Double Taxation Treaties in Romania- Foreign Investment Insights

Double Taxation Treaties in Romania- Foreign Investment Insights

Romania has over 80 double taxation treaties (DTTs).

These treaties help attract global investors by providing international tax relief.

With about 20 million people, Romania is a key player in the European Union.

Double taxation treaties in Romania prevent businesses from being taxed twice on the same income.

They are key to your international investment strategy.

These treaties help reduce tax burdens and make cross-border transactions smoother.

Romania’s adoption of EU fiscal legislation in 2007 changed its tax approach.

Foreign investors can use these tax treaties to improve their financial structures.

This helps reduce tax complexities when working in Romania.

Key Takeaways

- Romania has over 80 double taxation treaties with EU and third-state partners;

- Tax treaties help prevent duplicate taxation for international businesses;

- EU membership enhances Romania’s fiscal transparency and investment attractiveness;

- Bilateral tax conventions offer strategic financial advantages;

- Understanding international taxation rules is key for foreign investors.

Understanding Romania’s Tax Treaty Network and Framework

Romania has built a wide tax treaty network to help with cross-border investments and avoid double taxation.

With over 85 tax treaties worldwide, it offers a solid base for international tax dealings.

These agreements are key in setting up clear tax rules for foreign investors.

The Romanian tax treaty system follows international standards, mainly the OECD Model Convention.

This ensures that tax policies are clear and consistent across different countries.

Current Status of Tax Treaties

Romania’s tax treaty network includes important partnerships with many countries.

The main goals of these agreements are:

- Preventing double taxation for individuals and corporations;

- Setting clear rules for where taxes are paid;

- Lowering taxes on money sent across borders;

- Making it easier for tax authorities to share information.

OECD Model Convention Implementation

Romania has made the OECD guidelines a part of its tax treaty system.

This helps make tax rules consistent and clear for investors worldwide.

Romanian tax treaties cover important topics like how income is taxed and how to solve disputes.

Key Treaty Partners and Jurisdictions

Romania has key tax treaties with big economic partners like Germany, Austria, and the United States.

These agreements offer lower taxes on money sent across borders and clear rules for business activities.

This makes Romania a great place for international investment.

Corporate Income Tax Structure for Foreign Investors

Foreign investors need a smart plan to deal with Romania’s corporate taxes.

The country has a clear tax system.

It aims to draw in international businesses while keeping taxes fair.

Romania’s corporate income tax is competitive and easy to understand for global investors.

The main tax rate is 16% for most companies.

This makes it easier to plan and invest in Romania.

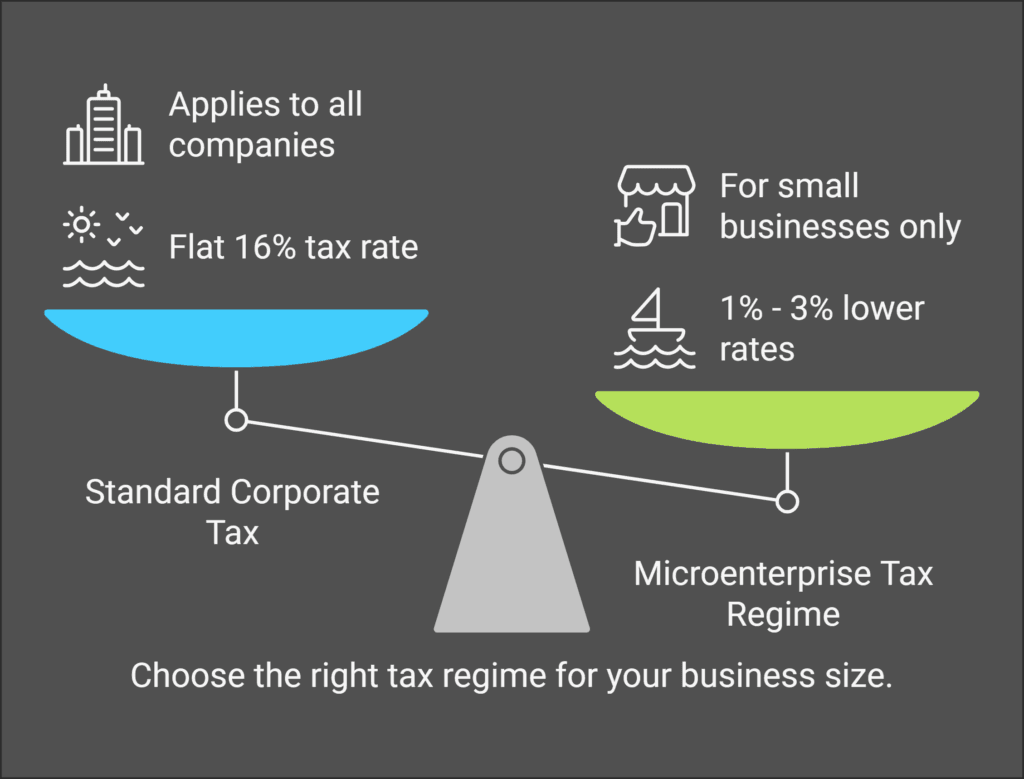

Standard Corporate Tax Rates

Romania has a flat 16% corporate income tax rate.

This rate is applied to profits.

It shows Romania’s effort to make it attractive for investors.

- 16% flat tax rate for standard corporate income;

- 25% tax rate for income from specific gambling activities;

- 50% tax rate for revenues from countries without information exchange agreements.

Microenterprise Tax Regime

Small businesses can enjoy a special tax regime. This system has lower taxes for companies with less than €500,000 in annual revenue. It’s a good option for small businesses.

| Annual Revenue | Tax Rate | Eligibility |

|---|---|---|

| Up to €500,000 | 1% – 3% | Optional for qualifying microenterprises |

Profit Taxation and Reporting Requirements

Foreign investors must know the detailed reporting rules for taxes.

Non-residents need to get tax residence certificates.

They also have to meet certain document requirements to get treaty benefits and avoid tax issues.

- Submit tax residence certificate within 60 calendar days;

- Provide documentation for permanent establishment verification;

- Maintain accurate records for fiscal conventions compliance.

- Effective tax planning requires a thorough understanding of Romania’s complex corporate taxation framework and international fiscal conventions.

Double Taxation Treaties in Romania

Romania has a strong network of tax treaties to help foreign investment and cross-border deals.

With over 80 double tax avoidance agreements, it offers multinational companies great tax benefits.

Investors can use these treaties to lower their tax bills.

They do this by setting up international business plans.

The main benefits are lower withholding taxes and avoiding double taxation on corporate income.

- Romania has signed tax treaties with 87 countries;

- Dividend tax rates can be as low as 3-5% under specific treaties;

- Holding companies can optimize tax positioning.

These treaties help with tax planning for expats and international investors.

Companies often set up holding structures in places like the Netherlands or Luxembourg.

This helps them get the most from treaty benefits.

| Country | Dividend Tax Rate | Interest Rate | Royalty Rate |

|---|---|---|---|

| Italy | 5% | 5% | 5% |

| Norway | 5-10% | 5% | 5% |

| UAE | 3% | 3% | 3% |

Knowing about these tax treaties can improve your investment plan.

It can also lower your tax bill when working in Romania.

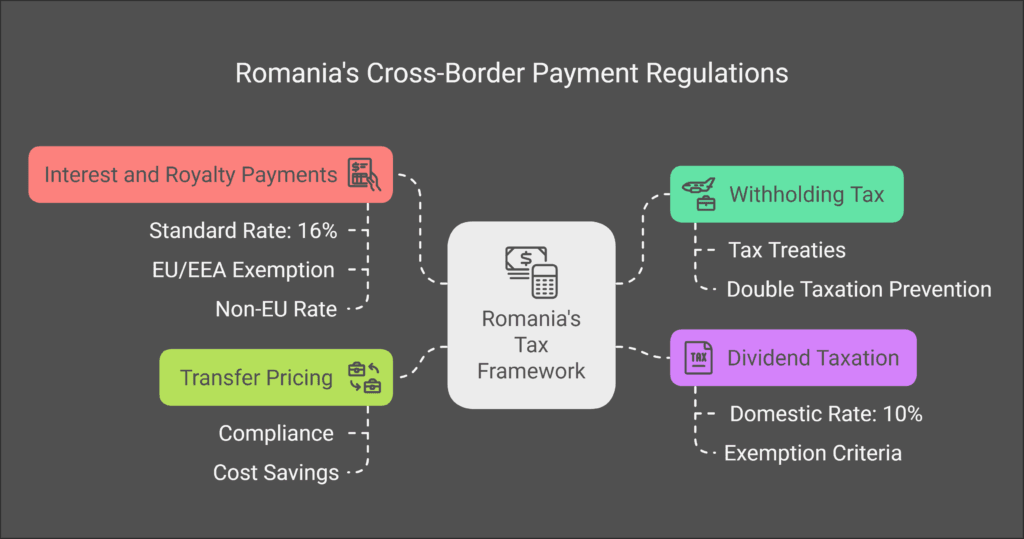

Cross-Border Payment Regulations and Withholding Taxes

Understanding withholding tax in Romania is key for international businesses.

The country’s tax treaties help manage payments across borders.

This ensures fair taxes and prevents double taxation.

Romania’s tax agreements help manage payments abroad.

They make sure taxes are collected fairly and prevent double taxation.

Dividend Taxation Dynamics

Changes in dividend taxes affect foreign investors.

Starting January 2025, there are new rules:

- Domestic dividend tax rate: 10%;

- Minimum shareholding for tax exemption: 10%;

- Minimum uninterrupted holding period: 1 year.

Interest and Royalty Payment Considerations

Romania has specific tax rates for interest and royalties:

- Standard withholding tax rate: 16%;

- Zero withholding tax for EU/EEA companies meeting specific criteria;

- 50% tax rate for payments to countries without tax information exchange agreements.

Transfer Pricing Insights

Romania ensures fair prices in transactions between related parties.

When making payments abroad, follow Romania’s tax rules.

This keeps you compliant and saves on taxes.

Understanding Romania’s complex tax treaties is vital for international success.

Tax Residency and Permanent Establishment Rules

Understanding tax residency rules is key for foreign investors in Romania.

Romania has clear criteria for tax residency.

These rules affect your tax duties and corporate income tax liability.

For businesses in Romania, tax residency involves several important factors:

- Place of incorporation in Romania;

- Primary business location;

- Management and control headquarters;

- Duration of business activities.

Permanent establishment rules are also vital.

They can lead to more taxes, affecting your double taxation avoidance plans.

| Criteria for Permanent Establishment | Tax Implications |

|---|---|

| Fixed Business Location | Subject to Corporate Income Tax |

| Sustained Business Operations | Mandatory Tax Registration |

| Management Control in Romania | Full Fiscal Residency Requirements |

Foreign companies must understand their income tax rules and fiscal residency.

The corporate income tax rate is 16% for permanent establishments.

There are special rules for different business types.

Proactive tax planning can help optimize your tax position while ensuring compliance with Romanian bilateral tax agreements.

International Tax Relief Mechanisms

Understanding international taxation is complex.

For foreign investors in Romania, there are ways to reduce double taxation.

These strategies help in managing taxes and staying compliant with global rules.

Romania’s tax treaties are key in lowering taxes on foreign investments.

They help businesses deal with taxes from abroad.

This ensures they follow international tax laws.

Foreign Tax Credits

Foreign tax credits are vital for cutting down tax bills in cross-border deals.

Romanian tax authorities offer credits for taxes paid overseas.

But, there are certain rules to follow:

- Credits apply only if documented in relevant tax treaties;

- Maximum credit cannot exceed Romanian tax on equivalent income;

- Requires submission of official tax residence certificates.

Treaty Benefits and Applications

Investors can use treaty benefits to lower withholding tax.

This prevents tax avoidance. Important points to remember include:

- Providing detailed documentation;

- Understanding specific treaty provisions;

- Maintaining accurate financial records.

Mutual Agreement Procedures

When tax disputes happen between Romania and its treaty partners, mutual agreement procedures help.

They solve interpretation issues and ensure fair tax treatment for investors.

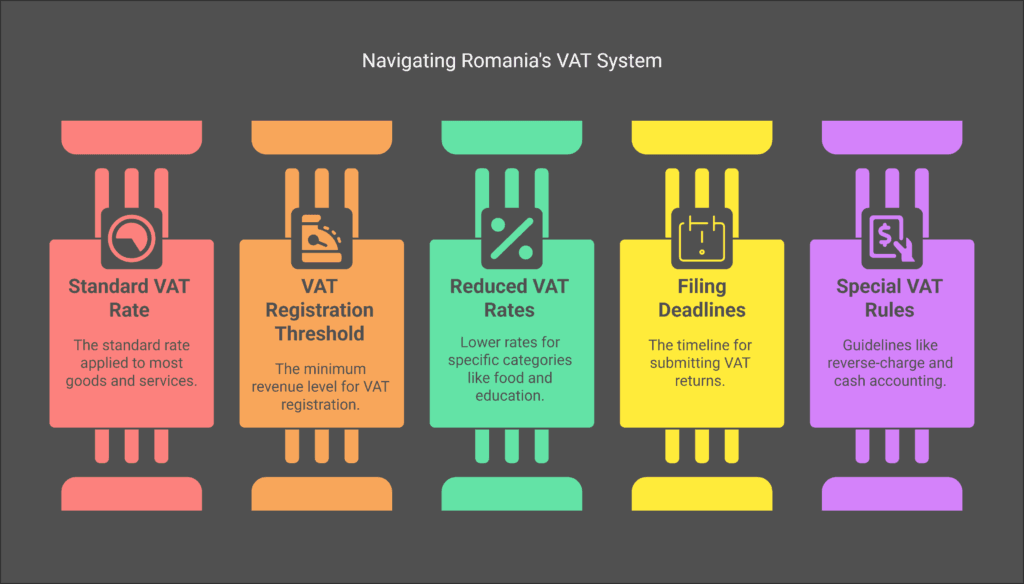

Value-Added Tax Implications for Foreign Businesses

Understanding Romania’s Value-Added Tax (VAT) is key for foreign businesses.

The VAT system in Romania has its own rules and benefits.

It’s part of the country’s tax treaty network.

Romania has a standard VAT rate of 19%.

There are also lower rates for certain goods and services.

Foreign businesses need to know about these rates and rules.

- VAT registration threshold of RON 300,000 (approximately EUR 88,500)

- Reduced VAT rates for specific goods and services:

- 9% for food, beverages, entertainment, and green energy

- 5% for educational materials and certain publications

- Quarterly or monthly VAT return submissions.

Foreign businesses must follow special VAT rules.

These include the reverse-charge system and cash accounting schemes.

Keeping track of these rules helps in managing taxes and getting tax relief.

| VAT Aspect | Details |

|---|---|

| Standard VAT Rate | 19% |

| VAT Registration Threshold | RON 300,000 (EUR 88,500) |

| Reduced VAT Rates | 9% and 5% for specific goods/services |

| Filing Deadline | 25th day of following month |

Knowing the tax rules in Romania helps businesses run smoothly.

Planning well can also help them use tax treaties to their advantage.

Recent Developments in Romanian Tax Treaties

Romania’s tax laws are changing, with new rules in bilateral tax agreements and double taxation avoidance.

It’s key for businesses to understand these changes in cross-border taxation.

Implementation of Multilateral Instrument (MLI)

Romania signed the Multilateral Instrument on July 7, 2017.

This was a big step in its tax strategy.

But, it’s yet to ratify the treaty fully.

This shows how hard it is to adopt global tax standards.

- Signed MLI on July 7, 2017;

- Ratification status: Pending;

- Potential implementation: Near future.

BEPS Action Plan Integration

The BEPS Action Plan is changing how tax authorities share information.

Romania is updating its tax treaties to follow OECD guidelines.

This aims to stop tax avoidance.

| Year | Mutual Agreement Procedures | Case Resolution |

|---|---|---|

| 2022 | 46 total cases | 37 cases closed |

| 2022 Resolution Rate | 89.2% rejection | No full double taxation elimination |

Future Treaty Updates

Romania’s tax scene is seeing big changes.

With a 187.5% jump in transfer pricing requests, it’s showing strong commitment to tax compliance.

Your business needs to keep up with these changes.

They will affect cross-border deals, mutual agreements, and tax planning in Romania.

Conclusion

Romania has strong rules to prevent double taxation through its tax agreements.

It’s important for foreign investors to know these rules well.

The Romanian Fiscal Code, or Law no. 227/2015, makes sure taxes are fair and protect businesses.

Investors can use Romania’s tax relief by looking at treaty details.

Withholding tax rates change in different agreements.

So, planning carefully is key.

Getting help from experts is a good idea to understand Romania’s tax rules.

The Romanian Lawyers ( e-mail address: office@theromanianlawyers.com) can offer detailed advice.

Our Romanian Law Office can help with tax procedures and how to save on taxes in Romania.

Keeping up with changes in global tax laws is important.

Knowing about Romania’s tax updates and international tax news is vital.

Your knowledge will help your investment plans succeed.

FAQ

What are double taxation treaties, and why are they important for foreign investors in Romania?

Double taxation treaties help prevent being taxed twice on the same income in two countries.

For investors in Romania, these treaties are key.

They remove tax barriers, lower withholding tax rates, and help avoid double taxation.

How many double taxation treaties does Romania currently have?

Romania has over 90 double taxation treaties worldwide.

These agreements are based on the OECD Model Convention.

They help international trade and investment by setting clear tax rules for cross-border deals.

What is the standard corporate tax rate in Romania for foreign investors?

The standard corporate tax rate in Romania is 16%.

But, there are special tax systems for small businesses.

These could offer tax benefits for smaller companies in Romania.

How does Romania determine tax residency for foreign businesses?

Romania checks several things to decide if a business is tax resident.

It looks at where the business is set up, where it’s managed, and how long it’s been there.

A business might be considered tax resident if it’s managed in Romania or meets certain Romanian tax law criteria.

What are the withholding tax rates for dividends in Romania?

The dividend withholding tax rate in Romania is now 8%.

This rate can drop or even go away, thanks to tax treaties and EU rules.

This is true for certain parent-subsidiary relationships.

How can foreign investors claim tax credits under Romania’s double taxation treaties?

Investors can claim tax credits by showing they’ve paid tax in another country.

They need to provide documents like proof of foreign tax paid and tax residence certificates.

This shows they’ve been taxed in both countries, allowing for tax relief.

What is the Value-Added Tax (VAT) rate in Romania for foreign businesses?

Romania’s VAT rate is 19%. But, there are lower rates of 9% and 5% for some goods and services.

Foreign businesses must register for VAT if they earn over a certain amount.

They also need to follow local invoicing and reporting rules.

How do Romania’s tax treaties address permanent establishment?

Romania’s tax treaties follow the OECD Model Convention on permanent establishment.

A permanent establishment is a fixed place of business or significant presence.

It can also be certain economic activities that show a business is really there.

What recent developments are affecting Romania’s tax treaty network?

Romania is working on the Multilateral Instrument (MLI) and OECD BEPS recommendations.

These efforts aim to update tax treaties, stop tax avoidance, and make international tax clearer.

Are there special tax considerations for holding companies in Romania?

Romania gives good tax treatment to holding companies, like those under the EU Parent-Subsidiary Directive.

These companies get dividend exemptions, lower withholding tax rates, and other tax benefits when set up right.

What is the Purpose of Double Taxation Treaties in Romania?

The primary purpose of double tax treaties or double taxation agreements that Romania has entered into is to eliminate or reduce the burden of being taxed twice on the same income.

When individuals or companies operate across borders, they may be subject to taxation in both Romania and the other contracting state. A double tax treaty provides clear rules on which country has the right to tax specific types of income and outlines methods for tax relief.

These agreements typically cover various types of income such as business profits, dividends, interest, royalties, and employment income.

By establishing these frameworks, Romania aims to create a favorable environment for international business and investment while ensuring tax certainty and preventing tax evasion.

The treaties also typically contain provisions for the exchange of information between tax authorities to enhance transparency and compliance with tax laws.

How Many Double Tax Treaties Has Romania Signed and With Which Countries?

Romania has developed an extensive network of double tax treaties, having signed agreements with over 90 countries worldwide.

This comprehensive coverage includes major economic partners such as EU member states, the United States, China, Russia, Japan, and Canada.

Romania has also established tax treaties with countries in the Middle East including Kuwait and the United Arab Emirates.

In recent years, Romania has continued to expand its treaty network, with some of the newer agreements being concluded or renegotiated to align with the latest international tax standards, particularly those developed under the OECD’s Base Erosion and Profit Shifting (BEPS) initiative.

Each treaty is individually negotiated, so specific provisions may vary from one agreement to another.