IP Protection in Romania for Startups & Creators | Legal Guide

IP Protection for Creators & Startups in Romania

IP Protection for Creators & Startups in Romania

Beyond Registration – A Strategic Legal Perspective

Romanian intellectual property law is aligned with EU legislation and protects patents, trademarks, copyrights, industrial designs, and trade secrets through distinct legal regimes. Trademark and patent protection require registration with the Romanian State Office for Inventions and Trademarks (OSIM) or relevant EU authorities. Copyright protection arises automatically upon the creation of an original work and does not require registration, although voluntary evidentiary deposit may be used.

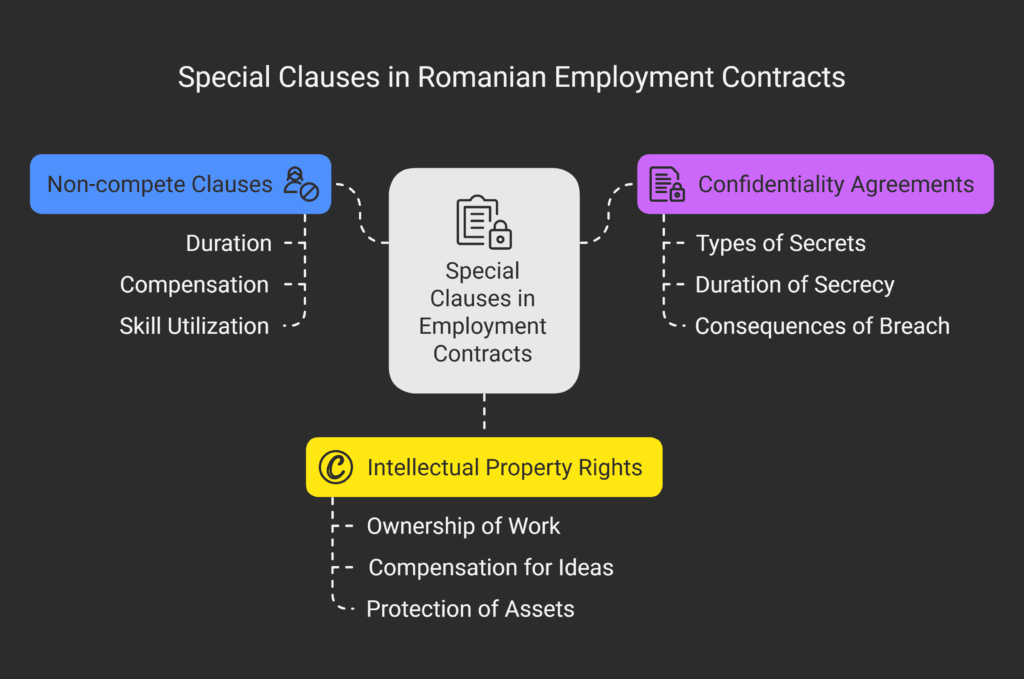

Ownership of intellectual property depends on the type of right and contractual arrangements. Software created by employees generally vests in the employer unless otherwise agreed, while other copyrighted works require explicit assignment. Contractors do not transfer intellectual property rights automatically.

Why Intellectual Property Is No Longer a Formality in Romania

For many founders and creators entering the Romanian market, intellectual property is still perceived as a bureaucratic checkbox: register a trademark, maybe file a patent, move on. This mindset is outdated and increasingly dangerous.

In today’s Romanian and EU business environment, IP is not merely a legal formality. It is a strategic asset, a valuation driver, and often a risk factor capable of blocking investment, scaling, or exit. For startups, creative professionals, and technology-driven companies, intellectual property is no longer something you “deal with later”—it is something that shapes the business from day one.

Romania offers a robust, EU-aligned IP framework. Yet many disputes, failed funding rounds, and blocked transactions stem not from lack of law, but from poor IP decisions made early. This guide explains how IP actually works in Romania, where founders make mistakes, and how a strategic approach changes outcomes.

Understanding Intellectual Property in Romania: The Practical Reality

At a conceptual level, intellectual property refers to creations of the mind: inventions, software, brands, designs, artistic works, and confidential know-how. In practice, Romanian IP law divides these creations into distinct legal regimes, each with its own logic, risks, and enforcement mechanisms.

A recurring mistake among startups is treating IP as a single category. It is not. A trademark does not behave like copyright. Software is not treated like a patent. Trade secrets disappear the moment confidentiality is lost. Understanding these differences is essential, because the law applies differently depending on the asset. For expert guidance on intellectual property protection in Romania, consult with experienced legal advisors.

Key Institutions in Romanian IP

- OSIM – State Office for Inventions and Trademarks, responsible for patents, trademarks, and industrial designs

- ORDA – Romanian Copyright Office, administers copyright registration and evidentiary matters

- Romanian Courts – enforce IP rights through civil and criminal proceedings

- EUIPO – European Union Intellectual Property Office, handles EU trademark and design registrations

Startups and IP: Where Strategy Matters More Than Law

The Early-Stage IP Trap

Most Romanian startups fail to address IP strategically at the incorporation or MVP stage. Founders focus on product-market fit and funding, assuming legal structuring can wait. In reality, early IP decisions determine whether later protection is even possible.

Common irreversible mistakes include:

- Public disclosure before patent assessment

- Launching under an unprotected or unregistrable brand

- Using contractors without IP assignment clauses

- Mixing open-source code without license control

These are not technicalities. They directly affect ownership, enforceability, and valuation.

IP as an Investment Filter

From an investor’s perspective, IP is not about certificates—it is about control and exclusivity. During due diligence, investors focus on:

- Who owns the code

- Whether trademarks are registered or merely used

- Whether patents are filed or still possible

- Whether key assets can be legally transferred

A startup with weak IP rarely fails because of infringement; it fails because no one is willing to invest in legally uncertain assets. For a deeper analysis of IP due diligence in startup funding, see our comprehensive IP protection guides.

Trademarks in Romania: Brand Protection as Market Control

In Romania, trademarks protect signs capable of distinguishing goods or services: names, logos, slogans, and sometimes non-traditional marks. Protection is obtained only through registration—use alone offers limited and risky protection.

Strategic Timing of Trademark Registration

Many founders wait until traction appears. Legally, this is a mistake. Romania applies a first-to-file system, meaning that the party who files first acquires rights, regardless of who used the mark first.

Delays can result in:

- Forced rebranding

- Opposition proceedings

- Loss of domain or social media alignment

National vs EU Trademark Protection

Romanian businesses may choose:

- National registration via OSIM: Focused protection with faster enforcement locally

- EU-wide registration via EUIPO: Broader coverage but higher risk of opposition

Copyright in Romania: Automatic Protection, Complex Ownership

Copyright Exists Without Registration—But Ownership Is Not Automatic

Under Romanian law, copyright arises automatically upon creation of an original work. No registration is required. This includes software, written content, designs, audiovisual works, and databases.

However, ownership and economic rights are frequently misunderstood.

Employees vs Contractors: A Legal Fault Line

Romanian law draws a sharp distinction:

Software created by employees: Economic rights generally belong to the employer, unless otherwise agreed

Other copyrighted works: Economic rights remain with the author unless expressly assigned

Contractors: Nothing transfers automatically. Without a written assignment, the company may lawfully use the work—but does not own it

This distinction becomes critical in litigation, exits, and acquisitions.

Evidentiary Registration and ORDA

Romania allows voluntary deposit or registration of works with ORDA for evidentiary purposes. This does not create rights, but it can significantly strengthen proof of authorship and creation date in disputes.

Patents in Romania: Powerful, Rare, and Often Misused

Patent protection in Romania follows EU standards: novelty, inventive step, and industrial applicability.

Software and Patents: The Hard Truth

Software as such is not patentable. Patent protection is available only where software contributes to a technical solution producing a technical effect.

Many startups assume their algorithm is patentable. Most are wrong. A proper patentability assessment must be conducted before disclosure, or the opportunity is permanently lost.

National vs European Patents

Romanian inventors may file:

- National patents via OSIM: Lower cost, focused protection

- European patents via the European Patent Office: Broader coverage, higher cost

The choice depends on commercial scope, budget, and enforcement strategy.

Trade Secrets: The Most Fragile IP Asset

Trade secrets protect confidential business information with economic value, provided reasonable secrecy measures are in place.

In practice, Romanian courts examine:

- Confidentiality clauses

- Access limitations

- Internal security measures

Once information becomes public, protection is lost—irreversibly. Protect your trade secrets with proper legal frameworks. Learn more about confidentiality agreements and trade secret protection.

Licensing and Monetization: Turning IP into Revenue

IP has little value if it cannot be commercialized.

Licensing allows IP owners to retain ownership while granting usage rights. Romanian law recognizes exclusive and non-exclusive licenses, sublicensing, and cross-licensing arrangements.

These contracts must be carefully drafted to avoid antitrust, tax, and enforcement issues. For startups, licensing is often the bridge between innovation and market entry.

Enforcement of IP Rights in Romania: What Actually Works

Enforcement options include:

- Civil litigation: Injunctions and damages

- Criminal proceedings: For counterfeiting and piracy

- Customs measures: Seizure of infringing goods at the border

In practice, early intervention and evidence preservation matter more than aggressive litigation. Many disputes are resolved through injunction pressure rather than final judgments.

IP Audits: The Missing Discipline in Romanian Businesses

Regular IP audits are still rare in Romania, yet they are one of the most effective risk management tools.

An IP audit clarifies:

- Ownership of all IP assets

- Validity and enforceability

- Licensing obligations

- Exposure to infringement claims

Audits are essential before funding, mergers, or international expansion.

The Future of IP in Romania: From Formal Rights to Strategic Assets

As Romania’s startup ecosystem matures, IP disputes are shifting from registration issues to ownership, valuation, and enforcement complexity.

AI-generated content, software licensing conflicts, and cross-border enforcement will dominate future litigation.

Businesses that treat IP strategically—not administratively—will have a decisive advantage. For guidance on developing a comprehensive IP strategy, consult with our IP and technology law team.

Final Thoughts: IP as Business Infrastructure

In Romania, intellectual property is not just about protecting ideas. It is about controlling risk, enabling growth, and securing value.

The law provides the tools, but strategy determines outcomes.

For creators and startups, the question is no longer whether to protect IP—but whether your IP strategy is strong enough to support your ambitions. Schedule a consultation with our legal team to assess your IP position and develop a protection strategy tailored to your business.

Frequently Asked Questions

Romanian law protects patents, trademarks, industrial designs, copyrights, and trade secrets. Each category follows a different legal regime, registration logic, and enforcement mechanism. Choosing the correct form of protection is essential for enforceability and valuation.

Yes, effective trademark protection requires registration. Romania applies a first-to-file system, meaning prior use alone offers limited protection and does not prevent third parties from registering identical or similar marks.

EU registrations provide broader territorial coverage, but national Romanian enforcement, local language proceedings, and procedural rules still apply. Many businesses use a combined national and EU IP strategy.

Software is automatically protected by copyright as an original work. Patent protection is available only when software forms part of a technical invention that produces a technical effect and meets patentability criteria.

Ownership depends on the IP type. For employee-created software, economic rights generally vest in the employer unless otherwise agreed. For other works, rights remain with the author unless expressly assigned by contract.

No. Romanian law does not provide automatic transfer of IP rights from contractors. Without a written assignment, the contractor usually retains ownership, even if the company paid for the work.

No registration is required for copyright protection. Voluntary deposit or registration with ORDA is available for evidentiary purposes only and does not create rights.

| IP Type | Duration |

|---|---|

| Trademarks | 10 years, renewable indefinitely |

| Patents | Up to 20 years |

| Copyright | Generally 70 years after the author’s death |

| Industrial Designs | Up to 25 years |

Rights can be enforced through civil litigation, criminal proceedings in cases of counterfeiting or piracy, and customs measures to stop infringing goods at the border.

An IP audit reviews ownership, registrations, licenses, and risks related to intellectual property. It is essential before investment, mergers, international expansion, or restructuring.

Ideally before public disclosure, branding decisions, fundraising, or signing development contracts. Early legal input prevents irreversible IP loss and costly disputes.

Yes. Foreign companies may register and enforce IP rights in Romania directly or through EU mechanisms, subject to the same legal standards and enforcement rules.

Trade secrets are protected only as long as confidentiality is maintained. Once information becomes public, protection is permanently lost, unlike registered IP rights.

Domain names and handles are not IP rights themselves but may infringe trademarks or be protected indirectly through trademark enforcement and unfair competition law.

Romanian law currently protects works created by human authors. AI-generated content raises unresolved legal questions, particularly regarding authorship and ownership, and should be assessed case by case.

Disclaimer: This article is provided for general informational purposes only and does not constitute legal or intellectual property advice. The analysis is based on Romanian IP law and EU legislation as of January 2026. Application of the law may vary depending on individual circumstances, administrative practice, and subsequent guidance or case law. Professional advice should be obtained before taking any action based on this content.