Romania Personal Income Tax Rate 2023

What Is the Personal Income Tax Rate in Romania for 2023?

What is the personal income tax rate in Romania for 2023?

This is a question that many people are wondering as the new year approaches.

The personal income tax rate in Romania is currently set at 10%.

The personal income tax is levied on all individuals who earn income from Romanian sources.

This includes wages, salaries, pensions, interest, dividends, and other forms of income.

The tax is levied at a flat rate of 10%, regardless of how much income you earn.

If you are a resident of Romania, you are liable for personal income tax on your worldwide income.

However, if you are a non-resident, you are only liable for personal income tax on your Romanian-source income.

The tax year in Romania runs from January 1st to December 31st.

This is different from the calendar year, which runs from January 1st to December 31st.

The tax year is the same as the fiscal year in Romania.

All taxpayers must file a personal income tax return by March 31st of the following year. For example, if you earned income in 2022, you must file your return by March 31st, 2023.

If you owe taxes, you must pay them by May 30th of the following year.

If you don’t file your return or pay your taxes on time, you will be subject to late fees and interest charges.

So it’s important to make sure that you do both on time!

The Romanian Tax Authority is responsible for collecting personal income taxes.

personal taxes 2023

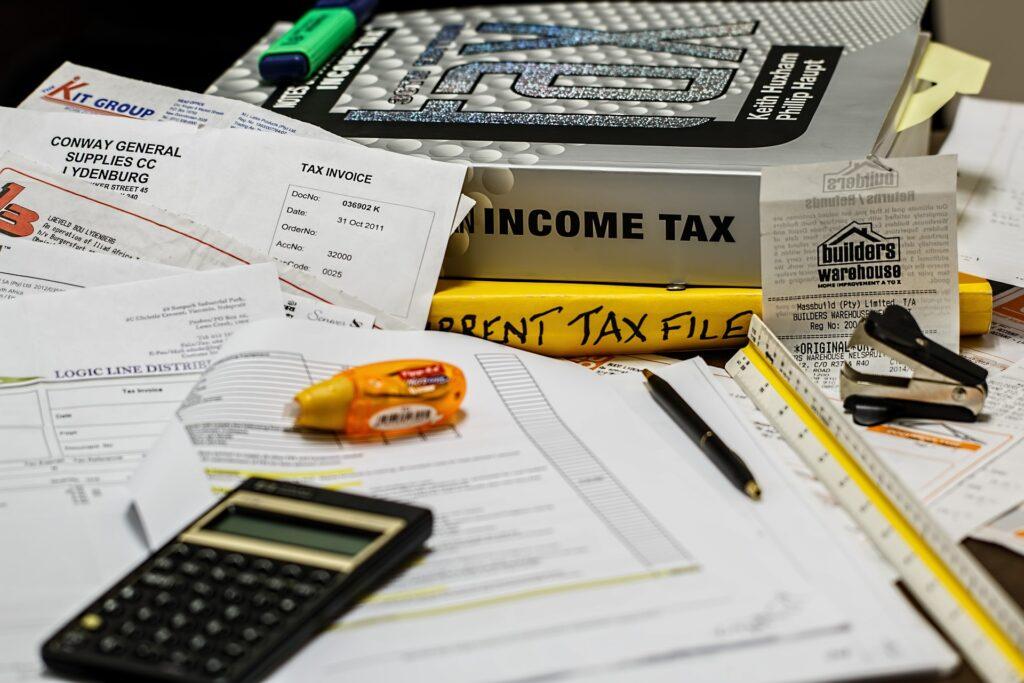

Calculating Your Personal Income Tax in Romania for 2023

If you’re a resident of Romania and you’ve earned income in the country during the year, you’ll need to file a personal income tax return. The deadline for filing is May 31 of the year following the tax year.

For the tax year 2022, the Romanian government has set the following rates for personal income tax:

To calculate your personal income tax, you’ll first need to total up all your taxable income from all sources for the year.

This includes wages, interest and dividends, capital gains, and other types of income.

Once you have your total taxable income, you’ll apply the appropriate tax rate to calculate your tax liability.

If you’re owed a refund, the Romanian government will issue a cheque within 30 days of receiving your tax return.

If you owe taxes, you’ll need to pay by the May 31 deadline. The Romanian government offers a few different payment options, including online banking, credit or debit cards, and bank transfers.

Deductible Expenses Under Romania’s Personal Income Tax for 2023

The Romanian government has published the list of deductible expenses under the personal income tax for 2023.

The following expenses are deductible:

1. Printing and photocopying costs

2. Internet costs

3. Mobile phone costs

4. Software licenses

5. Subscriptions to scientific journals

6. Home office expenses

7. Accountancy and legal services

8. Bank charges

9. Insurance premiums

10. Depreciation of assets

11. Rent

12. Repairs and maintenance

13. Donations

14. Tuition fees

15. Romania income tax

Filing Your Personal Income Tax Return in Romania for 2023

Filing Your Personal Income Tax Return in Romania for 2023

Your personal income tax return is the document you use to declare your income and any other money that you received during the year.

This includes your salary, any interest or dividends from investments, and any other sources of income.

You’ll need to file your return by the end of April each year. If you’re self-employed, you have until the end of May to file.

In order to file your return, you’ll need a few things.

First, you’ll need your social security number.

You’ll also need your fiscal residence certificate.

This is a document that proves that you’re a resident of Romania for tax purposes.

You’ll also need to have your tax return forms.

These can be obtained from your employer or from the Romanian Tax Authorities.

Once you have all of your documents in order, you can start filling out your return.

The first section is your personal information, including your name, address, and social security number.

Then, you’ll move on to the section about your income. Here, you’ll list all of your sources of income, as well as how much money you earned from each one.

After you’ve declared your income, you’ll move on to the deductions section.

Here, you’ll be able to deduct certain expenses, such as your health insurance premiums or your pension contributions.

Once you’ve taken all of your deductions into account, you’ll calculate your tax liability.

This is the amount of money you owe in taxes for the year.

If you’re due a refund, you’ll calculate that amount in this section as well.

Finally, you’ll sign and date your return, and mail it off to the Romanian Tax Authorities.

That’s it! Now you know how to file your personal income tax return in Romania for 2023.

How to Get Help with Romania’s Personal Income Tax Rate for 2023

How to Get Help with Romania’s Personal Income Tax Rate for 2023

If you’re struggling to figure out how much you’ll owe in taxes for 2023, you’re not alone.

There are several tax calculators available online that can help you figure out your tax liability.

Additionally, the Romania Tax Authority offers a free tax consultation service for taxpayers who need assistance.

If you’re a business owner, you’ll also need to pay corporate income tax in addition to your personal income tax.

No matter how complex your tax situation may be, there’s help available to make sure you’re meeting your obligations.

By using a tax calculator and seeking assistance from the Romania Tax Authority, you can ensure you’re paying the right amount of tax for 2023.

Are There Any Other Taxes in Romania for 2023?

Are There Any Other Taxes in Romania for 2023?

If you are an expat living in Romania, you may be wondering if there are any other taxes that you need to be aware of in 2023. In addition to the income tax and VAT rate, there are a few other taxes that you may be liable for.

Here is a brief overview of the other taxes that you may be required to pay in Romania:

If you own property in Romania, you will be required to pay an annual property tax. The amount of tax you will need to pay will depend on the value of your property.

- Capital Gains Tax:

If you sell your property for a profit, you will be liable for capital gains tax. The tax rate on capital gains is 16%.

- Inheritance Tax:

If you inherit property from someone who has passed away, you may be required to pay inheritance tax.

The amount of tax you will need to pay will depend on the value of the property and your relationship with the deceased.

These are just a few of the taxes that you may be liable for in Romania. It is always best to speak to a Romanian tax advisor to ensure that you are aware of all of the taxes that you may be required to pay.