Freelancing vs. Employment Contract in Romania: What’s Better Legally?

Freelancing vs. Employment Contract in Romania: What’s Better Legally?

Are you trying to figure out the best way to work in Romania?

You might be thinking about freelancing or traditional jobs.

Both have their own legal benefits and financial perks.

Romania’s work scene has changed a lot.

Now, more people are choosing to work for themselves.

This gives them the chance to be more flexible and make choices that fit their career goals.

The job market in Romania is pushing people to think differently about work.

It’s important to know the legal differences between freelancing and traditional jobs.

This helps you understand your rights, duties, and what it might mean for your money.

Key Takeaways

- Romania’s professional landscape increasingly supports flexible work arrangements;

- Legal distinctions between freelance and employment contracts significantly impact professional strategies;

- Financial and regulatory considerations are key when choosing work models;

- Professional autonomy and risk management differ between employment and freelance status;

- Understanding legal frameworks is essential for making informed career decisions.

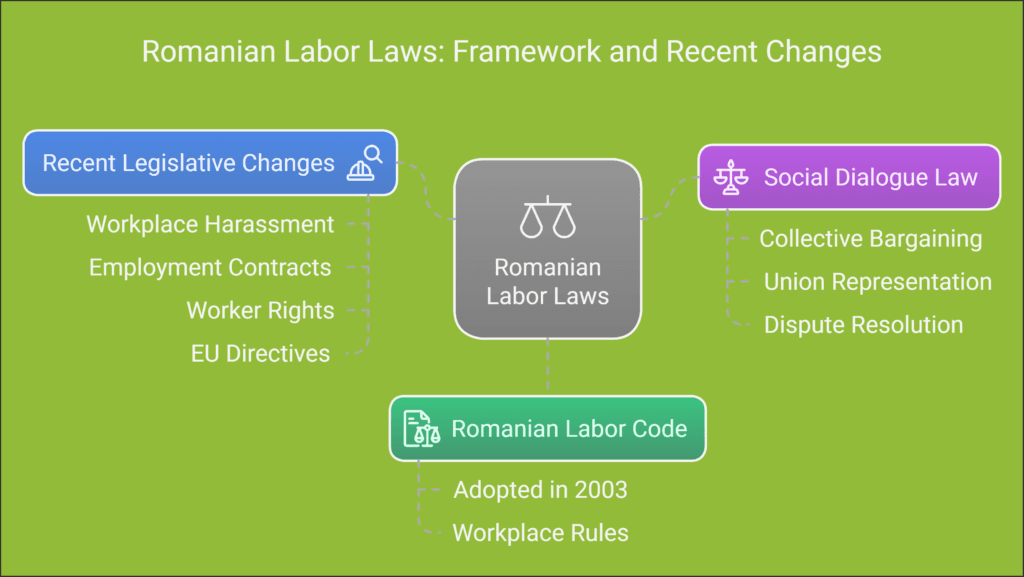

Understanding Legal Status in Romanian Labor Market

The Romanian labor market is complex for those in the gig economy.

It’s important to know the difference between dependent and independent work.

This is key for employers and workers to understand labor laws in Romania.

The Romanian Fiscal Code outlines the rules for different work setups.

It affects employee rights and taxes. This law helps decide who is considered a worker based on certain criteria.

Defining Dependent Activities

Dependent activities have a few main points:

- Direct subordination to an employer;

- Fixed working schedule;

- Predetermined workplace;

- Employer-provided equipment and resources.

Defining Independent Activities

Independent activities are different, with:

- Autonomous work arrangement;

- Flexible working hours;

- Self-managed professional services;

- Personal risk and investment.

Key Legal Framework Differences

The legal differences between these types affect work relationships, social security, and taxes.

Workers and businesses must check their work setup to follow Romanian labor laws.

Knowing these legal details helps workers and companies make smart choices in Romania’s labor market.

Freelancing vs. Employment Contract in Romania

Understanding the Romanian labor market is key.

It’s important to know the difference between freelancing and traditional jobs.

Romania’s flexible work options let professionals design their careers with more freedom.

Independent contractor laws in Romania give workers a lot of freedom.

Freelancers can use these laws to build careers that fit their skills and lifestyle.

- Freelancing offers tax benefits;

- Employment contracts provide more structured social benefits Romania;

- Independent work allows for greater schedule flexibility;

- Traditional employment ensures more consistent income streams.

Choosing between freelancing and a job depends on your career goals and how much risk you’re willing to take.

Freelance work in Romania supports entrepreneurship while protecting workers’ rights.

Professionals need to think about several things:

- Income stability;

- Legal protections;

- Tax implications;

- Long-term career development.

Freelancing offers flexibility and the chance for higher earnings.

On the other hand, traditional jobs provide steady income and strong social security benefits.

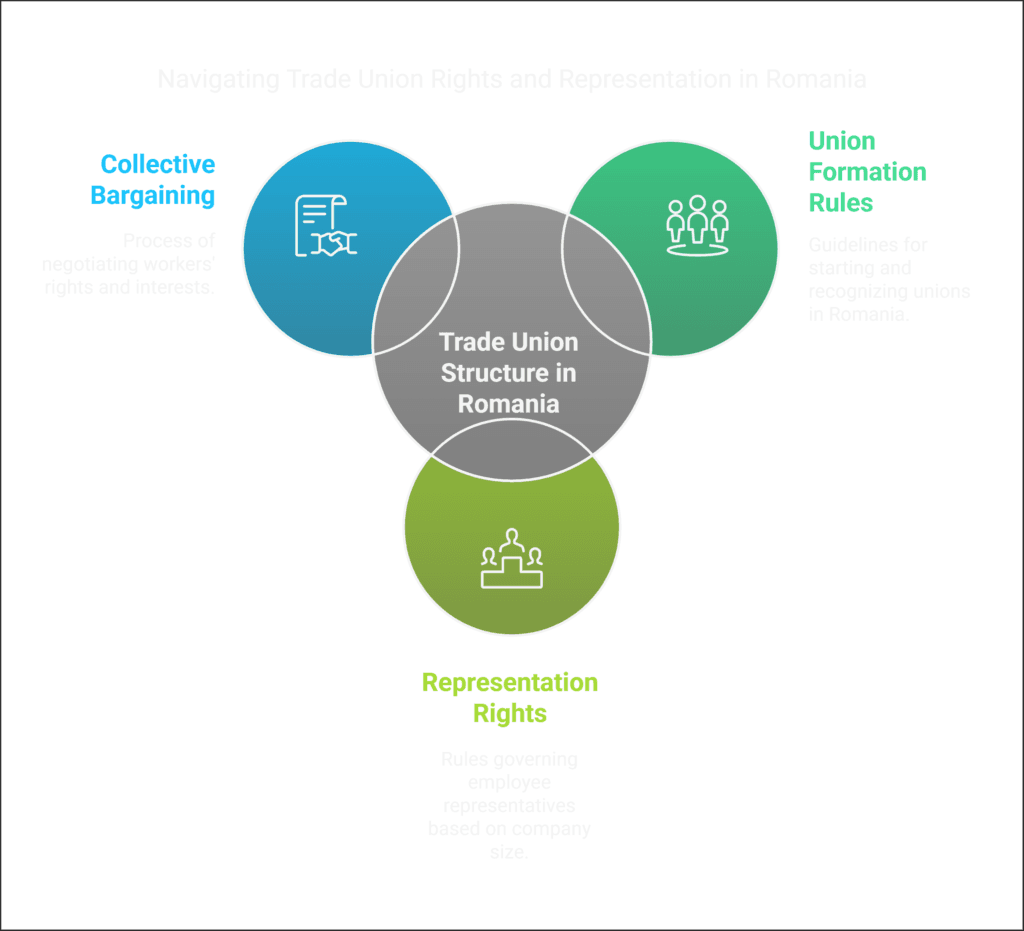

Legal Distinctions Between Contractors and Employees

Understanding employment laws in Romania is key.

It’s important to know the differences between contractors and full-time employees.

Romanian labor laws set clear criteria for these distinctions.

These criteria affect rights, responsibilities, and legal duties.

The Romanian legal system looks at work relationships closely.

It uses several key factors to decide the type of work arrangement.

Subordination Criteria

Subordination is the main difference between contractors and full-time employees in Romania.

The rights of contractors differ from those of employees.

This is based on several key criteria:

- Direct management control;

- Work schedule compliance;

- Reporting hierarchies;

- Performance evaluation processes.

Workplace Integration

Workplace integration is also key in determining work relationships.

The following elements help tell if someone is an independent contractor or an employee:

- Physical workspace utilization;

- Company resource access;

- Organizational communication channels;

- Team participation requirements.

Risk and Responsibility Distribution

| Aspect | Contractor | Employee |

|---|---|---|

| Financial Risk | High Personal Risk | Minimal Personal Risk |

| Equipment Provision | Self-Funded | Employer-Provided |

| Legal Liability | Personal Responsibility | Shared Organizational Responsibility |

Those working in Romania’s labor market need to understand these legal differences.

This ensures they follow the law and protect their interests.

Tax Implications and Financial Considerations

Understanding taxes for independent contractors in Romania is key.

The country’s tax system has both benefits and challenges for freelancers.

It’s important to know the financial landscape well.

Romania has a flat tax rate of 10% for all income.

This rate is the same for both employees and freelancers.

It makes managing finances easier for freelancers.

- Flat tax rate of 10% for individual income;

- Self-employed professionals responsible for personal tax filings;

- Mandatory social contribution calculations;

- Potential tax deductions for business expenses.

Freelancers in Romania must register with tax authorities and keep detailed financial records.

They need to know about tax reporting and possible benefits.

Financial planning for freelancers in Romania is different from traditional jobs.

Remote work adds complexity to taxes.

It requires careful financial planning.

| Financial Aspect | Employee Status | Freelance Status |

|---|---|---|

| Tax Rate | 10% Flat Rate | 10% Flat Rate |

| Social Contributions | Employer Managed | Self-Managed |

| Expense Deductions | Limited | More Flexible |

Freelancers need to plan their finances wisely.

This ensures they stay tax-efficient and compliant in Romania’s rules.

Contractual Rights and Obligations

Understanding the legal side of work in Romania is key.

The country has two main work setups: full-time jobs and freelance work.

Each has its own rules to protect workers and employers.

The laws around work contracts in Romania are very important.

They help workers feel secure and flexible in their jobs.

Knowing these differences helps people choose the right career path.

Employment Contract Requirements

Full-time jobs in Romania follow strict rules from the Romanian Labor Code.

The main points are:

- Mandatory written contract detailing job responsibilities;

- Clear specification of work hours and compensation;

- Explicit definition of employee rights and obligations;

- Provisions for social security and benefits.

Freelance Contract Elements

Freelance deals offer more freedom but need to be well-written for legal safety.

Important parts are:

- Scope of work and deliverable specifications;

- Payment terms and conditions;

- Project timeline and milestones;

- Intellectual property rights allocation.

Termination Provisions

Tax and work-life balance issues vary between jobs and freelance work.

Termination rules also differ.

Jobs usually have more set rules than freelance work.

It’s important for professionals to know their contract well.

This ensures they are protected and can have a good career.

Social Security and Benefits Comparison

Understanding employee benefits in Romania is key.

It’s important to know the differences between working as an employee and being a freelancer.

The social security system has its own rules for each choice.

Employees in Romania get many benefits.

These include:

- Mandatory health insurance coverage;

- Pension fund contributions;

- Paid annual leave;

- Sick leave compensation;

- Maternity and paternity leave benefits.

Freelancers in Romania face different rules.

They must handle their social insurance on their own.

This gives them freedom but also more responsibility.

It’s important to know these rules before deciding how to work.

Freelancers need to plan for their social security:

- Registering with local social security authorities;

- Making regular self-employed contributions;

- Purchasing supplemental health insurance;

- Creating personal retirement savings strategies.

Choosing between being an employee or a freelancer affects your future.

You need to think about your risk level and financial goals.

This choice is important in Romania’s changing work scene.

Business Structure Options for Freelancers

Freelancers in Romania have many legal ways to organize their work.

It’s important to know the business structures that fit with labor laws for freelancers in Romania.

The Romanian legal system has three main business structure options for freelancers.

Each has its own tax rules and regulations.

PFA (Persoană Fizică Autorizată): Individual Authorized Person

The PFA is the simplest business structure for solo entrepreneurs. It has key features like:

- Easy registration process;

- Low administrative costs;

- Direct personal tax responsibility;

- Great for small freelance projects.

SRL (Limited Liability Company): Scalable Business Entity

An SRL offers more legal protection for freelancers who want to grow.

It has benefits such as:

- Separate legal entity status;

- Limited personal liability;

- Potential tax savings;

- Opportunities for investment and growth.

Civil Contract Options: Flexible Professional Arrangements

Civil contracts give freelancers flexible work arrangements with clients.

They allow professionals to set work terms while keeping their independence under freelance laws in Romania.

Choosing the right business structure needs careful thought.

It depends on your professional goals, financial situation, and future plans.

Intellectual Property Rights and Ownership

Understanding intellectual property (IP) rights in contract work in Romania is key.

The rules on who owns created work vary between employees and independent contractors.

This makes it vital to have clear contracts.

For employees in Romania, the law usually says the employer owns the work done.

Unless a contract says differently, the employer owns what’s created during work hours.

- Employee IP ownership defaults to the employer;

- Independent contractors usually retain original IP rights;

- Explicit contract terms are key for IP protection.

Remote work in Romania adds more complexity to who owns what.

Independent contractors have more protection for their ideas.

When deciding to work as a contractor or employee, it’s important to make detailed agreements.

These should cover who owns what, how it can be used, and any payment for it.

Important steps to protect intellectual property include:

- Make sure who owns what is clear in the first contract;

- State who can use the work and any limits;

- Set out how much to pay for using someone’s ideas;

- Add clauses about keeping information secret.

Experts in law should be consulted to make sure all IP is protected.

This helps both sides in professional settings in Romania.

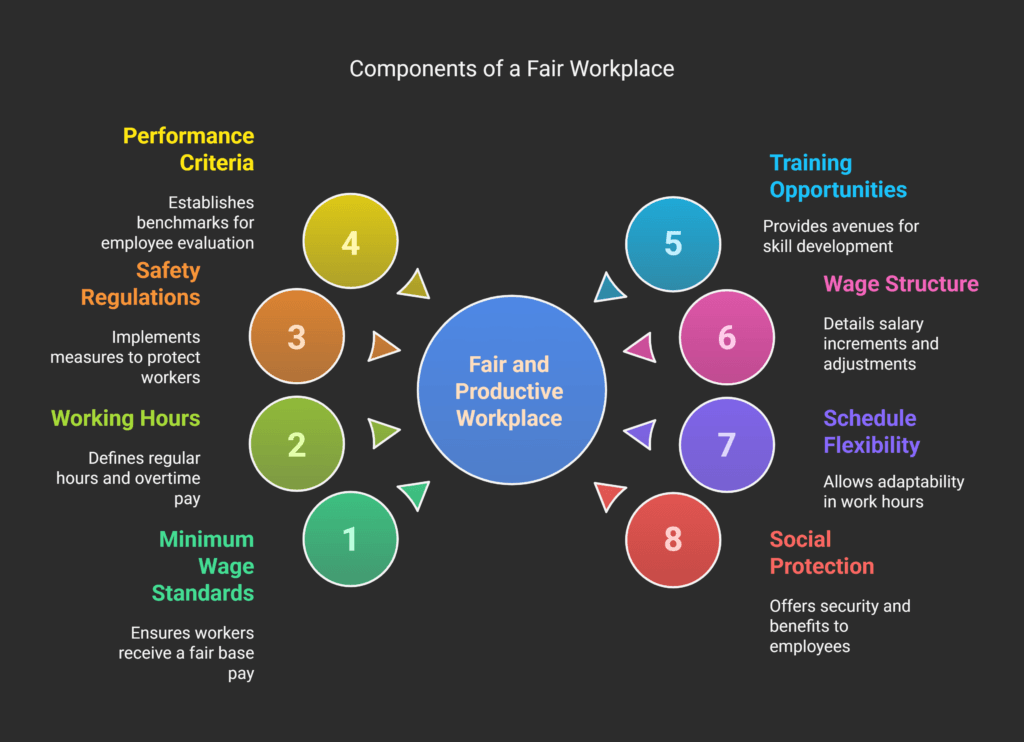

Working Hours and Flexibility Considerations

Freelancing in Romania brings unique benefits in work hours and flexibility.

Unlike regular jobs, freelancers can set their own schedules.

They can work when they’re most productive and feel best.

Freelancing in Romania also means more freedom.

Freelancers can enjoy several key benefits:

- Complete control over daily work schedule;

- Ability to work from multiple locations;

- Potential for increased productivity during peak personal energy times;

- Opportunity to balance professional and personal commitments.

But freelancing also has its downsides. It can be hard to keep work and personal life separate.

Without set hours, freelancers might work too much and earn irregularly.

They need to be good at managing themselves to avoid burnout.

Freelance taxes in Romania add another layer of complexity.

Freelancers must keep track of their hours, manage projects, and keep accurate records.

This is to follow local tax laws.

Managing work hours as a freelancer requires careful planning.

Here are some tips:

- Set clear boundaries between work and personal time;

- Create a daily routine;

- Use time-tracking tools for project management;

- Take regular breaks to stay productive.

Freelancing in Romania needs discipline and planning.

Freelancers must balance their freedom with the need to be professional.

This is key to success in the Romanian market.

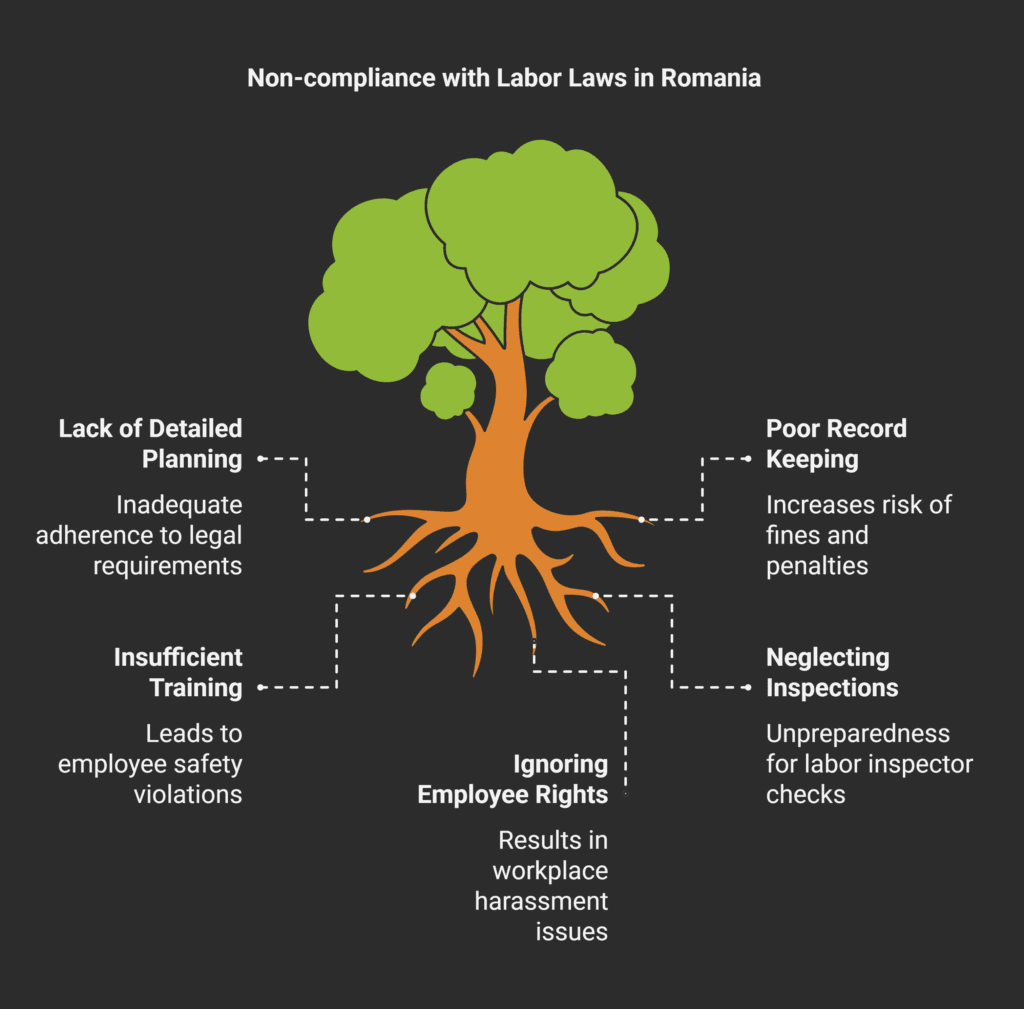

Registration and Compliance Requirements

Starting a remote work career in Romania means you need to know the legal rules.

Freelancers and employees have different paths to follow in the Romanian job market.

Freelancers first need to register with the National Trade Register Office (ONRC).

This step sets the legal rules for working on your own.

- Register as a Persoană Fizică Autorizată (PFA);

- Get the right business permits;

- Get a tax ID number;

- Sign up for social security.

Freelancers need to have certain documents ready.

These include:

- Your ID;

- Proof of your skills;

- A business plan;

- Tax compliance papers.

For employees, the rules are different. Employers handle most of the paperwork.

This includes social security and health insurance.

The whole process for freelancers usually takes 3-5 business days.

It’s important to have all your documents in order to follow the law in Romania.

Common Industries for Freelancing in Romania

The Romanian gig economy is growing fast. It offers many flexible work options for freelancers.

This shows how self-employment and full-time jobs are both viable in Romania.

Digital skills and online work have opened new doors.

They let people choose to work as independent contractors in Romania’s changing economy.

IT and Digital Services

Romania’s tech sector is booming for freelancers.

Jobs in software development, web design, cybersecurity, and digital marketing are plentiful.

These roles are perfect for those who want to work on their own terms.

- Software engineering;

- Mobile application development;

- Cloud computing solutions;

- Digital infrastructure consulting.

Creative Industries

Creative fields in Romania are also ripe for freelancers.

Graphic design, content creation, multimedia production, and digital arts offer flexible careers.

They suit skilled individuals who prefer independent work.

- Graphic design services;

- Video production;

- Digital marketing content;

- Brand communication strategies.

Professional Services

Consulting, translation, legal advice, and financial services are also good for freelancers.

These areas in Romania’s professional world offer opportunities for independent work.

- Management consulting;

- Technical translation;

- Financial advisory;

- Legal research services.

Conclusion

Choosing between freelancing and traditional jobs in Romania needs careful thought.

Freelancers face both benefits and challenges, like tax implications.

Knowing your rights is key when deciding your career path.

Freelancing in Romania offers freedom and tax benefits.

But, it also means less job security and fewer social benefits.

Planning well and understanding the law can help manage these risks.

Experts say it’s smart to do your homework and maybe talk to a Romanian lawyer before switching jobs.

Romania’s laws help both freelancers and employees make good choices for their careers and lives.

If you’re unsure about Romania’s job rules, seek advice from Romanian legal experts.

FAQ

What is the difference between a freelancer and an employee in Romania?

How do I choose between freelancing and traditional employment in Romania?

What tax obligations do freelancers have in Romania?

What business structures are available for freelancers in Romania?

How do intellectual property rights work for freelancers in Romania?

What are the social security implications for freelancers?

What industries are most suitable for freelancing in Romania?

What registration requirements exist for freelancers in Romania?

How do working hours differ between freelancers and employees?

What legal protections do freelancers have in Romania?

What are the main differences between employment contracts in Romania and freelancing arrangements?

In Romania, the distinction between employment contracts and freelancing arrangements is significant from both legal and financial perspectives.

An employment contract (contract individual de muncă) is governed by the Romanian Labor Code and establishes a subordination relationship between the employee and employer.

Freelancers in Romania typically operate as independent contractors, either through a PFA (Persoană Fizică Autorizată) or other legal entity forms.

The key differences include:

1. Legal framework: Employment contracts are strictly regulated by the Romanian Labour Code, while freelancing activities are governed by civil law and tax regulations, often through civil contracts or service agreements.

2. Subordination: An employee works under the direct supervision and control of the employer, following a predetermined schedule and procedures.

An independent contractor in Romania has autonomy regarding how, when, and where they complete their work.

3. Social protection: Employees in Romania are entitled to social benefits including paid vacation, sick leave, maternity leave, and unemployment benefits.

Freelancers must arrange their own social protection.

4. Tax responsibility: For employees, the employer handles tax withholding and social contributions.

Freelancers are responsible for their own tax and social contribution obligations.