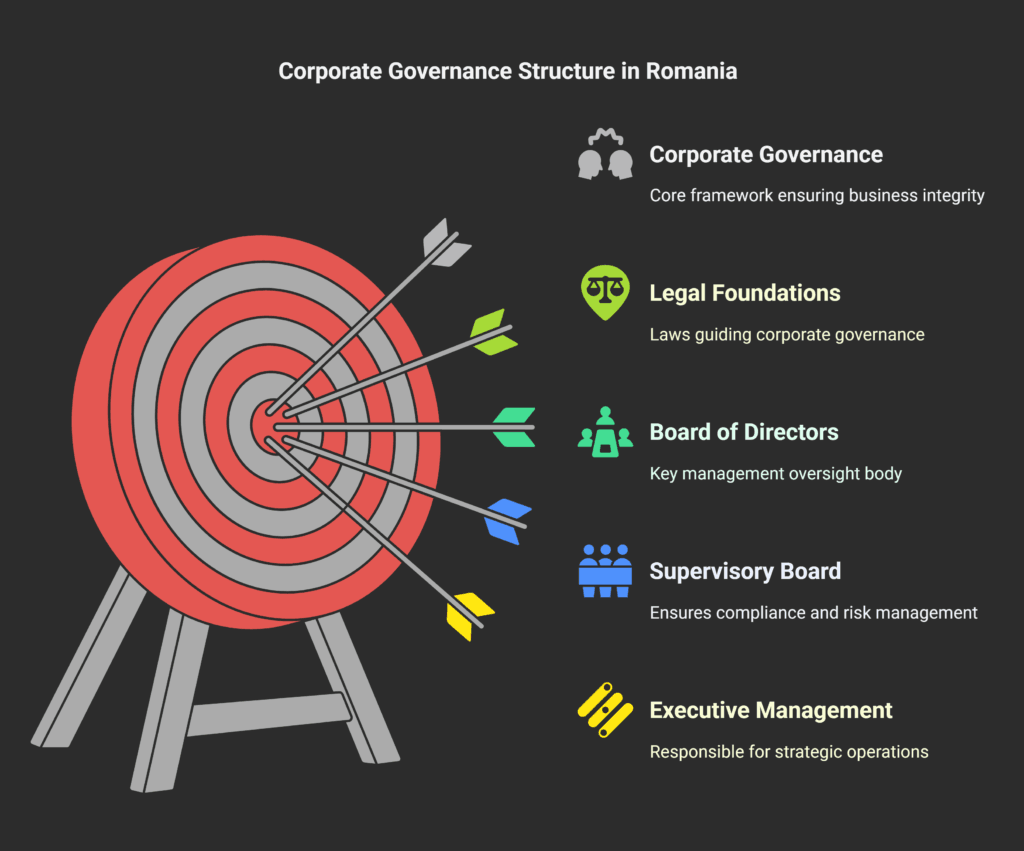

Corporate Governance and Compliance Standards

Getting to know corporate governance in Romania means dealing with many rules and documents.

Companies here must follow strict standards.

These ensure their management is clear and works well.

The laws that guide corporate governance come from two main sources.

Companies Law No. 31/1990 and Trade Registry Law No. 26/1990 set the rules.

They cover what each business type needs and how they should be managed.

Board of Directors Requirements

Setting up a Board of Directors in Romania comes with important rules. Companies must follow these to stay legal:

- Minimum board size varies depending on company type;

- Joint-stock companies typically require at least three directors;

- Independent board members are key for clear management;

- Professional liability insurance is a must for board members.

Supervisory Board Documentation

The Supervisory Board is vital in a two-tier management system.

It needs to keep detailed records.

This includes:

- Detailed meeting minutes;

- Annual performance reports;

- Compliance verification documents;

- Risk management assessments.

Executive Management Papers

Executive management in Romania has its own set of rules.

You must keep detailed records.

These show you’re responsible and strategic.

By following these corporate governance rules, your Romanian business can stay legal.

It also keeps things transparent and has a strong management system.

Single Administrative Document (SAD) Requirements

Understanding the Single Administrative Document (SAD) is key for businesses in international trade.

The SAD is a standardized customs declaration form used in many places, including the European Union and some partner countries.

Your business needs to know how important the SAD is in legal and corporate law in Romania.

It’s vital for tracking and managing goods, mainly for deals outside the EU or with non-EU goods.

- Covers multiple customs procedures including export and transit;

- Consists of eight distinct copies with specific functions;

- Used for trade with non-EU countries and movement of non-EU goods;

- Essential for proving goods origin during customs clearance.

Business documentation laws demand careful filling out of the SAD.

The form needs to have all the details about the goods, their origin, and the customs procedure.

Being accurate is key for easy customs processing and following Romanian and EU rules.

Businesses bear ultimate responsibility for the accuracy and completeness of customs declarations submitted on their behalf.

There’s a move towards fully electronic customs declarations.

Your business must get used to new digital submission rules.

Knowing these changes helps keep your international trade smooth and legal.

Economic Operator Registration and Identification (EORI)

Understanding the Economic Operator Registration and Identification (EORI) system is key in Romania.

If your business wants to do customs work in the European Union, you need an EORI number.

It’s important for managing your corporate documents.

The EORI system started in Romania on July 1, 2009.

It helps identify economic operators in international trade.

Your business must follow these rules for easy customs dealings.

Application Process

To get your EORI number, follow these steps:

- Register with your national customs authority;

- Prepare necessary business documentation;

- Submit your application electronically;

- Receive your unique EORI identifier.

Required Supporting Documents

You’ll need these documents for legal compliance in Romania:

- Company registration certificate;

- VAT registration proof;

- Identification documents for company representatives;

- Proof of business address.

Registration Timeline

The EORI registration is quick.

Romanian customs usually process applications in two days.

And it’s free.

Your EORI number is good for 10 years for businesses, keeping you in line with EU customs rules.

Knowing and following EORI rules helps your business with international trade.

It reduces customs problems.

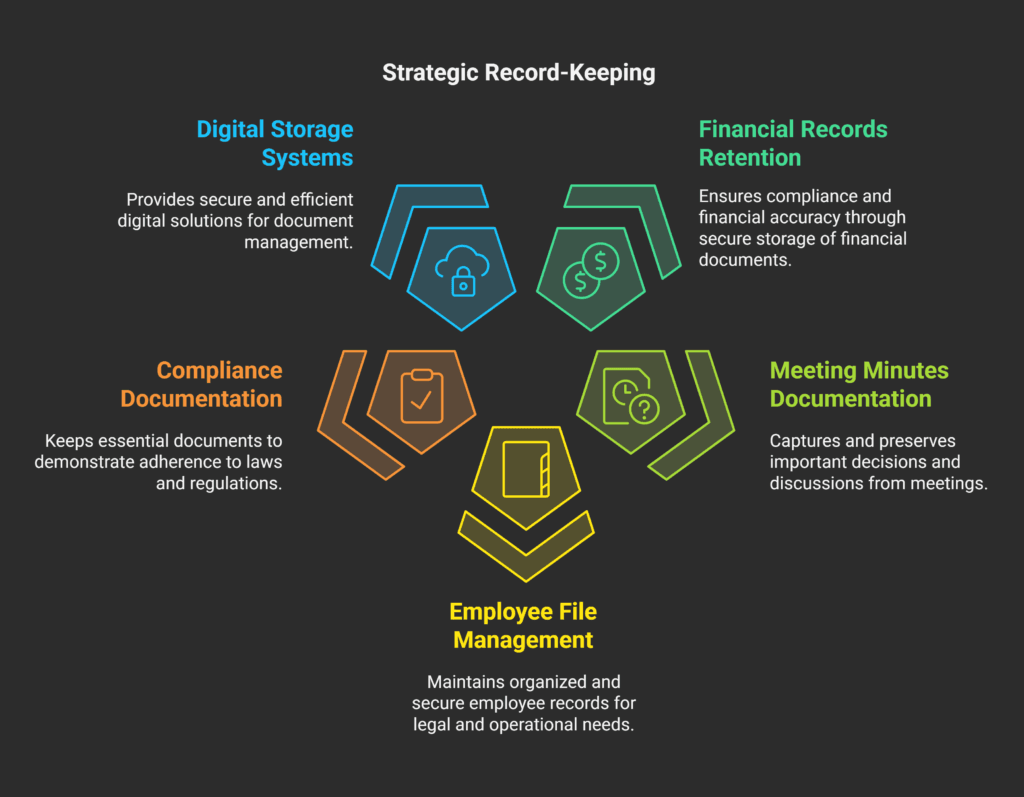

Record-Keeping and Documentation Maintenance

Keeping records well is key for businesses in Romania.

Your company needs to keep detailed records to follow the law and work smoothly.

The National Trade Register Office gives important rules for keeping business documents.

Romanian laws require keeping documents in order across many areas.

Your company’s rules should cover:

- Financial records retention;

- Meeting minutes documentation;

- Employee file management;

- Compliance documentation.

Digital storage is now vital in Romania.

The Ministry of Communications and Information Society says companies need special approvals for digital documents.

You must tell the authorities 30 days before starting digital archiving.

Your systems must also meet strict rules.

Proper documentation is not just a legal requirement, but a strategic asset for your business.

Important steps for good documentation include:

- Use safe digital storage systems;

- Make clear filing rules;

- Check and update records often;

- Train staff on document handling.

By focusing on keeping good records, you help your business avoid legal problems.

You also make your operations clear and efficient.

Conclusion

Mastering corporate record keeping in Romania is complex.

It requires a deep understanding of legal frameworks.

Your business’s success depends on following corporate compliance rules and keeping accurate records.

The Romanian business world needs strict paperwork management.

This must follow national legal standards.

Effective business paperwork in Romania does more than follow rules.

It protects your company, sets clear rules, and makes communication clear.

Getting help from legal experts can guide you through this complex area.

They ensure your business stays compliant and competitive.

Keeping up with Romanian business laws is key for growth.

Work with legal pros who know Romanian corporate rules well.

They can give you specific advice, explain complex laws, and reduce risks from mistakes.

For help with your corporate documents, contact Romanian legal experts.

They can help with creating, checking, and keeping your documents up to date.

Reach out to our Romanian Law Office to make sure your documents are top-notch and effective.

FAQ

What are the main legal entity types in Romania?

In Romania, there are two main types of legal entities.

Joint Stock Companies (JSC) are for bigger businesses with many shareholders.

Limited Liability Companies (LLC) are better for smaller businesses with fewer shareholders.

What essential documents are required for business registration in Romania?

You’ll need several important documents for business registration.

These include articles of incorporation and shareholder agreements.

You’ll also need a company registration certificate, tax number (CUI), and proof of a registered office.

Depending on your business type, you might need more documents.

How long must I retain corporate documents in Romania?

Romanian law says you must keep most corporate documents for at least 10 years.

This includes financial records and meeting minutes.

Keeping these documents well is key for audits and following the law.

What is the Single Administrative Document (SAD), and why is it important?

The SAD is a key document for international trade.

It’s used for customs declarations when moving goods in or out.

It gives detailed info about the goods, their value, and where they’re going.

This helps with smooth customs clearance in Romania and the EU.

What is an EORI number, and do I need one?

An EORI number is vital for EU customs operations.

If your business trades internationally, you’ll need one.

It helps with customs procedures and tracking your trade activities.

What are the management structure documentation requirements in Romania?

Romanian businesses must keep detailed records of their management structure.

This includes documents for directors and board members.

You’ll need meeting minutes and records of shareholder decisions for both one-tier and two-tier systems.

How difficult is it to set up a company in Romania?

Setting up a company in Romania is relatively easy but needs careful attention to legal details.

You’ll need to prepare incorporation documents and register with local authorities.

You’ll also need to get business permits and a tax ID.

What are the key compliance standards for corporate governance in Romania?

Romanian corporate governance requires detailed documentation.

This includes annual reports and meeting minutes.

Companies must show they follow local and EU rules through transparent records.

Are there specific documentation requirements for foreign investors?

Foreign investors need extra documents.

This includes translated and apostilled corporate documents and proof of registration in their home country.

It’s wise to work with a local legal expert to ensure you meet all requirements.

What penalties exist for non-compliance with documentation requirements?

Not following the rules can lead to big fines and even business suspension.

Penalties can be financial or more severe, like canceling your business registration for serious breaches.

What are the main documents required for incorporating a Romanian company (SRL)?

To incorporate a limited liability company (SRL) in Romania, you need to prepare and submit several documents required to the Trade Register.

The primary documents include:

1. Articles of Association

2. Proof of registered office;

3. Shareholder identification documents;

4. Criminal record certificates for company representatives;

5. Specimen signatures of company representatives;

6. Proof of share capital deposit;

7. Company name reservation certificate;

8. Declaration of honor from company representatives;

9. Power of attorney (if applicable);

10. Fiscal record certificate;

These necessary documents are crucial for setting up a company in Romania and ensuring compliance with Romanian law.

How do I prepare the Articles of Association for a Romanian company?

The Articles of Association is a fundamental document for company formation in Romania.

It should include:

1. Company name and type of company (SRL);

2. Registered address;

3. Object of activity (using NACE codes);

4. Share capital amount and distribution;

5. Shareholder information;

6. Administrator details and responsibilities;

7. Duration of the company (if not indefinite);

8. Profit distribution method;

9. General meeting of shareholders procedures;

The document must be submitted to the Trade Register Office and should be drafted according to the Romanian legislation.

It’s advisable to seek legal assistance to ensure all legal requirements are met.