Employment Contracts in Romania: Tips for Drafting Work Contracts

Employment Contracts in Romania: Tips for Drafting Work Contracts

Ever thought about what makes a Romanian employment contract legally strong?

Knowing the details of labor contracts in Romania can help avoid legal issues.

Creating work contracts in Romania needs careful focus on legal rules in the Romanian Labor Code.

As an employer or professional, you must understand complex employment laws in Romania.

This ensures your contracts follow all rules.

The Romanian Standard Individual Employment Contract offers a clear structure.

It protects both employers and employees.

Your contract must be carefully made to meet Romanian labor laws’ strict standards.

Key Takeaways

- Romanian employment contracts must be written in Romanian and registered before work begins;

- Contracts are governed by Law No. 53/2003, with the latest republication in November 2024;

- Employment agreements must cover both private and public sector employees;

- Contracts require specific mandatory elements and legal compliance;

- Professional guidance is key for creating strong employment agreements.

For personalized legal help in making your Romanian employment contracts, contact our expert team at office@theromanianlawyers.com.

Understanding Romanian Employment Contract Requirements

Getting to know the rules for employment contracts in Romania is key.

The Romanian Labor Code sets out the rules for making and using these contracts.

When you make employment contracts in Romania, you must follow important legal points.

These points help you meet the national standards for contracts.

Legal Framework and Basic Requirements

The Labor Code of 2003 is the base for Romania’s employment contract rules.

It has been updated several times. Employers must follow strict rules to start work relationships.

- Minimum working age is 16 years;

- Written contracts are mandatory;

- Contracts must be in Romanian language;

- Registration with ReviSal is required before work begins.

Mandatory Contract Elements

Your employment contracts in Romania must have certain key parts to be valid.

These parts help protect both sides by clearly outlining the work relationship.

- Job description and responsibilities;

- Exact remuneration details;

- Working hours and schedule;

- Location of work;

- Start date of employment.

Language and Registration Requirements

When drafting contracts in Romania, pay close attention to language and registration rules.

Contracts must be in Romanian.

They also need to be registered online through ReviSal before the first day of work.

Knowing these rules for contracts in Romania helps ensure your agreements follow the law.

This protects both your company and your employees’ rights.

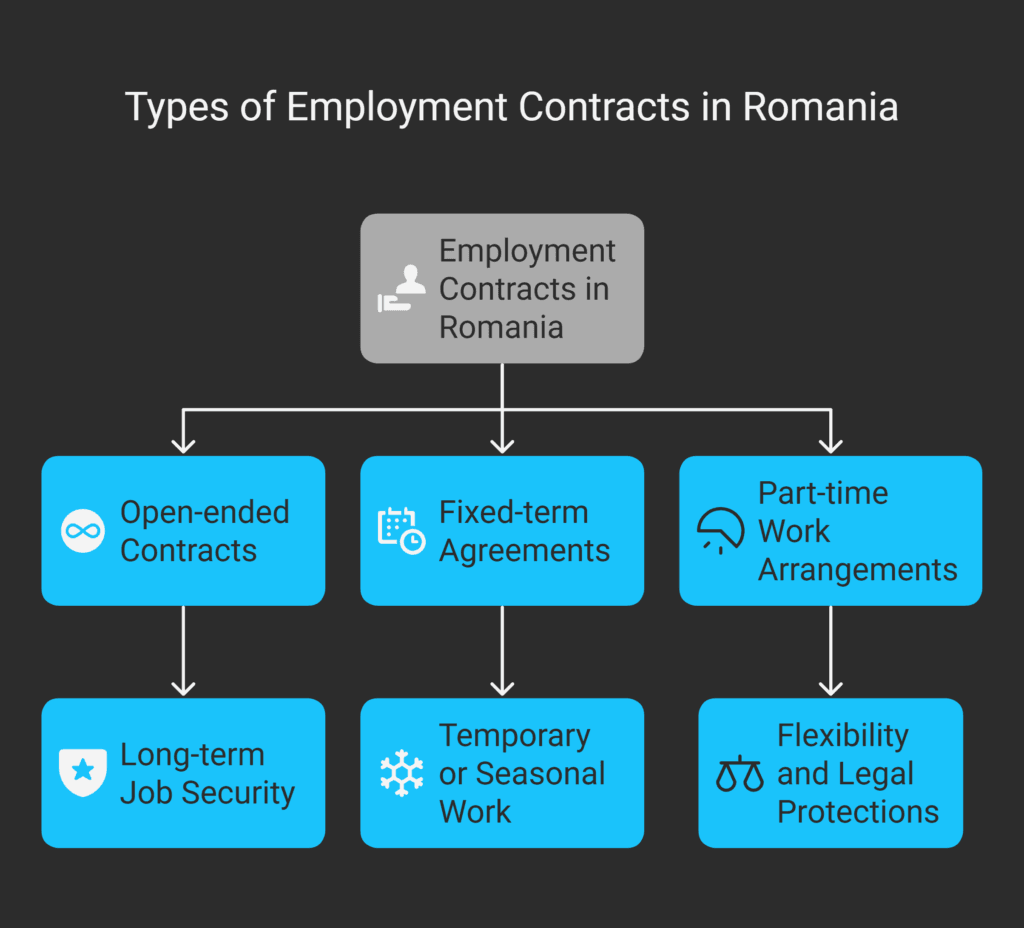

Types of Employment Contracts in Romania

It’s key for businesses and workers to know about the different employment contracts in Romania.

The law here offers many contract options for various work setups.

Romania has six main types of employment contracts.

Each is made for different work needs.

These contracts help with agreements for independent contractors, temporary jobs, and freelancers.

Open-ended Contracts

Open-ended contracts are the most common in Romania.

They offer long-term job security with no end date.

They include:

- Unlimited duration of employment;

- Standard legal protections for workers;

- Comprehensive benefits package;

- Typical for permanent full-time positions.

Fixed-term Agreements

Fixed-term contracts are for temporary jobs or seasonal work.

Romanian laws have rules for these contracts:

- Maximum contract duration: 36 months;

- Maximum of three contract renewals;

- Specific conditions for temporary work contracts;

- Detailed documentation requirements.

Part-time Work Arrangements

Part-time contracts offer flexibility.

They allow for fewer working hours while keeping legal protections.

They include:

- Flexible working hours;

- Proportional salary and benefits;

- Suitable for freelance work contracts;

- Clearly defined work schedules.

Choosing the right employment contract in Romania is vital.

It should match your business needs and workforce requirements.

Essential Components of Romanian Work Contracts

Creating a strong employment contract needs careful focus on key details.

These details protect both employers and employees.

Knowing how to draft contracts well is very important in Romania.

Your contract must have several important parts to follow the law and be clear.

These parts are the foundation of the employment agreement.

- Employee and employer full identification details;

- Precise job title and detailed job description;

- Exact workplace location;

- Detailed working hours specification;

- Complete salary and compensation structure;

- Contract duration and termination conditions;

- Notice periods for contract termination.

The terms and conditions should be clear to avoid confusion.

Romania’s labor laws require certain things in employment contracts.

For example, contracts must be registered within a day before starting work.

Don’t forget about pay details.

Your contract must say how much you’ll earn in Romanian lei.

It should also cover any raises, bonuses, or extra pay.

By focusing on these key points, you’ll make a detailed employment agreement.

This agreement will meet legal standards and protect both sides.

Drafting Work Contracts in Romania

Creating strong employment contracts in Romania needs careful attention to legal details.

Your contract services must understand Romanian employment laws well.

This ensures both employer and employee are protected.

Creating a good contract means knowing the legal templates Romania offers.

It’s important to get professional legal advice to avoid mistakes in the drafting process.

Contract Structure and Format

Romanian employment contracts have a specific structure.

They must include important elements:

- Detailed job description;

- Compensation and benefits information;

- Work location and responsibilities;

- Duration of employment.

Legal Compliance Considerations

When making employment agreements, you must follow Romanian labor laws closely. Key compliance points include:

- Written confirmation of all contract terms;

- Precise job role definition;

- Clear compensation structure;

- Adherence to mandatory social protections.

Common Pitfalls to Avoid

When drafting contracts, knowing common mistakes is important. Key areas to watch out for include:

| Pitfall | Potential Consequence |

|---|---|

| Vague Job Descriptions | Legal disputes and unclear expectations |

| Incomplete Compensation Details | Potential salary conflicts |

| Missing Mandatory Clauses | Contract invalidity |

Using professional legal templates from Romania can help avoid these issues.

Working with experienced contract drafting services ensures your agreements are solid and legally correct.

This protects both your organization and your employees.

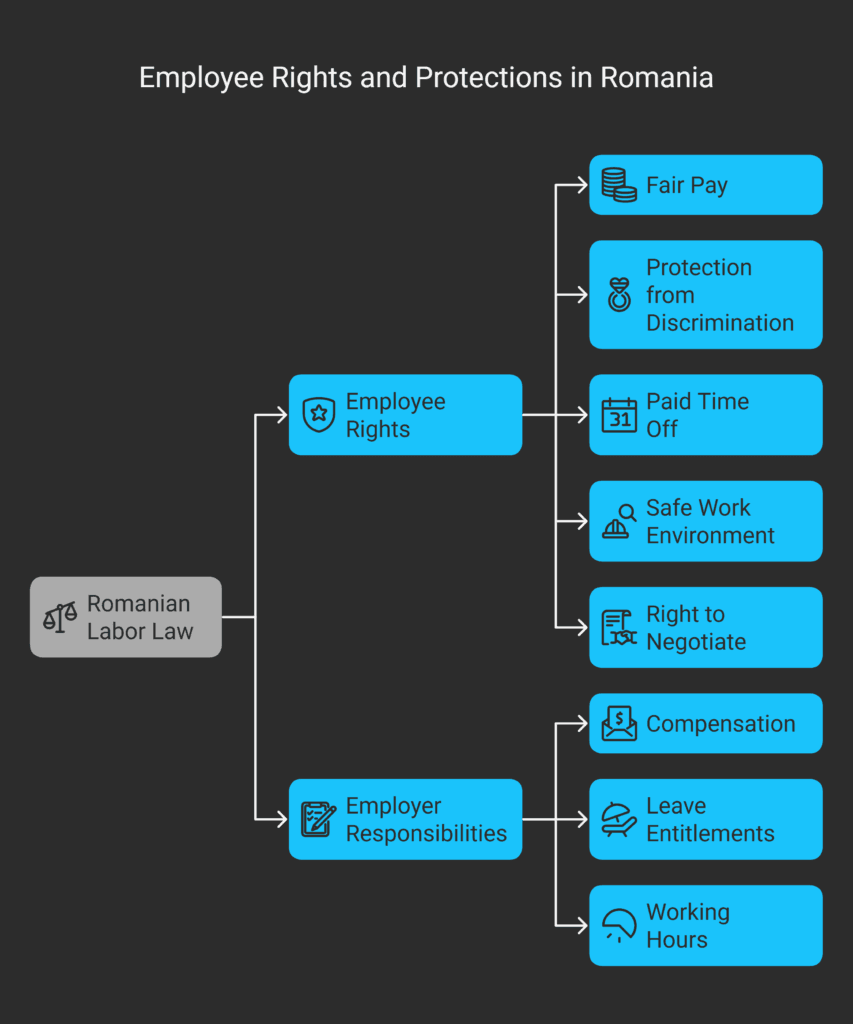

Employee Rights and Protections

It’s important to know about employee rights and protections in Romania.

The Romanian labor law has rules to protect workers’ rights.

These rules help make sure workplaces are fair and follow the law.

Some main employee rights in Romania include:

- Fair pay and a minimum wage;

- Protection from workplace discrimination;

- Paid time off and vacation days;

- A safe place to work;

- The right to negotiate with employers.

Employers need to follow certain rules when making employment contracts.

These rules help make sure workers are treated fairly in all industries.

| Right Category | Key Provisions | Legal Protection |

|---|---|---|

| Compensation | Minimum monthly wage of 3,700 RON | Labor Code Article 39 |

| Leave Entitlements | Minimum 20 paid vacation days annually | National Labor Regulations |

| Working Hours | Maximum 40-hour workweek | Employment Protection Laws |

When following employer guidelines in Romania, companies should be open and respect workers’ rights.

This not only keeps them legal but also makes the workplace better for everyone.

By focusing on these rights, you can make your workplace more welcoming, productive, and legally correct in Romania.

Working Hours and Compensation Structures

Understanding wage regulations in Romania is key.

You need to know about employment law and workplace compliance.

This includes working hours, pay, and benefits.

Knowing these details helps avoid labor disputes.

Romanian work contracts outline the rules for work hours.

The standard week is 40 hours over five days.

Workers get fair pay and benefits.

Standard Working Hours

- Maximum 40 hours per week;

- 8-hour daily work limit;

- Minimum rest period of 12 consecutive hours between work shifts.

Overtime Regulations

Overtime pay in Romania is clear.

Workers get 75% more than their regular pay for extra hours.

There are rules for overtime:

- Overtime must be approved in advance;

- Maximum 48 hours per week, including overtime;

- Compensation can be monetary or time off.

Salary and Benefits Requirements

As of January 2025, the minimum wage is RON 4,050 monthly.

Employers must also offer benefits and pay social security.

Important pay elements include:

- Mandatory social security contributions;

- Minimum 20 paid vacation days annually;

- 15 public holidays with paid time off;

- Non-taxable benefits like voluntary pension fund contributions.

Knowing these rules keeps your company legal and competitive in Romania.

Focus on fair pay and benefits to attract and keep good workers. This way, you avoid legal issues.

Probationary Periods and Contract Termination

Understanding termination clauses in Romania is key for employers and employees.

The Romanian Labor Code outlines rules for probation and contract end.

It protects both sides.

Probationary periods are a big part of jobs in Romania.

Here’s what you need to know:

- Non-managerial jobs have a 90-day probation period.

- Managerial jobs have a 120-day probation period.

- Probation lets both sides check if they fit well together.

When it comes to contract termination in Romania, there are important points to remember:

- Termination is allowed for reasons like:

- Company closure;

- Redundancy;

- Performance problems;

- Major misconduct.

- Termination is not allowed during:

- Pregnancy;

- Maternity leave;

- Parental leave.

Severance pay in Romania applies in certain cases:

| Termination Scenario | Severance Pay Requirement |

|---|---|

| Company Cessation | Minimum one month’s salary |

| Role Redundancy | Minimum one month’s salary |

| Company Relocation | Minimum one month’s salary |

When ending a contract, follow the notice rules.

For regular jobs, it’s 20 working days.

For management roles, it’s 45 working days.

Always stick to the Romanian Labor Code to safeguard rights.

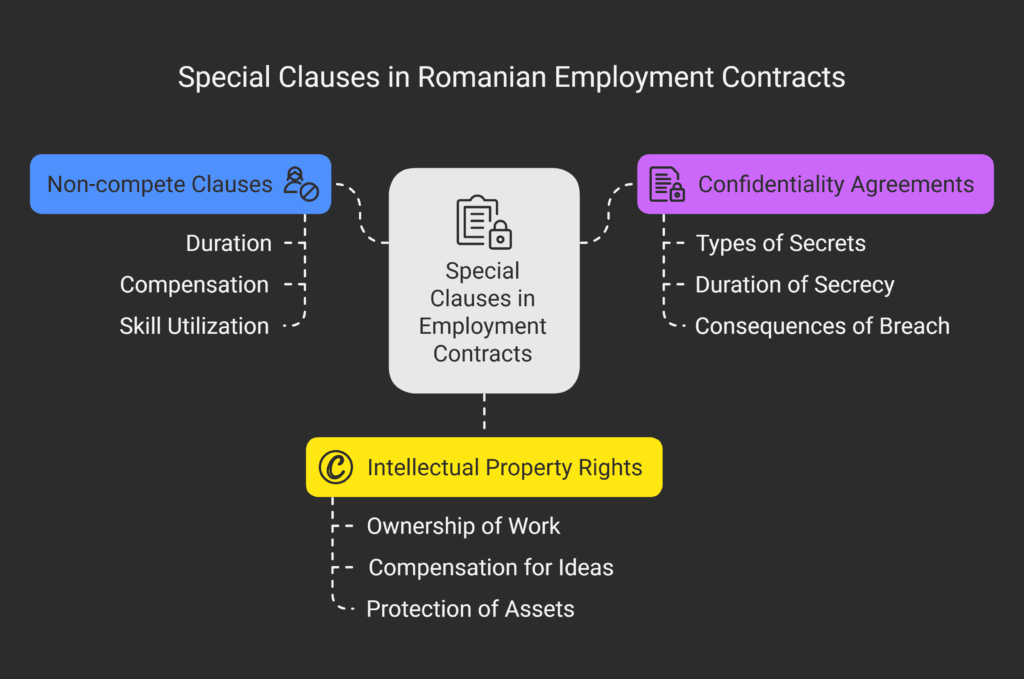

Special Clauses and Additional Provisions

When making employment contracts in Romania, special clauses are key.

They protect both the employer and the employee.

Knowing these clauses helps manage workplace relationships and follow the law.

Non-compete Clauses in Romania

Non-compete clauses in Romania are important.

They stop employees from working for competitors after they leave.

These clauses have specific rules:

- They can last up to 2 years after the contract ends;

- The employee must get at least 50% of their average salary each month;

- They can’t completely stop the employee from using their skills.

Confidentiality Agreements Romania

Confidentiality agreements in Romania keep business secrets safe.

You need to make sure:

- The types of secrets are clear;

- How long the secrecy lasts;

- What happens if someone breaks the agreement.

Intellectual Property Rights

Intellectual property in Romania needs careful planning.

Your contracts should cover:

- Who owns work done while employed;

- How to pay for new ideas;

- How to protect creative assets.

By using these special clauses, you can make strong contracts.

They protect your business and follow Romanian laws.

Remote Work and Teleworking Agreements

Romania has changed its work policies to welcome digital nomads.

The country’s telework scene has grown a lot.

This change started in July 2017, when the Ministry of Labor suggested new rules for remote work.

It’s important to know the visa rules for digital nomads in Romania.

The new work laws offer a clear guide for remote work agreements.

They ensure both flexibility and legal safety.

- Telework is defined as work done outside the usual office using technology;

- Employees must sign a special agreement or addendum to work remotely;

- Remote workers get the same rights as those in the office.

When making a remote work contract in Romania, you need to think about a few things.

The new work rules require specific details.

These include:

- What equipment is provided;

- How flexible work hours can be;

- How work performance is checked;

- How communication should happen.

Remote work is appealing because of the financial benefits.

Employers save on office space, utilities, and travel costs.

Employees enjoy better work-life balance and save time.

The pandemic made Romania adopt remote work faster.

About 50% of workers started teleworking during this time.

Now, digital nomads and local workers have clear, safe work rules.

Collective Bargaining Agreements and Their Impact

Collective bargaining agreements are key in Romania’s workforce rules.

They set out detailed rules for work and employee rights.

This is important for labor contracts in Romania.

To understand these agreements in Romania, you need to know their legal side and real-world effects.

Employers must see how these agreements can change individual work contracts.

- Employers with 10 or more employees must engage in collective bargaining;

- Negotiations must start 45 calendar days before the current agreement expires;

- Collective agreements typically last between 12-24 months.

Following workplace rules in Romania means paying close attention to collective bargaining.

Important things to think about include:

| Requirement | Specification |

|---|---|

| Minimum Negotiation Meetings | Three face-to-face meetings |

| Maximum Negotiation Period | 60 calendar days |

| Penalty for Non-Compliance | RON 5,000 to RON 10,000 fine |

Your company needs to get ready well for collective bargaining.

Make a detailed first proposal, know the law, and negotiate smartly.

This helps protect both employer and employee interests.

Legal Consultation and Contract Review

Professional legal consulting in Romania is key to protecting your business.

When making employment contracts, getting help from experienced legal services in Romania can lower risks.

Studies show that companies with legal help in contract talks are 50% more likely to get good terms.

Contract review in Romania can spot unclear parts that might cause future problems.

About 60% of contract issues come from unclear terms.

Working with a specialized team of lawyers in Romania can make sure your contracts are clear, legal, and fit your business needs.

Understanding Romania’s legal system is complex.

With 80% of companies seeing regulatory changes as big risks, getting legal advice is vital.

Our team of Romanian Lawyers can craft contracts that cover important points like how to end a contract, who owns what, and how to deal with market changes.

For personalized advice and expert contract review, contact our team at office@theromanianlawyers.com.

We offer detailed legal services to safeguard your business and ensure you follow Romanian employment laws.

FAQ

What is the primary legal document governing employment contracts in Romania?

The Labor Code (Codul Muncii) is the main law for employment contracts in Romania.

It sets the rules for making, following, and ending employment agreements.

This ensures everyone follows the national labor laws.

Are written contracts mandatory in Romania?

Yes, written contracts are a must in Romania.

Every job must have a written contract (contract individual de muncă).

It must be in Romanian and registered with ReviSal, the online employee registry.

What are the main types of employment contracts in Romania?

Romania has three main types of employment contracts.

These are open-ended contracts, fixed-term agreements, and part-time work.

Each type has its own rules about how long it lasts and if it can be renewed.

What mandatory elements must be included in a Romanian work contract?

A Romanian work contract must have key details. These include:

– Who the employer and employee are;

– What the job is and what’s expected;

– Where the job is;

– How many hours to work;

– How much money is paid;

– How long the contract lasts;

– How much notice is needed to end the contract.

How long can probationary periods last in Romania?

In Romania, probationary periods depend on the job’s complexity.

– Up to 30 days for simple jobs;

– Up to 90 days for professional jobs;

– Up to 120 days for management jobs.

Are non-compete clauses legal in Romanian employment contracts?

Yes, non-compete clauses are legal in Romania.

But they must follow certain rules:

– The agreement must be in writing

– It must have reasonable limits in time and place

– The employee must get paid for it

– It must protect the employer’s real business interests

What are the rules for overtime in Romania?

Romanian laws say overtime can’t be more than 8 hours a week.

It must be:

– Agreed to by the employee

– Paid extra (usually 75% more than normal pay)

– Documented and approved by the employer

How does Romania handle remote work contracts?

Romania has rules for remote work under Law No. 81/2018.

It requires:

– A detailed remote work agreement;

– Clear ways to check work;

– Equipment and pay for remote work;

– Flexible hours.

What is the minimum wage in Romania for 2024?

In 2025, the minimum wage in Romania is 4,050 RON (about €814.18).

This must be in the contract and paid on time.

Can foreign companies hire employees in Romania?

Yes, foreign companies can hire in Romania.

They must:

– Set up a legal entity;

– Register with local authorities;

– Follow Romanian labor laws;

– Make contracts in Romanian;

– Pay all social contributions.

What protections exist for employees during contract termination?

Romanian laws protect employees when contracts end.

They include:

– Required notice periods;

– Possible severance pay;

– Protection from unfair dismissal;

– Right to appeal in court.

What are the key elements that must be included in an employment contract in Romania?

In Romania, an individual employment contract must contain several essential elements as per the Romanian Labor Code.

These include:

1. The identities of the parties

2. The workplace

3. Job description and duties

4. Working conditions and occupational hazards

5. Working hours

6. Holiday entitlements

7. Base salary and other compensation elements

8. Notice period for termination

9. The applicable collective labor agreement, if any 10.

Probationary period, if applicable the employment contract must be concluded in writing, in the Romanian language, before the employee starts work.

Both the employer and employee should sign the contract, with each party receiving a copy.

What are the different types of employment contracts available under Romanian law?

Romanian employment law recognizes several types of employment contracts:

1. Indefinite-term contracts: The most common type, with no specified end date;

2. Fixed-term contracts: Limited to a maximum of 36 months, with specific conditions for use;

3. Part-time contracts: For work less than 8 hours per day or 40 hours per week;

4. Temporary work contracts: For employees hired through temporary work agencies;

5. Home-based work contracts: For employees working from home;

6. Apprenticeship contracts: For professional training purposes Each type of contract has specific regulations and limitations under the Romanian Labour Code, and employers must ensure compliance with the relevant provisions when drafting these agreements.

How should the job description be formulated in a Romanian employment contract?

The job description is a crucial element of any employment contract in Romania.

It should be detailed and specific, outlining the employee’s main responsibilities, tasks, and duties.