Remote Work in Romania: What Employers Need to Know

Remote Work in Romania: What Employers Need to Know

In 2020, nearly 32% of Romanian workers started working from home.

But, only 17% of companies had the right documents to follow the law.

This shows how important it is for businesses to know about telecommuting laws in Romania.

Law No. 81/2018 set up the rules for flexible work in Romania.

Even though it’s been around for a while, many employers are unsure about how to follow it.

This is true for both local and international companies.

Companies with remote teams face special challenges.

They need to deal with paperwork, taxes, and management rules specific to Romania.

Making sure work from home policies are followed correctly is key.

But, many businesses miss important legal details.

This guide looks at the current laws and gives practical advice.

It covers what employers need to do and what rights employees have.

For help with flexible work rules, companies can email office@theromanianlawyers.com.

They offer advice that fits each company’s needs.

Key Takeaways

- Law No. 81/2018 provides the legal foundation for teleworking activities in Romania;

- Proper documentation is essential for compliance with Romanian employment regulations;

- Both domestic and international employers must understand specific tax implications;

- Employee rights and employer obligations are clearly defined under current legislation;

- Professional legal guidance can help navigate the complexities of remote employment rules;

- Proper implementation helps companies avoid possible penalties and legal issues.

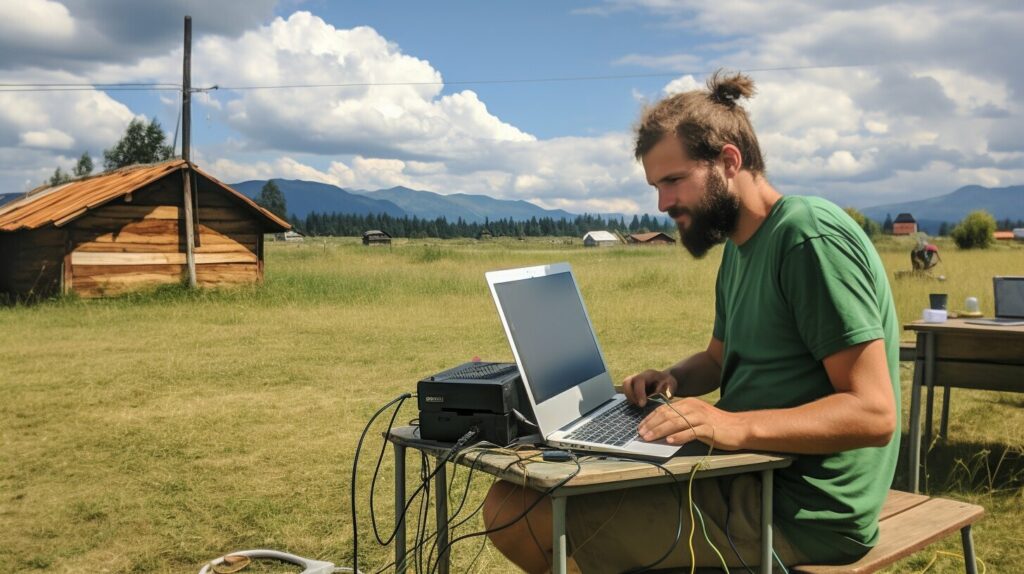

The Current State of Remote Work in Romania

Remote work in Romania has grown fast, bringing new chances and challenges.

It has changed how businesses work, affecting their structure, management, and rules.

Knowing this landscape is key for employers to make good remote work policies and stay ahead in the job market.

Remote Work Adoption Statistics and Trends

More Romanian companies started working remotely after 2020.

The National Institute of Statistics says about 32% of them now offer remote work, up from 8% before the pandemic.

This shows how fast Romanian businesses have adapted to new work ways.

Remote work is now seen as a permanent part of work in Romania.

Studies show 68% of employers want to keep hybrid work forever.

Also, 24% have gone fully remote for some jobs.

Workers in Romania also want more flexible work.

About 71% of them want to work from home or have flexible hours.

This makes it easier for companies to attract skilled workers, like in IT and digital services.

Industry-Specific Remote Work Patterns

Remote work varies by industry in Romania.

The tech sector has taken to it the most, with 87% of companies going fully or partially remote.

This is because tech jobs can be done from anywhere, thanks to digital tools.

Financial services and consulting are next, with 65% of them allowing flexible work.

These jobs need a lot of knowledge and can be done from home, keeping client service high.

But, industries like manufacturing, retail, and healthcare face more hurdles.

They have jobs that need to be done in person.

Yet, 28% of companies in these sectors offer some remote work for certain jobs.

| Industry | Remote Work Adoption Rate | Predominant Model | Key Challenges |

| Information Technology | 87% | Fully Remote/Hybrid | Maintaining team cohesion |

| Financial Services | 65% | Hybrid (3:2 model) | Data security concerns |

| Professional Services | 62% | Hybrid (flexible) | Client relationship management |

| Manufacturing | 28% | Limited Remote (admin only) | Operational continuity |

| Healthcare | 22% | Partial Remote (non-clinical) | Regulatory compliance |

Post-Pandemic Work Environment Changes

The Romanian workplace has changed a lot.

Flexible workplace norms have become common.

Now, 58% of employers have new ways to check how well remote workers are doing, focusing on what they produce.

Offices are being changed to fit new work styles.

About 43% of companies have made their offices smaller.

And 37% have redesigned them to make teamwork easier.

Companies are spending more on digital tools and keeping data safe.

This helps the remote workers in Romania and tackles security issues.

Support for workers’ mental health has grown.

Almost 52% of employers now offer help for feeling isolated or having trouble separating work from personal life.

This shows they understand the challenges of working from home.

The laws about remote work in Romania are also changing.

New rules have made it clearer what employers and workers need to do in remote jobs.

These updates show the government sees remote work as here to stay.

Understanding Remote Work Regulations in Romania

Romania’s remote work rules are based on Law 81/2018.

This law sets the stage for teleworking, giving clear rules for both bosses and workers.

Knowing these rules is key for any company starting or growing remote work in Romania.

Law 81/2018 on Teleworking Activities

Law 81/2018 is Romania’s first law on telework.

It was passed on April 19, 2018.

It defines telework as working from home or elsewhere using tech.

The law has key rules for employers:

- Both employer and employee must agree to telework;

- The agreement must be in the job contract or an addendum;

- Employers must give the right tools and tech support;

- Work conditions, schedule, and how to check up on work must be clear;

- Teleworkers have the same rights as office workers.

In Romania, employers must ensure good working conditions, even when workers are remote.

This includes health, equipment, and communication.

Legal Distinctions Between Telework and Work-From-Home

Romanian law makes big differences between telework and work-from-home. These differences are important for employers.

Telework is regular remote work.

It needs a formal job contract or addendum. It’s covered by Law 81/2018.

Work-from-home is occasional or short-term remote work.

It doesn’t need a formal agreement. Until recently, it was in a legal gray area.

The main differences are:

- Telework needs a formal contract change; work-from-home can have simpler agreements;

- Telework has strict rules on equipment and costs; work-from-home is more flexible;

- Telework has strict health and safety rules; work-from-home has less strict rules;

- Telework needs formal checks and reports; work-from-home has less strict oversight.

Recent Legislative Updates and Amendments

The COVID-19 pandemic led to big changes in Romania’s remote work laws.

Emergency Ordinance 192/2020 made key updates.

Recent changes include:

- Easier ways to start temporary work-from-home during emergencies;

- Clearer rules for what employers must provide and pay for;

- Better rules for digital signatures and online documents;

- New health and safety rules for working from home.

In 2021, more updates were made to the remote work laws.

These changes fixed issues found during the pandemic.

They made it clearer how to check on remote workers while protecting their privacy.

They also set clearer rules for what expenses employers must pay back.

The Romanian government keeps updating the remote work laws.

These updates aim to balance checking on workers with giving them freedom.

This includes flexible schedules and fair ways to judge their work.

It’s very important for employers to understand these rules when starting remote work in Romania.

The laws are changing to keep up with the growing need for remote work in Romania’s economy.

Legal Requirements for Implementing Remote Work

For remote work to work in Romania, employers need to know the law well.

The country’s labor laws now cover remote work, setting clear rules.

Companies must follow these rules to make sure remote work policies are fair for everyone.

Setting up remote work in Romania means you need to document everything properly.

This is true whether you’re moving current employees to remote work or hiring new ones.

You must meet all legal standards to avoid trouble.

Mandatory Employment Contract Provisions

Remote work needs a clear agreement between employer and employee.

This agreement is usually added to the employment contract or included in the contract for new hires.

The law says remote work agreements must have specific provisions.

These provisions protect both sides and set clear expectations.

Every remote work contract or addendum must include:

- It must say the employee will work remotely;

- The days and hours they will work from home;

- The exact places where they will work remotely;

- When they need to work and their schedule;

- How their work will be checked and evaluated;

- Who is responsible for the equipment and how it will be kept in good condition;

- How to handle technical problems;

- How to keep data safe and private.

It’s important to remember that remote workers have the same rights as those working in the office.

The law makes sure everyone is treated fairly, no matter where they work.

Documentation and Compliance Requirements

There’s more to remote work compliance in Romania than just the contract.

Employers need to keep detailed records.

These records show they’re following the law and can help in case of any issues.

Important documents for remote work compliance include:

- Written remote work policy – A detailed guide on how remote workers should work;

- Equipment inventory – A list of all equipment given to remote workers, including its condition and maintenance history;

- Health and safety assessments – Proof that remote workspaces are safe and healthy;

- Training records – Proof that remote workers have been trained on safety, equipment, and data security;

- Time tracking systems – Records of how much time remote workers spend working.

Employers must teach remote workers about safety, equipment, and data security.

This training should be documented and updated regularly to keep up with the law.

Employers also need to make sure remote workspaces are safe.

They can’t check the home without permission, but they must help employees make their workspaces safe.

Working Hours and Availability Regulations

Romanian laws set rules for remote work hours and availability.

These rules help keep productivity up while protecting workers from too much work and ensuring they have a good work-life balance.

The standard workday in Romania is 8 hours a day, 40 hours a week.

This rule applies to remote workers too.

But, remote work can have flexible hours if agreed upon in the contract.

Key rules for working hours include:

- Employers must clearly tell remote workers when they should be available;

- Remote workers get the same breaks as office workers;

- Overtime must be asked for and approved in advance, and workers must be paid for it;

- Employers must track remote work hours;

- Workers have the right to not work outside of work hours.

Employers can use systems to check if remote workers are available and working during hours.

But, these systems must respect privacy.

Watching workers all the time outside of work hours is not allowed by Romanian privacy laws.

Employers should have clear rules for communication.

These rules should say how quickly workers should respond and which channels to use.

These rules should be in the remote work policy and shared with all remote workers.

Following these legal rules is key to making remote work work in Romania.

By understanding and following these rules, employers can create a fair and productive remote work environment for everyone.

Employer Responsibilities and Obligations

In Romania, employers have clear duties when it comes to teleworking.

They must provide equipment, cover costs, ensure safety, and protect data.

These rules are set out in Law 81/2018 and its updates.

It’s key for any company to understand these duties to follow remote employment policies in Romania.

Remote work offers flexibility but doesn’t reduce employers’ legal duties.

In fact, it can add new rules that companies must follow.

Equipment and Technical Support Requirements

Romanian law requires employers to give remote workers the tools they need.

This includes computers, software, and other technology for their jobs.

Employers must list the equipment they provide in the employment contract.

They also need to say who will take care of it.

Employers must also offer technical support.

This means having a plan for fixing tech problems that happen while working from home.

This includes:

- Having a helpdesk or tech support team;

- Setting up ways to fix or replace equipment;

- Training workers on the software and systems they use;

- Making sure internet and other connections work well.

While employers must give equipment, workers must take care of it.

The agreement should explain who is responsible for any damage.

Cost Reimbursement Guidelines and Allowances

Romanian work from home rules say employers must pay for work-related costs.

This helps workers not have to pay for things related to their job.

Employers can give up to RON 400 a month without paying taxes for these costs.

This includes things like internet, electricity, and office supplies.

Employers can pay in different ways. Some give a fixed amount each month.

Others ask workers to report their expenses.

The agreement should say how this will work.

If employers pay more than RON 400, it might be taxed.

This is because of Romanian tax laws.

Health and Safety Obligations for Remote Workspaces

Even though they can’t control remote workspaces, employers must make sure they are safe.

This is a big challenge for home office policies in Romania.

Employers need to make sure remote workspaces are safe.

This includes:

- Providing safety guidelines and checklists;

- Helping with ergonomic setup;

- Checking remote workspaces when they can;

- Writing down safety rules in the agreement.

Accidents at work are the employer’s fault, even if they happen at home.

Companies need to have a plan for reporting accidents.

Companies should also help with ergonomic equipment.

This helps prevent injuries and shows they care about their workers’ health.

Data Security and Confidentiality Measures

Virtual office compliance in Romania means keeping data safe.

Employers must protect sensitive information when workers are not in the office.

The agreement should talk about keeping data safe.

This includes:

- Keeping information confidential;

- How to handle sensitive documents;

- Using security tools like VPNs;

- How to report security problems.

Employers should give workers the right tools and training.

This includes secure ways to access information and regular training on staying safe online.

For very sensitive work, companies might need to do more.

This could mean only doing certain tasks in a secure place or using extra security checks.

| Responsibility Area | Traditional Workplace | Remote Work Setting | Key Compliance Considerations |

| Equipment Provision | Employer provides and maintains on-site | Employer provides for home use with documented inventory | Clear documentation of provided items and maintenance responsibilities |

| Cost Coverage | Workplace utilities covered by employer | Allowance up to RON 400/month for home utilities | Tax implications for amounts exceeding statutory limits |

| Health & Safety | Direct employer control and monitoring | Indirect oversight with employee participation | Documentation of safety protocols and incident reporting procedures |

| Data Security | Controlled network environment | Distributed access requiring additional safeguards | Implementation of technical measures and clear security policies |

Creating good remote workforce policies in Romania needs careful planning.

Companies that follow these rules well are not only legal but also make a better work environment for everyone.

Remote Worker Rights in Romania

Remote worker rights in Romania are covered by laws that protect employees in virtual jobs.

The laws have changed to help teleworkers get fair treatment and protection.

It’s important for employers and employees to know these rights.

Equal Treatment and Non-Discrimination Provisions

Romanian labor laws say remote workers must be treated the same as office workers.

They have the right to:

- Equal pay and benefits;

- Same chances for promotions;

- Part in company events;

- Collective bargaining rights.

Employers can’t make remote workers go back to the office without their okay.

If an employee doesn’t want to go back, they can’t be punished or fired.

Companies must treat remote and office workers the same.

This includes how much work they do and how they’re judged.

This fairness is key in Romania’s remote worker laws.

Right to Disconnect Regulations

Romanian laws help remote workers have a good work-life balance.

They make it clear when work time ends and personal time starts.

Remote workers have the right to:

- Not work outside agreed hours;

- Not answer work emails when not working;

- Work regular hours as agreed;

- Take breaks and holidays without trouble.

Employers must respect these rules.

They can’t punish workers for taking breaks.

This helps prevent burnout and keeps workers healthy.

Privacy Protections and Monitoring Limitations

Remote work raises privacy and monitoring issues.

Romanian laws limit how much employers can watch remote workers.

This protects their privacy.

Key privacy rules include:

- Notice before virtual checks;

- Limit on constant watching;

- Rules on work devices;

- Respect for home office privacy.

Employers must balance watching workers with respecting their privacy.

Any monitoring must be fair, open, and for work reasons.

Romanian law says employers must tell remote workers before checking on them at home.

This keeps personal space safe while ensuring work is done right.

Training and Professional Development Rights

Remote workers in Romania have the right to keep learning and growing.

The law makes sure they get the same training as office workers.

These rights include:

- The same training as office workers;

- Chances to learn new skills;

- Feedback and career advice;

- Part in learning programs.

Employers must not stop remote workers from growing in their careers.

Remote work policies in Romania should plan for training and growth for all workers.

Knowing and following these rights helps companies create good remote work places.

For remote workers, knowing these rights helps them fight for fair treatment and support in virtual jobs.

Tax Implications for Remote Work Arrangements

The tax rules for remote work in Romania are complex.

They affect both employers and remote workers.

It’s key to know these rules to stay in line and get tax benefits.

Remote work brings new tax issues.

These are different from working in an office.

Employer Tax Obligations and Deductions

Employers in Romania have to deal with special tax rules for remote workers.

They must handle all employment taxes, no matter where the work is done.

Employers must figure out, withhold, and pay income tax at 10% for remote workers.

This rule is the same for everyone, whether they work from home or in an office.

Employers can get tax breaks for remote work.

They can deduct costs for equipment and tech needed for remote work.

But, they need to keep good records for tax audits.

Employee Tax Considerations and Benefits

Remote workers in Romania need to know how their work affects their taxes.

Being a tax resident is a big factor in tax duties.

Under Romanian tax law, you’re a tax resident if you’re here for over 183 days a year.

Tax residents pay taxes on all their income, while non-residents only pay on income from Romania.

Remote workers who are tax residents pay 10% income tax.

Those working for non-resident companies might have to declare their income and pay taxes themselves.

Remote Work Expense Taxation Guidelines

Remote work expenses have their own tax rules in Romania.

Knowing which expenses get tax breaks helps both employers and employees.

Home office costs are a big deal for remote workers.

Costs like utilities and internet might get tax benefits.

It’s important to keep records of these expenses.

Equipment and tech costs are another area.

If employers give equipment, it’s not taxable for employees.

But, if employees buy their own, the tax situation is different.

| Expense Category | Tax Treatment for Employer | Tax Treatment for Employee | Documentation Required |

| Home Office Equipment | Deductible business expense | Non-taxable benefit if company-owned | Purchase receipts, asset registers |

| Internet/Utilities | Deductible if documented properly | May be partially tax-exempt | Monthly bills, usage logs |

| Remote Work Allowance | Deductible business expense | Potentially taxable as income | Employment contract, payment records |

| Training/Development | Deductible if job-related | Non-taxable if job-relevant | Course certificates, relevance justification |

Social Security and Health Insurance Requirements

Remote work doesn’t mean you’re exempt from social security and health insurance in Romania.

These are required, no matter where you work in the country.

Health insurance costs 10% of your income, and social security is 25%.

Remote workers pay these just like office workers.

Employers take out these contributions.

Digital nomads and short-term remote workers have special rules.

They might not have to pay Romanian taxes if they’re covered by their home country’s social security.

Employers with teams worldwide need to understand Romanian social security rules.

This helps avoid double taxation and ensures workers are covered.

Cross-Border Remote Work and the Digital Nomad Visa

Romania is becoming a top spot for digital nomads with its special visa and remote work rules.

The country sees the value of international remote workers for its economy.

This makes Romania a great choice for people who work from anywhere.

Digital Nomad Visa Eligibility and Application Process

Romania’s digital nomad visa is for people who work remotely for companies outside the country.

It lets remote workers live in Romania while keeping their jobs abroad.

To get the digital nomad visa Romania, you need to meet certain requirements:

- Proof of remote work for companies outside Romania;

- A minimum income of at least three times the Romanian average salary;

- A clean criminal record;

- Valid health insurance for your stay;

- Proof of where you’ll live in Romania.

To apply, you’ll need to send documents to the Romanian Immigration Office.

This includes an application, document checks, and an interview.

If approved, you can live in Romania for up to a year, with options to extend.

Tax Implications for International Remote Workers

Understanding taxes is key for remote workers in Romania.

Your tax status affects your tax duties and benefits.

If you stay less than 183 days a year, you’re likely not taxed in Romania.

You’ll pay taxes in your home country instead.

But, if you stay more than 183 days, you might become a Romanian tax resident.

This means you’ll pay taxes on all your income, not just what you earn in Romania.

| Stay Duration | Tax Residency Status | Income Tax Implications | Documentation Required |

| Less than 183 days | Foreign tax resident | Generally exempt from Romanian income tax | Tax residency certificate from home country |

| More than 183 days | Romanian tax resident | Subject to Romanian income tax on global income | Romanian tax registration and declarations |

| Digital nomad visa holders | Special status | Income from foreign sources often exempt | Digital nomad visa documentation |

Digital nomad visa holders in Romania might not have to pay taxes on foreign income.

This makes the visa very appealing for remote workers.

Compliance Requirements for Employing Foreign Remote Workers

Companies hiring remote workers in Romania face several rules.

These rules vary based on the worker’s nationality.

EU/EEA workers have it easier.

They don’t need work permits for remote jobs in Romania, but they might need to register for long stays.

For workers from outside the EU/EEA, things are more complicated:

- Short-term visitors can work remotely on standard visas;

- Longer stays need a digital nomad visa or traditional permits;

- Companies must watch out for “permanent establishment” rules to avoid taxes;

- Following GDPR is key for data protection.

Employers should check all the rules before starting remote work in Romania.

This helps avoid legal issues and unexpected taxes.

Managing Cross-Border Employment Challenges

Employers face many challenges when managing remote workers in Romania.

They need to handle several areas well to keep everyone productive.

Setting up contracts is a big task.

Employers must clearly outline work terms, laws, and how to solve problems.

This is even more important when working across borders.

Managing benefits is also a challenge. Remote workers have different needs for healthcare, retirement, and time off.

Companies with Romania digital nomad visa holders need clear policies for these benefits.

Getting remote workers to feel part of the company culture is hard.

Employers should use regular communication, virtual team-building, and in-person meetings to include them.

Having good technology is essential for remote work.

Employers need secure ways to communicate, access company systems, and handle sensitive information.

By tackling these challenges, employers can build strong teams with remote workers in Romania.

This takes advantage of the country’s growing reputation for remote work.

Best Practices for Managing Remote Teams in Romania

Managing remote teams in Romania needs special strategies.

These strategies must meet legal rules and business goals.

Romanian employers must find ways to follow local laws and global best practices.

Effective Remote Communication Strategies

Good communication is key to managing remote teams in Romania.

Clear and regular communication helps team members and managers stay connected.

Romanian culture values face-to-face talks.

So, moving to remote communication is hard.

Employers should set clear communication rules that respect local culture and global standards.

Good strategies include regular meetings with clear goals.

Daily chats keep everyone connected.

Weekly meetings focus on progress and problems.

Monthly meetings help everyone stay on the same page.

Keeping records is also important in remote work.

Meeting notes, action items, and decision logs help everyone get important info, no matter where they are or when they work.

Choosing the right communication channels is important.

Romanian laws on data protection must be followed.

Employers should tell team members which channels to use for different types of messages.

Performance Evaluation Methods for Remote Employees

Old ways of checking work performance don’t work well for remote teams.

Now, we need to focus on what employees do, not just how they do it.

Romanian employers should set clear goals that can be measured.

This way, everyone knows what’s expected and can be fairly judged.

Good ways to check performance include:

- Objective Key Results (OKRs) that match individual goals with company goals;

- Regular talks that give feedback, not just once a year;

- Feedback from many people, not just one;

- Letting employees rate themselves, which helps them grow.

Romanian laws say employers must be open about how they judge work.

All rules for judging work should be clear in job contracts or company rules.

Building and Maintaining Remote Company Culture

Creating a strong company culture is hard when teams are far apart.

Romanian companies need to find ways to keep everyone connected and share values.

Virtual team-building activities should fit Romanian culture but also help everyone feel connected.

Try virtual coffee breaks, online celebrations of Romanian holidays, and ways to recognize achievements.

Good remote culture ideas include:

- Virtual onboarding that teaches new employees about the company;

- Online mentorship that helps new and experienced employees learn from each other;

- Ways to give feedback that show employees’ opinions matter;

- Systems to celebrate both work and personal achievements.

Remote working compliance in Romania is more than just following laws.

It’s also about respecting local culture while being flexible.

Tools and Technologies for Remote Team Management

Choosing the right tools and technologies is key for managing remote teams.

Romanian employers must find tools that are both useful and follow data protection laws.

When picking tools, look at their security, where data is stored, and if they follow Romanian and EU laws.

Tools that support both work and follow rules are important.

Important tools for managing remote teams include:

| Tool Category | Primary Function | Compliance Considerations | Implementation Best Practices |

| Project Management Platforms | Task assignment, progress tracking, deadline management | Data storage location, access controls, audit trails | Standardize usage across teams, integrate with other systems |

| Communication Tools | Team messaging, video conferencing, file sharing | End-to-end encryption, recording consent, data retention | Establish clear channel guidelines, provide training on secure usage |

| Time Tracking Software | Work hours monitoring, availability tracking | Employee privacy, proportionality, transparency | Focus on productivity, not surveillance, and get consent |

| Document Collaboration | Co-editing, version control, knowledge management | Access permissions, confidentiality controls, backup systems | Implement clear naming conventions, establish review processes |

When using these tools, make sure to train everyone well.

Have clear rules for using tools that follow remote workforce guidelines in Romania.

Check how well tools work often.

Ask remote employees about their experiences with tools to keep improving your remote work setup.

By following these best practices, Romanian employers can make remote work environments that meet legal needs and keep teams happy and productive.

The key is to balance rules with how things work, through good policies, clear communication, and the right technology.

Conclusion

Remote work in Romania brings a lot of flexibility.

But, it also has rules to protect everyone.

Both sides must agree on where work happens.

Any changes need to be told and agreed to by both.

Law 81/2018 says employers can’t make workers go back to the office without their okay.

This rule helps keep remote workers’ rights safe. It also helps companies manage remote work better.

To make remote work work, you need clear rules, open talks, and follow the law closely.

Companies must find a balance between what they need to do and what their workers want.

This way, they can make good remote work plans.

As Romania’s rules for remote work change, it’s key to keep up with new laws.

Companies can get help from employment lawyers in Bucharest who know the law well.

Romanian lawyers in Bucharest can give advice that fits your company’s needs.

Our Romanian law office in Bucharest helps make sure your remote work plans follow the law.

If you need help with remote work laws, contact a employment lawyer in Bucharest or Romanian lawyer in Bucharest at office@theromanianlawyers.com.

We can help make sure your remote work plans are legal and work well for everyone.