Master GDPR Compliance in Dropshipping for Online Success

GDPR compliance is essential for achieving online success in dropshipping, as it ensures the protection of customer data and helps build trust.

The General Data Protection Regulation (GDPR) is a set of legal requirements that regulate the storage and use of personal data of EU citizens.

It applies to businesses that have customers in the EU, regardless of their physical location.

As a dropshipper, it is crucial to follow GDPR regulations and ensure the protection of customers’ personal data.

This includes information such as names, email addresses, home addresses, and more.

By informing customers about the data collected, obtaining their consent, and providing access to and deletion of their data upon request, you can establish a strong foundation of trust with your customers.

Non-compliant businesses may face severe penalties, including fines of up to 4% of their annual global turnover or €20 million.

To make your dropshipping store GDPR compliant, there are several steps you need to take:

- First, revise the types of data you collect and ensure they align with GDPR regulations. Review the suppliers you share data with and make sure they also adhere to data protection regulations.

- Create a privacy notice on your website, explaining how you use customer data and how you protect their privacy.

- Additionally, consider setting up a privacy notification on your website to inform visitors about the use of cookies or data collection practices. Remaining updated on GDPR regulations is also crucial to maintain compliance and avoid any potential penalties.

By mastering GDPR compliance in dropshipping, you can ensure the protection of customer data and build a reputation for trustworthiness.

Seek legal guidance from a reputable Romanian law firm, such as the Atrium Romanian Lawyers, to ensure your dropshipping business complies with GDPR and other relevant regulations.

And remember, Shopify dropshipping is a popular online business idea that can thrive when compliance with GDPR is prioritized.

Understanding GDPR Compliance in Dropshipping

To ensure GDPR compliance in dropshipping, it is crucial to have a solid understanding of the General Data Protection Regulation and its impact on dropshipping businesses.

The GDPR is a set of legal requirements that regulates the storage and use of personal data of EU citizens.

It applies to businesses that have customers in the EU, regardless of their physical location. As a dropshipper, you must follow GDPR regulations and take the necessary steps to protect your customers’ personal data.

Under GDPR, personal data includes information such as names, email addresses, home addresses, and more. As a dropshipper, you need to inform your customers about the type of data you collect, obtain their consent to collect and process their data, and provide them with access to their data or delete it upon request. This means you need to have clear privacy policies in place and ensure that your customers are fully aware of how their data will be used.

Non-compliant businesses may face severe penalties, including fines of up to 4% of their annual global turnover or €20 million. To make your dropshipping store GDPR compliant, you need to review the types of data you collect, evaluate the suppliers you share data with, and create a privacy notice that explains how you use and protect customer data.

It is also important to set up a privacy notification on your website to inform visitors about your data collection practices.

Staying updated on GDPR regulations is essential to ensure ongoing compliance.

By taking these steps and prioritizing the protection of your customer’s personal data, you can build trust and credibility with your customers.

GDPR compliance not only helps you avoid legal consequences but also contributes to the success and growth of your dropshipping business.

Key Steps for GDPR Compliance in Dropshipping

Achieving GDPR compliance in dropshipping requires following key steps to ensure data protection and adhere to privacy regulations.

As a dropshipper, it is essential to revise the types of data you collect from customers and make sure you are in compliance with GDPR regulations.

Firstly, review the suppliers you share data with. Ensure that they are also GDPR compliant and have robust data protection measures in place.

It is crucial to work with suppliers who prioritize customer privacy and data security.

Secondly, create a privacy policy for your dropshipping business.

This policy should clearly state how you collect, store, and use customer data.

Include information about the legal basis for processing data, how long you retain the data, and how customers can request access or deletion of their personal information.

Thirdly, set up a privacy notification on your website.

This notification should inform visitors that you collect and process personal data in compliance with GDPR regulations.

It should also provide a link to your privacy policy for customers to review.

Example of a Privacy Policy

| Data Collected | Purpose of Collection | Retention Period |

|---|---|---|

| Customer’s name, email, and shipping address | To process orders and provide customer support | Until order completion and customer request for deletion |

| Payment information | To facilitate secure payment processing | As required by legal and financial obligations |

By following these key steps, dropshippers can ensure the protection of customer data and comply with GDPR regulations. Remember to stay updated on GDPR guidelines and any changes in data protection regulations to maintain compliance and build trust with your customers.

Ensuring Customer Data Protection in Dropshipping

Customer data protection is a critical aspect of GDPR compliance in dropshipping, and dropshippers must take measures to ensure the safeguarding of personal data. The General Data Protection Regulation (GDPR) requires businesses to handle customer information with utmost care and transparency. This includes the collection, processing, and storage of personal data such as names, email addresses, and home addresses. To maintain compliance, dropshippers should implement the following practices:

- Revise data collection practices: Review the types of data your dropshipping store collects from customers. Ensure that you only collect the necessary information and that customers are fully aware of how their data will be used.

- Review suppliers: Assess the data-sharing practices of your suppliers. Ensure that they also comply with GDPR regulations and are committed to protecting customer data. Consider signing data processing agreements with your suppliers to establish clear responsibilities.

- Create a privacy policy: Develop a comprehensive privacy policy that outlines how customer data is collected, used, and protected. Make sure it is easily accessible on your dropshipping store’s website, and clearly explain customers’ rights and how they can exercise them.

- Set up privacy notifications: Implement a privacy notification system on your website to inform visitors about the data you collect and how it is processed. This will help build trust and transparency with your customers.

Table: Summary of Measures for Customer Data Protection in Dropshipping

| Measures | Description |

|---|---|

| Revise Data Collection | Review and limit the types of personal data collected from customers to only what is necessary, and ensure customers are informed about how their data will be used. |

| Review Suppliers | Assess the data-sharing practices of suppliers and sign data processing agreements to ensure they comply with GDPR regulations. |

| Create Privacy Policy | Develop a comprehensive privacy policy that clearly outlines the collection, use, and protection of customer data. |

| Set Up Privacy Notifications | Implement a system to notify website visitors about the data collection and processing practices on your dropshipping store. |

By implementing these measures, dropshippers can ensure compliance with GDPR regulations, protect customer data, and foster trust with their online store visitors. Remember, GDPR compliance is an ongoing process, and it’s crucial to stay updated on any changes or new requirements to maintain data security and lawful processing.

Consequences of Non-Compliance and Penalties

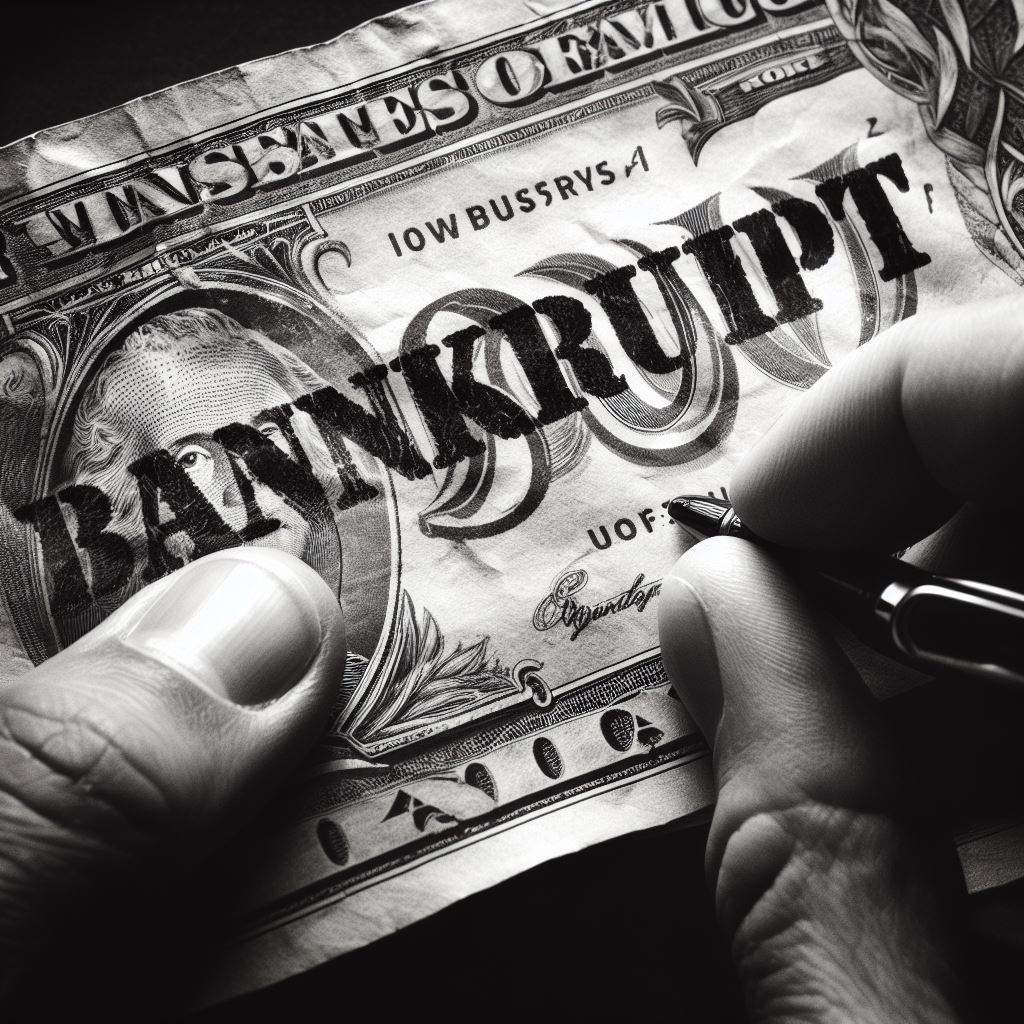

Non-compliance with GDPR regulations in dropshipping can result in severe consequences, including significant financial penalties and damage to a business’s reputation.

As a dropshipper, it is crucial to understand the potential risks and take proactive measures to ensure GDPR compliance.

Under GDPR, businesses that fail to comply with data protection regulations can face fines of up to 4% of their annual global turnover or €20 million, whichever is higher.

These penalties can have a devastating impact on a Romanian dropshipping business, especially for small and medium-sized enterprises.

The financial burden alone can be crippling, leading to potential bankruptcy and closure.

In addition to financial penalties, non-compliance can also damage a business’s reputation.

In today’s digital age, consumers are increasingly concerned about their data privacy.

If customers discover that a dropshipper has mishandled their personal information or failed to comply with GDPR, they are likely to lose trust in the company.

This loss of trust can lead to a decline in customer loyalty, negative reviews, and a negative impact on brand reputation.

Table: Potential Penalties for Non-Compliance

| Violation | Penalty |

|---|---|

| Failure to obtain customer consent for data processing | Up to 4% of annual global turnover or €20 million |

| Failure to implement data security measures | Up to 4% of annual global turnover or €20 million |

| Failure to provide customers with access to and deletion of their data upon request | Up to 4% of annual global turnover or €20 million |

| Failure to notify customers of data breaches | Up to 2% of annual global turnover or €10 million |

To avoid these consequences, dropshippers should prioritize GDPR compliance by implementing the necessary measures.

This includes revising the types of data collected, reviewing partners and suppliers for their compliance, creating a comprehensive privacy policy, obtaining customer consent for data processing, and ensuring data security measures are in place.

By taking proactive steps to comply with GDPR regulations, dropshippers can protect both their customers’ personal data and their own business’s success.

Conclusion

GDPR compliance is a vital aspect of dropshipping success, and seeking legal guidance from a trusted Romanian law firm can ensure adherence to data protection regulations and secure online prosperity.

Contact our team of Romanian Lawyers at office@theromanianlawyers.com for expert legal advice on GDPR compliance in dropshipping and other relevant legal matters.

FAQ

Q: Why is GDPR compliance important in dropshipping?

A: GDPR compliance is crucial in dropshipping to protect the personal data of EU citizens and ensure their privacy rights are respected. Non-compliance can lead to significant penalties and harm the reputation of your business.

Q: What is the General Data Protection Regulation (GDPR)?

A: The GDPR is a set of legal requirements that regulate the storage and use of personal data of EU citizens.

It applies to businesses that have customers in the EU, regardless of their physical location.

Q: What types of personal data should dropshippers protect?

A: Dropshippers should protect personal data such as names, email addresses, home addresses, and any other information that can identify an individual.

Q: How can dropshippers make their store GDPR compliant?

A: Dropshippers can make their store GDPR compliant by revising the types of data they collect, reviewing data sharing with suppliers, creating a privacy note, setting up privacy notifications on the website, and staying updated on GDPR regulations.

Q: Can dropshippers be penalized for non-compliance with GDPR?

A: Yes, non-compliant dropshippers can face penalties of up to 4% of their annual global turnover or €20 million. It is essential to prioritize GDPR compliance to avoid financial and reputational risks.

Q: Where can dropshippers seek legal guidance for GDPR compliance?

A: Dropshippers can seek legal guidance from reputable Romanian Law Firm, such as Atrium Romanian Lawyers, to ensure compliance with GDPR and other relevant regulations.