Corporate Restructuring Options Under Romanian Law: Mergers, Divisions, and Transformations

Corporate Restructuring Options Under Romanian Law: Mergers, Divisions, and Transformations

Did you know that Romania has seen a big rise in corporate restructuring?

This includes more mergers and acquisitions in 2025.

These changes are key for companies to stay competitive and efficient in a fast-changing market.

It’s important to know how these restructuring processes work.

This knowledge helps companies follow Romanian laws well.

This article will dive deep into the restructuring options in Romania.

It will show how these options can help your business grow.

Key Takeaways

- Corporate restructuring is increasingly vital for businesses in Romania.

- Mergers, divisions, and transformations are the key options available for restructuring.

- Compliance with Romanian corporate laws is essential for successful restructuring.

- Understanding the legal framework can guide effective restructuring strategies.

- The Romanian market experiences dynamic changes impacting restructuring processes.

Understanding Corporate Restructuring in Romania

In Romania, corporate restructuring is key for companies facing challenges.

It helps solve financial issues and opens up growth chances.

By restructuring, companies can improve operations, cut debts, and boost their competitive edge.

Definition and Importance of Restructuring

Corporate restructuring means changing a company’s financial or operational setup to tackle challenges or seize new chances.

It’s vital for boosting efficiency, managing debts, and aligning resources with market needs.

Companies that restructure can cut their debt by about 40%, helping them through tough times.

Context Within Romanian Corporate Law

In Romania, the legal framework for restructuring is clear.

The law provides ways for companies to reorganize, like voluntary liquidations and preventive compositions.

It sets rules for businesses, ensuring creditors can start legal actions if needed.

On average, restructuring in Romania takes about 12 months due to its complexity.

Romanian Legal experts are key in guiding companies through this process.

They help reduce risks and ensure compliance with current corporate laws.

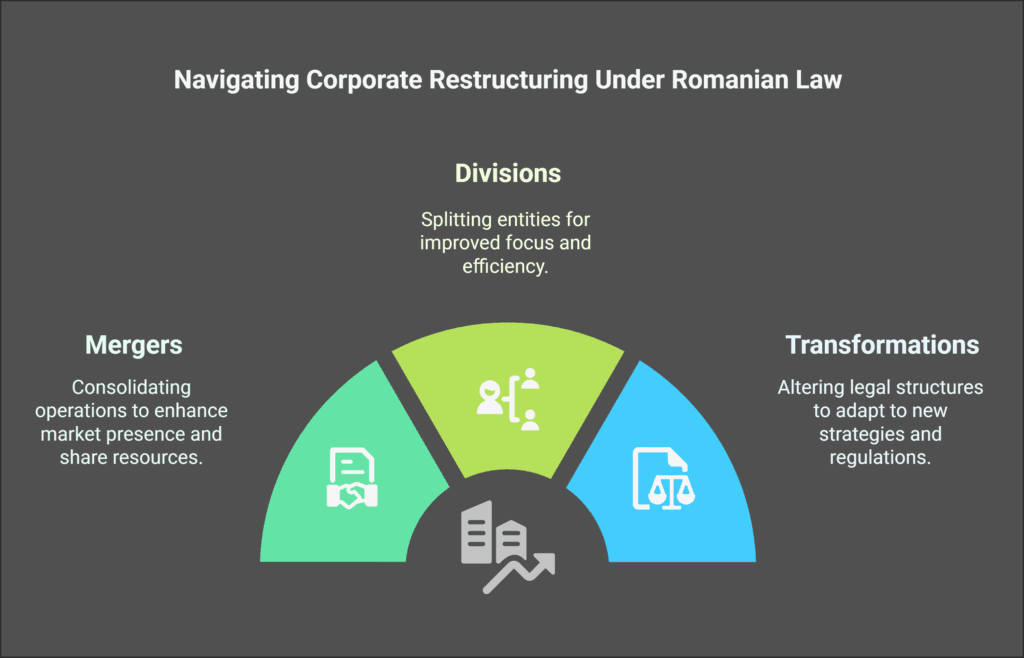

Types of Corporate Restructuring Options Under Romanian Law

Businesses in Romania can improve their efficiency and competitiveness through various restructuring options.

Mergers, divisions, and transformations are key strategies.

Each has its own purpose and must be carefully considered under Romanian law.

A thorough approach helps companies adapt well to market changes and operational needs.

Mergers: Consolidating Business Operations

Mergers combine two or more companies to make operations smoother and boost market presence.

This method can lead to bigger market shares and shared resources.

Romanian law requires detailed planning and negotiations to follow merger and acquisition rules.

Divisions: Splitting Companies for Increased Efficiency

Divisions let companies split into separate entities for better focus and efficiency.

Assets can be fully or partially transferred to new or existing companies.

Romanian law demands a structured spin-off process, including a detailed plan for asset distribution.

This plan must be decided within three months by the companies involved.

Transformations: Altering the Legal Structure

Transformations change a company’s legal structure to fit new strategies and market conditions.

This strategy is vital for adapting to regulatory changes and operational needs.

Whether it’s changing corporate form or adjusting governance, transformations can greatly affect a company’s future success.

Legal Framework for Corporate Restructuring in Romania

The legal framework for corporate restructuring in Romania is based on several laws.

These laws outline the processes and protections for companies going through big changes.

Knowing the key laws helps companies understand their changes better.

Key Romanian Legislation on Corporate Reorganization

The main laws for restructuring include the Romanian Company Law no. 31/1990 and insolvency rules.

These laws protect creditors and help businesses reorganize.

The Company Law sets the rules for mergers and divisions, including what’s needed for these steps.

It’s important for companies to follow these rules.

This ensures their restructuring is legal.

Regulations Affecting Restructuring Processes

There are more rules for restructuring in Romania.

The Romanian Trade Register requires companies to submit detailed documents, like changes to their articles of association.

Changes to the Fiscal Code can also impact a company’s financial plans during restructuring.

| Legislation or Regulation | Key Provisions |

|---|---|

| Romanian Company Law no. 31/1990 | Outlines processes for mergers and divisions, and protects shareholder rights. |

| Insolvency Regulations | Offers guidelines on restructuring processes, ensuring fair treatment of creditors. |

| Romanian Trade Register | Mandates documentation requirements for altering company structures. |

Restructuring Strategies for Businesses in Romania

Understanding and using effective restructuring strategies is key for businesses in Romania.

Companies facing financial issues find that strategic planning helps.

It aligns goals with legal needs and boosts efficiency.

By making a detailed plan, businesses can tackle their financial challenges.

This plan helps them overcome unique obstacles.

Strategic Planning for Effective Restructuring

Strategic planning is the core of restructuring.

Businesses need to create a plan that shows why restructuring is needed.

It should outline how to reach the desired outcomes.

This plan must include how to involve stakeholders, set a timeline, and allocate resources.

It’s vital to get approval from shareholders for any job changes.

Clear communication and alignment among stakeholders are key for success.

Addressing Financial Challenges and Optimizing Operations

Dealing with financial issues in Romania needs careful attention and flexibility.

Companies should review their operations to find ways to improve.

This helps make smart decisions about cutting jobs while following local laws.

If restructuring means laying off workers, companies must follow legal steps.

This includes giving enough notice and telling the labor authorities.

Knowing labor laws well and planning for layoffs helps avoid problems and keeps employees happy.

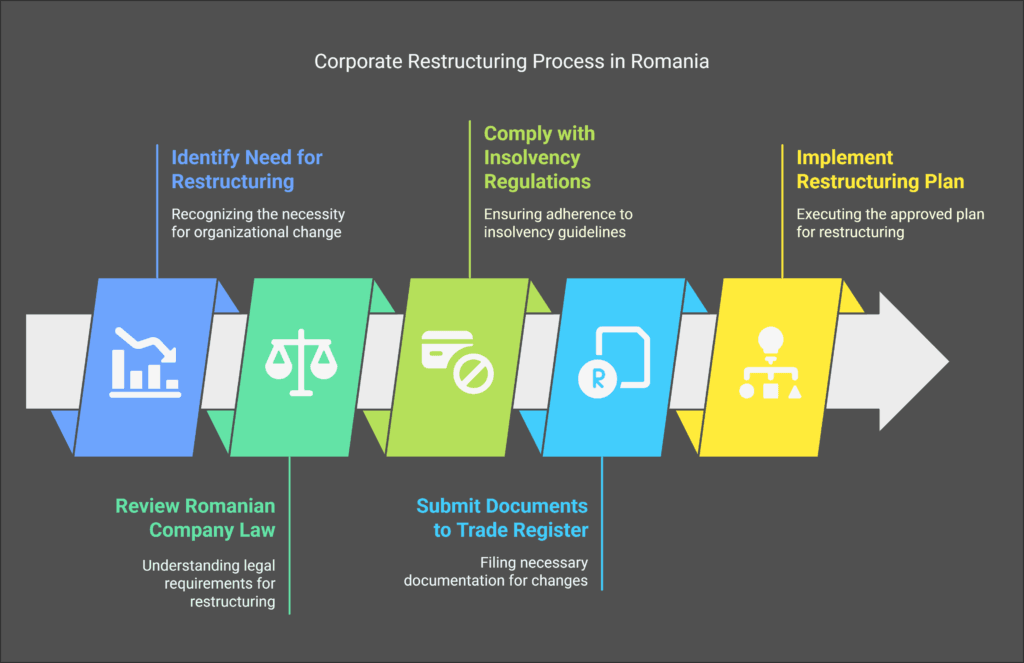

The Restructuring Process in Romania

The restructuring process in Romania involves several steps for businesses to follow.

A step-by-step guide to corporate restructuring is essential for firms looking to improve their operations.

Working with corporate restructuring specialists can offer valuable insights and expertise.

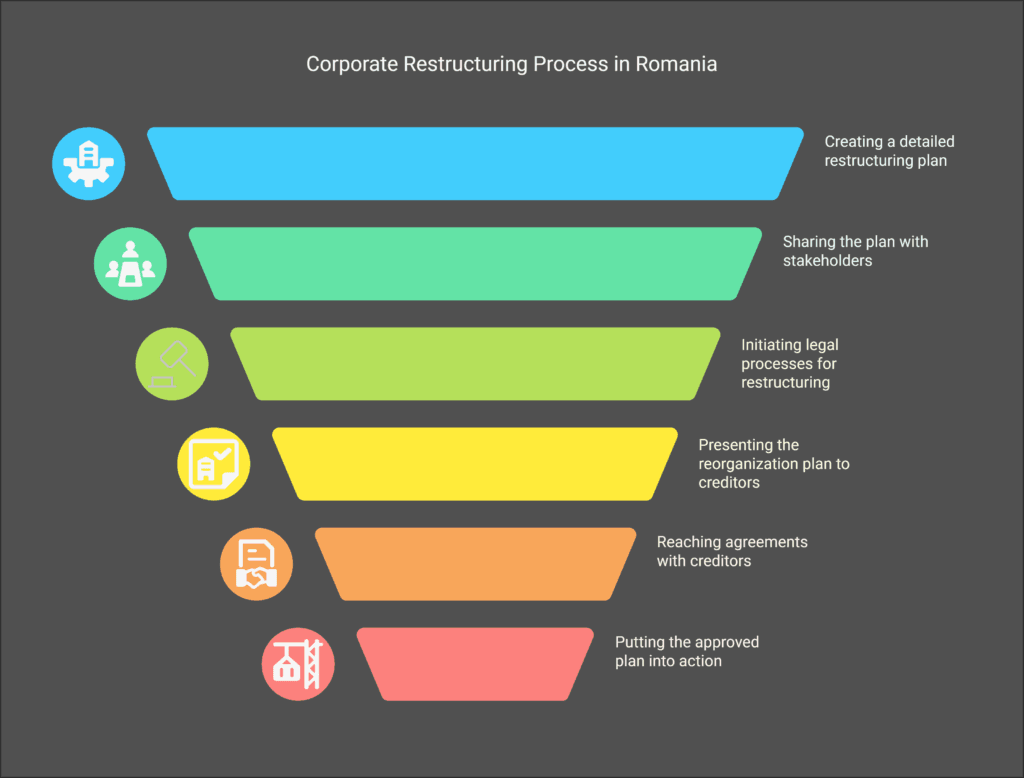

Step-by-Step Guide to Corporate Restructuring

The first step is to assess your business’s current state.

This includes looking at its financial health, operational efficiency, and market position.

After identifying the need for restructuring, you can start the next steps.

- Developing a detailed restructuring strategy;

- Sharing the plan with all stakeholders;

- Starting legal procedures, like submitting a restructuring agreement;

- Proposing a reorganization plan to creditors within set timeframes;

- Negotiating with creditors to get a fair agreement;

- Putting the approved restructuring plan into action and tracking progress;

Engaging Corporate Restructuring Specialists

Corporate restructuring specialists play a key role in guiding businesses through the restructuring process in Romania.

Our team of Romanian Lawyers can help you:

- Understand the legal rules for restructuring;

- Prepare the necessary documents for filing;

- Negotiate with creditors to avoid conflicts;

- Make sure you follow all legal rules during restructuring;

- Keep an eye on how well the restructuring plan is working.

Working with specialists can increase your chances of success.

It also helps you prepare for future challenges.

The right guidance can make the restructuring journey smoother.

Benefits of Corporate Restructuring Under Romanian Law

Corporate restructuring is key for companies in Romania to tackle challenges.

It can help your business grow and stay ahead.

By restructuring, you can improve your finances and how you operate, making your company more adaptable to market changes.

Improving Financial Performance and Competitiveness

One big plus of restructuring in Romania is better finances.

Companies often struggle with money due to market shifts or poor management.

A good restructuring plan can help use resources better and make operations smoother.

This can lead to more money for your business and make you more competitive.

Enhancing Operational Efficiency

Another big benefit is making your operations more efficient.

Restructuring helps find and fix problems in how you work.

This makes your company stronger and encourages ongoing improvement.

Your business will be quicker to respond to new needs or rules.

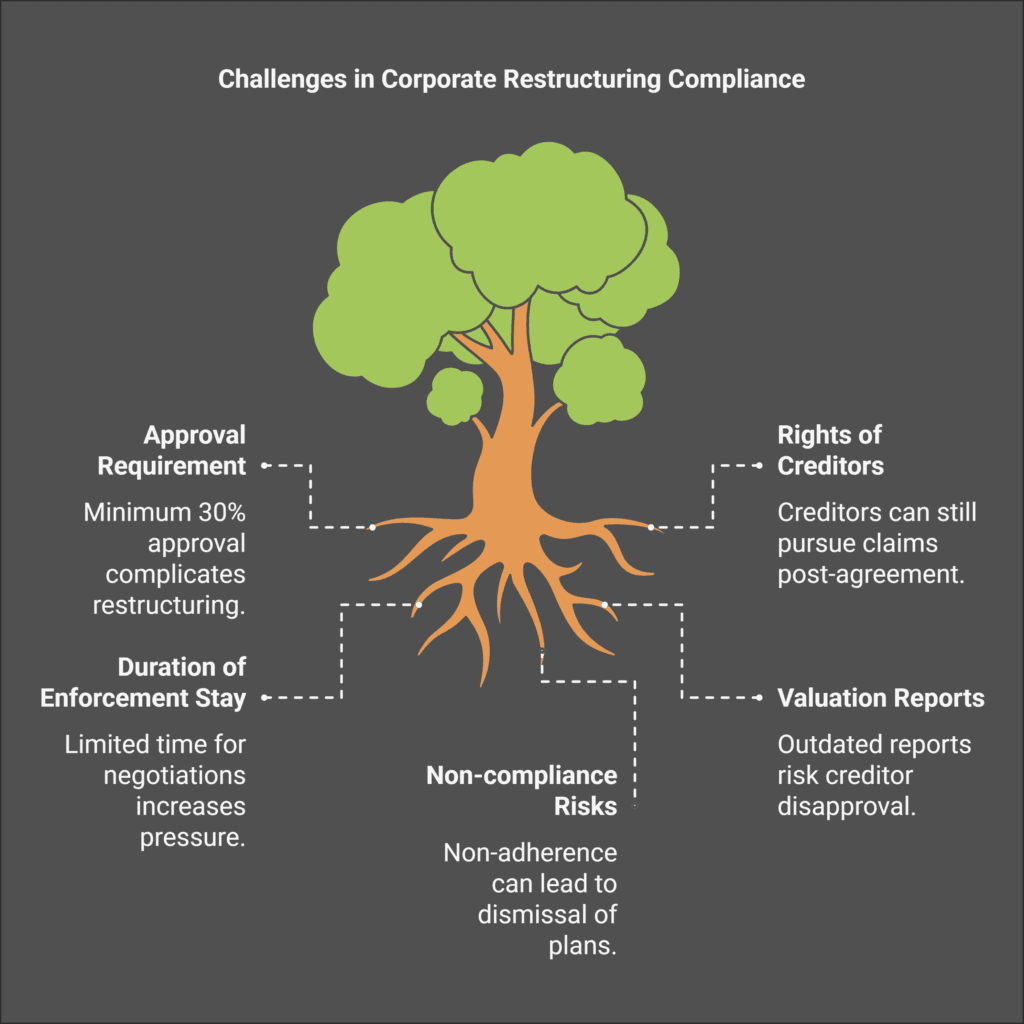

Legal Implications of Corporate Restructuring in Romania

Understanding the legal side of corporate restructuring in Romania is key.

It involves looking at creditors’ rights and the liabilities that come with them.

Knowing this helps protect your interests and ensures a smooth transition during restructuring.

Dealing with Creditors’ Rights and Liabilities

In Romania, creditors’ rights are shaped by Law No 85/2014.

Any restructuring plan needs approval from creditors who hold at least 30% of the affected receivables.

Creditors can keep pursuing claims against co-debtors or guarantors, even if they agree to a plan.

This shows how important it is to keep in touch with creditors during this time.

Compliance with Corporate Insolvency Procedures

Following corporate insolvency procedures in Romania is vital to avoid legal issues.

The restructuring process needs careful planning and must follow strict rules.

For example, the temporary stay of enforcement actions can last from three to 12 months, giving time for negotiations.

Also, a creditor arrangement must offer prospects that allow creditors to get at least what they would in bankruptcy, based on a recent valuation report.

Not following these rules can lead to the court dismissing the restructuring or creditors not approving it, which could harm the restructuring efforts.

| Aspect | Description |

|---|---|

| Approval Requirement | Minimum 30% of affected receivables must approve the restructuring agreement. |

| Rights of Creditors | Creditors can pursue claims against co-debtors and guarantors despite agreeing to restructuring. |

| Duration of Enforcement Stay | Stay lasts from 3 to a maximum of 12 months. |

| Valuation Reports | Must be no older than 6 months for ensuring creditor agreements in reorganizational plans. |

| Non-compliance Risks | Can lead to dismissal of proceedings or disapproval by creditors. |

Best Practices for Corporate Restructuring in Romania

Effective corporate restructuring in Romania needs careful planning and following best practices.

Businesses should focus on strategies that reduce legal risks.

Working with experienced professionals is key to success.

Strategies to Minimize Legal Risks

To lower legal risks, conducting independent business reviews (IBRs) is essential.

These reviews check financial, operational, and strategic performance.

They help find the best ways forward.

Pre-lending reviews also help set financial limits.

This impacts overall strategies.

It shows the need for legal solutions that match business goals.

Collaborating with Legal and Financial Experts

Working with financial experts in Romania can improve restructuring.

Firms like Atrium Romanian Lawyers are great examples.

They offer a team approach to handle various issues.

This way, companies can deal with complex laws better.

They can also aim for better results.

Conclusion

Understanding corporate restructuring in Romania is key.

You have options like mergers, divisions, and transformations.

Each one has legal aspects that affect your business’s health.

Delaying these steps can harm your business.

It can lead to lower sales and more debt.

This article shows why businesses need to think about restructuring early.

Working with experts can help you understand Romanian law better.

This way, you can use your resources wisely and stay up-to-date with new laws.

Thinking about restructuring can help your business.

It can make your operations better and save jobs.

It’s a chance to get through tough times and come out stronger.

FAQ

What is corporate restructuring?

Corporate restructuring means a company changes how it works, its money setup, or its legal form.

This can be through mergers, divisions, or changes in legal status.

It aims to make the company more efficient, financially stable, and competitive.

What are the primary options for corporate restructuring in Romania?

In Romania, companies can choose from mergers, divisions, or transformations.

Mergers combine companies to simplify operations.

Divisions split companies to boost performance.

Transformations change a company’s legal form.

How do Romanian laws govern corporate restructuring?

Romanian laws, like the Companies Law and insolvency rules, guide corporate restructuring.

These laws set the rules for mergers, divisions, or transformations.

They protect everyone involved legally.

What are the benefits of corporate restructuring?

Restructuring can make a company’s finances better, more competitive, and efficient.

It helps companies adjust to market changes, cut costs, and get stronger in the market.

What are the legal implications of restructuring for creditors?

When restructuring, it’s key to think about creditors’ rights and duties.

Following insolvency rules helps avoid legal issues and ensures fairness for everyone.

Why is strategic planning important in corporate restructuring?

Strategic planning is vital.

It makes sure restructuring goals match legal needs.

This helps companies tackle financial issues and improve operations during restructuring.

How can businesses ensure compliance during restructuring?

Working with restructuring experts and lawyers is helpful.

They offer advice and detailed checks.

This ensures the restructuring follows Romanian laws and rules.

What are best practices for corporate restructuring in Romania?

Good practices include carefully checking what restructuring is needed.

Working with legal and financial experts is also key.

Using strategies that reduce legal risks helps achieve success while following the law.

What are the main types of restructuring and insolvency procedures in Romania?

In Romania, there are several key restructuring and insolvency procedures available:

1. Preventive composition: This is a restructuring procedure aimed at companies facing financial difficulties but not yet insolvent.

It involves negotiations with creditors to reach a restructuring agreement.

2. Ad-hoc mandate: A confidential procedure where a mandatary is appointed to negotiate with creditors to overcome financial distress.

3. Insolvency proceedings: This is the main procedure for companies unable to pay its debts.

It can lead to reorganization or liquidation.

4. Simplified insolvency proceedings: A faster procedure for certain categories of debtors, typically leading to liquidation.

5. Restructuring procedure: Introduced by the implementation of the restructuring directive, this procedure aims to help companies in financial difficulties or facing imminent insolvency.

Each of these procedures has specific requirements and outcomes under Romanian insolvency law.

How does the new restructuring procedure work in Romania?

The new restructuring procedure in Romania, introduced through the implementation of the restructuring directive, works as follows:

1. Eligibility: The debtor must be facing financial difficulties or imminent insolvency but still be viable.

2. Initiation: The debtor proposes a restructuring and applies to the court.

3. Restructuring practitioner: The court appoints a restructuring practitioner.