Crypto License Romania 2025: Step-by-Step Company Formation for Digital Assets

Crypto License Romania 2025: Step-by-Step Company Formation for Digital Assets

What laws regulate crypto in Romania in 2025?

Romania follows the EU MiCA Regulation and EU AML Directives. Main authorities:

- ASF: Supervises crypto-asset service providers.

- BNR: Oversees banking & e-money.

- ONPCSB: AML/CFT enforcement.

👉 European Commission MiCA

👉 ASF | BNR | ONPCSB

MiCA Implementation Timeline in Romania

| Date | Milestone |

|---|---|

| June 2024 | EU MiCA technical standards effective |

| Dec 2024 | Romanian guidance published |

| July 2026 | Deadline for CASPs to comply fully with MiCA |

📊 Visual Timeline (Chart)

- 2024 H1: EU-level guidance → 📘

- 2024 H2: Romania issues notices → 🏛️

- 2026 H2: Full MiCA compliance → ✅

Romanian Company Structures for Crypto Firms

| Entity Type | Capital Requirement (Company Law) | Governance | Best Use Case | Regulatory Capital (Indicative) |

|---|---|---|---|---|

| SRL | Low (check current law) | Simple, flexible | Startups, wallet providers, MVP platforms | ~€25,000–€50,000 |

| SA | Higher (check current law) | Strong governance | Exchanges, custodians, trading platforms | ~€50,000–€75,000+ |

| Branch | N/A (not separate legal entity) | Parent-controlled | Foreign firms entering Romania | ASF/BNR may require local license |

📊 Visual Comparison (Bar Chart)

- SRL: Low setup, flexible governance 🟩

- SA: Higher capital, strong governance 🟦

- Branch: Depends on parent company 🟨

Capital & Financial Obligations

| Service Type | Indicative Minimum Capital | Notes |

|---|---|---|

| Wallet Provider | €25,000 | May need liquidity reserves |

| Exchange | €50,000 | Segregated accounts required |

| Trading Platform | €75,000 | Stronger governance expectations |

📈 Capital Requirement Graph (Illustrative)

- Wallet: ▓▓ 25k

- Exchange: ▓▓▓▓ 50k

- Trading Platform: ▓▓▓▓▓▓ 75k

Required Documentation

- Articles of association & ownership structure.

- AML/KYC policies, sanctions screening, SAR workflows.

- IT & security policies, custody architecture, penetration tests.

- Financial forecasts, proof of liquidity & audited accounts.

- Fit-and-proper evidence for directors.

- Business plan with projections.

AML & KYC Compliance Standards

| Requirement | Details |

|---|---|

| Customer Due Diligence (CDD) | ID verification, beneficial owner checks, sanctions & PEP screening |

| Enhanced Due Diligence (EDD) | Source of funds, high-risk monitoring, senior approval for onboarding |

| Transaction Monitoring | Blockchain analytics, alerts, suspicious activity reports to ONPCSB |

| Governance | AML officer appointment, staff training, independent AML audits |

Registration Process (Romania 2025)

| Stage | Key Actions | Duration |

|---|---|---|

| Pre-application | Prepare compliance pack (AML, IT, governance) | 2–6 weeks |

| Application Submission | File with ASF/BNR, pay fees | 1–3 weeks |

| Review & Clarifications | AML, governance, capital checks | 4–12 weeks |

| Inspection & Interviews | IT & operational audit | 4–8 weeks |

| Decision & Authorization | License granted + reporting duties | Ongoing |

📊 Visual Process Flow

➡ Pre-application → 📂 Submission → 🔎 Review → 🖥️ Inspection → ✅ License

Tax Implications for Crypto Businesses

| Activity | Tax Treatment | Notes |

|---|---|---|

| Crypto Trading | Corporate income tax on profits | Record all trades, conversions |

| Mining | Business or miscellaneous income | Track electricity & operational costs |

| Staking Rewards | Taxed as income when received | Maintain timestamped logs |

| Salaries in Crypto | Subject to payroll withholding tax | Adapt payroll systems |

📊 Visual Tax Map

- Trading: 📈 Profits → taxed under corporate tax.

- Mining: ⚡ Treated as business income.

- Staking: 🔗 Rewards → taxable when received.

- Payroll: 💼 Crypto salaries taxed.

Frequently Asked Questions (FAQ)

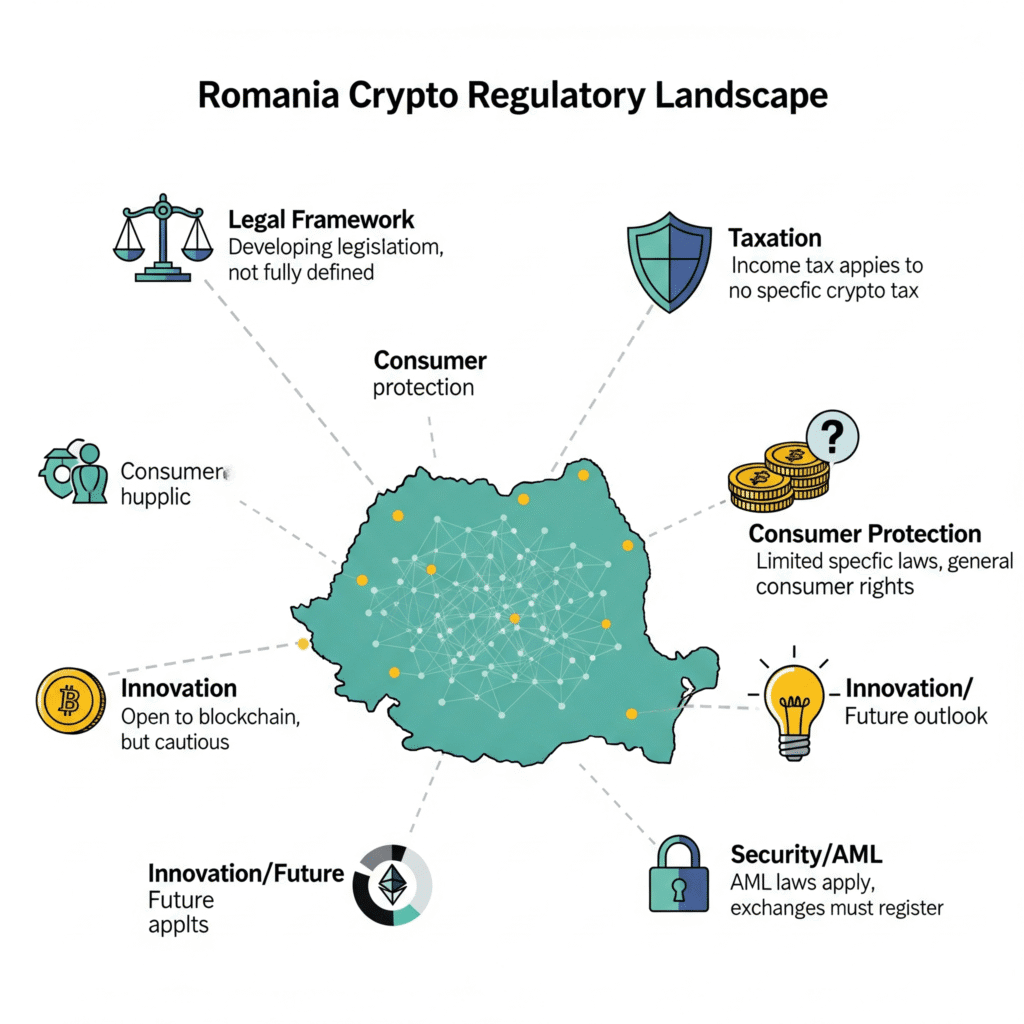

1. What is the current status of cryptocurrency regulation in Romania in 2025?

Romania is aligning with the EU Markets in Crypto-Assets (MiCA) regulation while also enforcing national AML/CFT rules.

Providers must comply with both MiCA and Romanian laws, supervised mainly by ASF, BNR, and ONPCSB.

2. What business structures are available for crypto companies in Romania?

The most common options are:

SRL (Limited Liability Company) – best for startups and smaller providers.

SA (Joint Stock Company) – suited for larger exchanges or custody platforms.

Branch – used by foreign firms entering Romania.

3. What are the capital requirements for a crypto license in Romania?

Indicative minimums under MiCA:

Wallet providers: ~€25,000

Exchanges: ~€50,000

Trading platforms: ~€75,000

Final figures must be confirmed with ASF or the competent authority.

4. How long does the licensing process take?

On average, 3–6 months, depending on the completeness of your compliance documentation and regulator reviews.

5. Can foreign companies operate in Romania with a branch office?

Yes, but depending on ASF/BNR recognition of the parent’s license, a local authorization may still be required.

6. Are crypto salaries and rewards taxed in Romania?

Yes. Crypto salaries are subject to payroll withholding tax, while trading profits and staking rewards are taxed as business income or capital gains depending on activity type.