Inheritance in Romania: Succession, Tax, and Navigating Romanian Law

Ever thought about how inheritance laws in Romania could affect your family’s future?

Understanding Romanian inheritance laws can be tough, even for those who know the country well.

It’s key to grasp succession laws and estate planning to protect your assets and make sure your wishes are followed.

Starting in 1990, Romania has seen more people asking about inheritance laws.

This change, along with the EU Regulation 650/2012 in 2015, has made Romanian succession laws more complex.

Whether you live in Romania or own property there, knowing these laws is vital for planning your estate.

Romanian inheritance laws follow a civil law system, focusing on statutory rights for heirs.

This means children and spouses have guaranteed shares, even if a will says differently.

Without a will, the estate goes to relatives in a specific order, as the Romanian Civil Code dictates.

Getting help from a legal expert is often necessary when dealing with inheritance in Romania.

The rules for cross-border inheritance, taxes, and property transfers can be very complex.

An expert can guide you through your rights, legal steps, and ensure your assets are passed on smoothly to your loved ones.

Key Takeaways

- Romanian inheritance laws prioritize statutory rights and forced heirship;

- EU Regulation 650/2012 impacts succession rules for cases after August 17, 2015;

- Intestate succession follows a predetermined order established by the Romanian Civil Code;

- Professional legal assistance is key for complex inheritance procedures;

- Regular updates to estate plans are recommended to align with changing laws and personal circumstances.

Understanding Romanian Inheritance Law Framework

The Romanian Civil Code is key to understanding inheritance laws in Romania.

It outlines the rules and procedures for succession rights.

It covers testamentary dispositions and intestate succession, providing a clear framework for inheritance.

Legal Basis and Civil Code Provisions

Romanian inheritance law is based on the Civil Code.

It defines legal heirs and their rights.

The code gives priority to family members, like children, spouses, and parents.

It also sets a hierarchy for succession without a will.

This includes descendants, ascendants, and collaterals.

Jurisdiction and Applicable Laws

Inheritance laws in Romania apply to both residents and non-residents with assets here.

The Romanian legal system has jurisdiction over all property within its borders.

This ensures consistent handling of succession matters for Romanian-based assets.

Key Legal Principles in Romanian Succession

Several key principles guide succession rights in Romania.

These include the recognition of three types of testaments: holographic, notarial, and secret.

For a will to be valid, it must be written, signed, and dated by the testator.

The law also protects certain heirs through reserved portion rights.

This limits a testator’s freedom to dispose of their entire estate.

Understanding these legal principles is vital for anyone dealing with inheritance in Romania.

They provide a solid foundation for navigating succession complexities and ensuring compliance with Romanian law.

Types of Succession Under Romanian Law

Romanian inheritance law has two main types: testamentary and intestate succession.

Knowing these is key for handling inheritance in Romania.

Testamentary succession in Romania happens with a valid will.

It lets people decide how their assets are shared after they pass away.

Wills in Romania can be handwritten, notarized, or made in special cases.

Intestate succession in Romania is for when there’s no will.

The law then decides how assets are split, usually favoring family first.

This means children, spouses, and parents get priority.

| Succession Type | Key Features |

|---|

| Testamentary | Based on a valid will, allows personal asset distribution choices |

| Intestate | Follows legal provisions, prioritizes family members |

Both types of succession in Romania have rules.

For example, children and spouses have guaranteed shares of the estate.

Inheritance tax is low, at 1% if the transfer is after two years of the decedent’s death.

Knowing about these succession types helps you understand Romanian inheritance law better.

It ensures your estate is planned and distributed correctly.

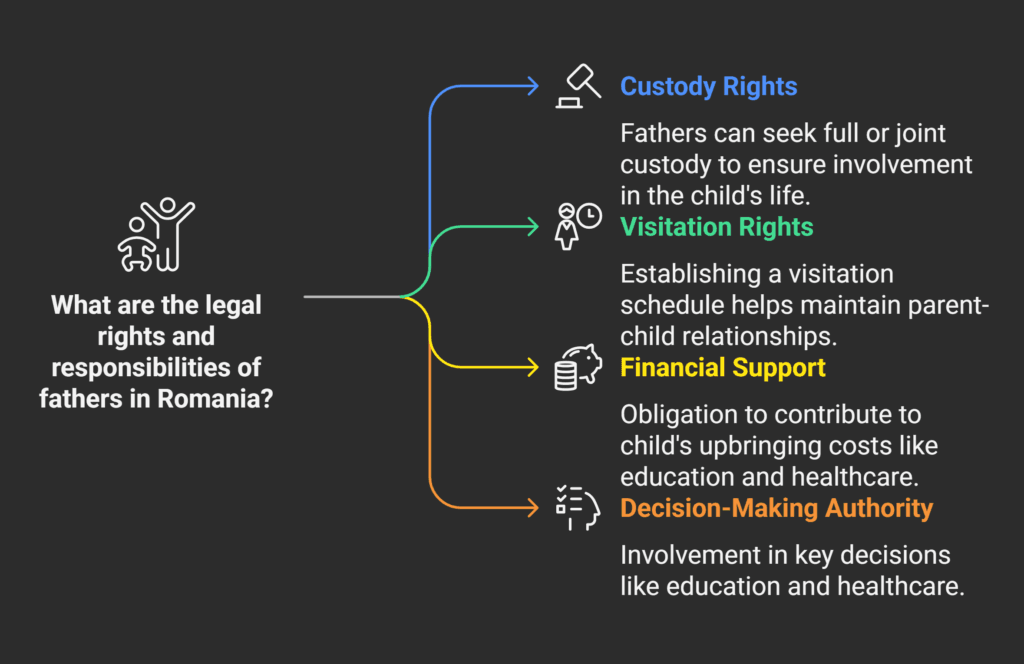

Legal Heirs and Their Rights in Romania

It’s important to know about legal heirs in Romania and their rights.

Romanian law has four classes of legal heirs.

Each class has its own rights and order in the inheritance process.

Classes of Legal Heirs

The Romanian Civil Code clearly lists the order of inheritance:

- First Class: Descendants (children, grandchildren);

- Second Class: Parents and siblings;

- Third Class: Grandparents and other ascendants;

- Fourth Class: Extended family members.

Heirs in higher classes get priority over those in lower classes.

Closer relatives get more than distant ones within each class.

Reserved Portion Rights

Reserved portion rights in Romania protect some heirs from being left out.

These rights make sure close family members get a fair share of the estate.

This is true even if the deceased wanted to leave them out.

| Heir | Reserved Portion |

|---|

| Children | 1/2 of legal share |

| Surviving Spouse | 1/4 of estate |

| Parents | 1/4 of estate (if no children) |

Disinheritance Rules

Disinheritance rules in Romania let testators exclude heirs under certain conditions.

Reasons include serious wrongs against the deceased or their family.

Courts can check these cases to make sure they follow the law.

Inheritance in Romania: Process and Procedures

The inheritance process in Romania is detailed and follows the Civil Code.

It involves notaries and courts working together.

This ensures assets are passed on to the right heirs.

Knowing the steps can help you understand this complex journey.

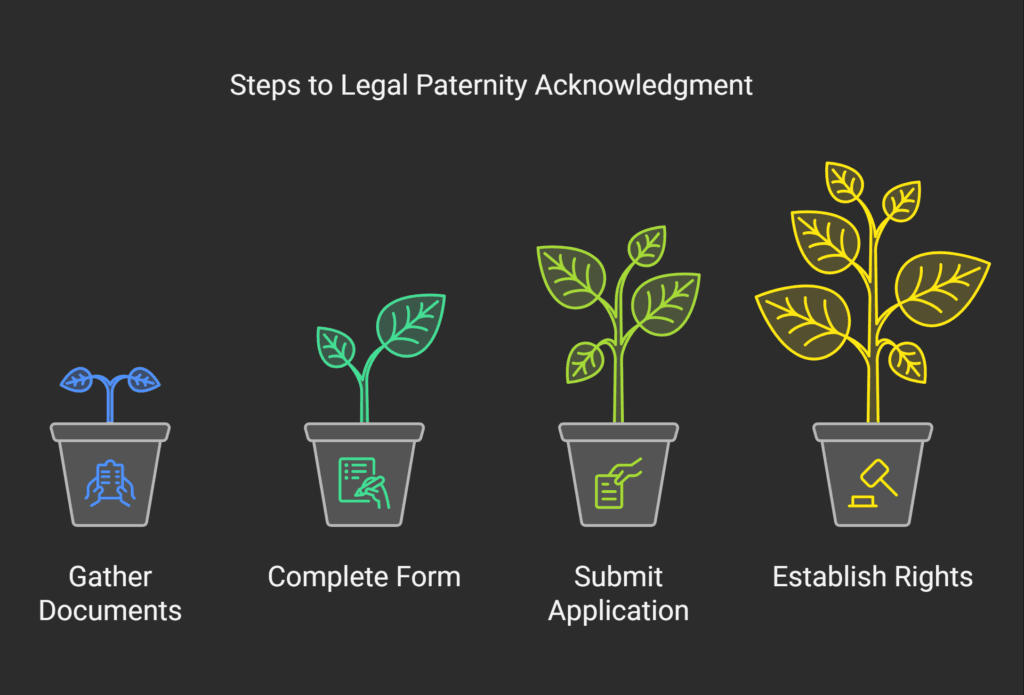

Opening the Succession

The first step is opening the succession.

A notary public must start this in the court area where the deceased lived.

The notary checks the family situation and verifies property documents and any will.

Notarial Proceedings

Notarial proceedings are key in the probate process in Romania.

The notary’s office is in the court area where the deceased lived.

Heirs have choices during these proceedings:

- Accept the inheritance;

- Accept under the benefit of inventory;

- Renounce the inheritance.

Required Documentation

To finish the inheritance process in Romania, you need certain documents.

These include:

- Death certificate of the deceased;

- Proof of kinship for heirs;

- Property ownership documents;

- The will, if one exists.

Heirs have one year to claim their inheritance after it’s opened.

If there are disputes, the court may step in.

Getting legal help can make navigating the process easier in Romania.

Romanian Testament Requirements

Making a valid will in Romania is key to passing on your assets as you wish.

Romanian laws allow for three types of wills: holographic, notarial, and secret.

Each has its own rules for being valid in Romania.

A holographic will is handwritten, dated, and signed by you.

It’s simple to make but less secure.

Notarial wills, made by a public notary, are safer.

Secret wills mix both, keeping your wishes private but legal.

When making a Romanian will, keep these points in mind:

- Be clear about who gets what;

- Choose someone to handle your estate;

- Follow rules for spouses and children;

- Make sure it’s dated and signed right.

Don’t think a printed document with a signature is enough under Romanian law.

For a will that’s legally sound, get help from a professional.

This can prevent arguments and make sure your wishes are followed.

Intestate Succession Rules

Intestate succession in Romania means how assets are shared when someone dies without a will.

The law has rules for who gets what and how much.

This ensures a fair split among family members.

Order of Inheritance

In Romania, the order of inheritance is clear.

First, children and spouses get the assets.

If there are no children, then parents, siblings, and more distant relatives get a share.

This way, everyone gets a fair piece of the estate.

Distribution of Assets

The rules for dividing up an estate are strict.

If there are multiple heirs in the same class, they get an equal share.

For example, if a person leaves a spouse and two kids, the estate is split into three parts.

The 2009 civil code also allows for dealing with heirs who don’t want to claim their share.

State’s Rights in Vacant Succession

If there are no legal heirs or they don’t claim the inheritance, the state takes it.

This is called vacant succession.

It makes sure that unclaimed assets benefit the public, not just sit idle.

| Heir Class | Inheritance Share | Conditions |

|---|

| Children | Equal parts | First in line |

| Spouse | Equal to child’s share | Inherits alongside children |

| Parents | Equal parts | If no children |

| Siblings | Equal parts | If no children or parents |

| State | Entire estate | If no legal heirs |

Inheritance Tax Obligations in Romania

In Romania, the inheritance tax is quite low.

This makes the country a good place for passing on wealth.

It’s important to know about the tax rules to plan your estate well.

The tax rate on inheritance in Romania is 1% of the estate’s value.

This rule applies to assets received after two years of the person’s death.

If you settle the inheritance within two years, you won’t have to pay this tax.

When you claim your inheritance can affect your taxes.

There’s no strict deadline to start the process.

But, settling within two years can save you a lot of money.

This gives heirs more control over their inheritance.

| Time Frame | Tax Rate |

|---|

| Within 2 years | 0% |

| After 2 years | 1% |

For court procedures, you’ll need to pay a judicial stamp duty of 5% of the estate’s value.

Notarial procedures are quicker but cost more based on the estate’s value.

The authority for notarial procedures depends on the deceased’s last home or where the assets are if they lived abroad.

Getting professional help is key when dealing with inheritance taxes in Romania.

The rules can be tricky, and experts can guide you.

They help you manage your inheritance legally and efficiently.

Cross-Border Inheritance Issues

Handling international inheritance in Romania can be tricky.

The EU Succession Regulation makes things easier for EU citizens.

But, those outside the EU might face different rules.

It’s key to know these rules when dealing with Romanian assets or heirs.

EU Succession Regulation

The EU Succession Regulation lets people choose the law of their nationality for inheritance.

This rule applies in the EU and some non-EU countries, except for Denmark and Ireland.

Romanian authorities can reject rules that go against local policies, like discrimination.

International Property Rights

Cross-border inheritance in Romania includes all assets, no matter where they are.

This means cars, bank accounts, and houses are all covered.

The law of the deceased’s last home decides who gets what, who can’t be left out, and special shares for family members.

Conflict of Laws

Conflicts can happen when different laws apply to inheritance.

The EU Succession Regulation tries to reduce these by using the law of the deceased’s last home.

But, things like inheritance tax, marital status, and property rules are not covered by EU rules.

This makes international inheritance in Romania more complex.

For smooth asset transfers in cross-border inheritance, getting legal advice is vital.

It helps follow both Romanian and international laws.

This protects your rights and makes the inheritance process easier.

Role of Public Notaries in Romanian Inheritance

Public notaries are key in the Romanian inheritance process.

They manage notarial proceedings and help people through the complex probate process.

Their knowledge ensures wills are executed correctly, assets are distributed fairly, and disputes are solved.

In Romania, notaries are vital for many life events, including inheritance.

They help protect the rights of minors and the elderly during succession.

Public notaries in Romania verify and authenticate legal documents like wills and contracts.

| Aspect | Notarial Services | Litigation |

|---|

| Cost | 0.5% – 1% of transaction value | Several times higher |

| Time | Few hours to several days | Months to years |

| Legal Certainty | High | Uncertain |

For help with notarial proceedings in Romanian inheritance, contact office@theromanianlawyers.com.

They can guide you through the probate process, ensuring a smooth and legal inheritance.

Inheritance Disputes and Resolution

Inheritance disputes in Romania can be complex and emotionally charged.

Understanding the common causes, legal remedies, and court procedures can help you navigate these challenging situations more effectively.

Common Causes of Disputes

Inheritance disputes in Romania often arise from contested wills, disagreements over asset valuation, or conflicts between heirs.

These disputes can strain family relationships and complicate the mourning process.

Legal Remedies

When facing inheritance disputes in Romania, you have several legal options.

Mediation offers a less adversarial approach to resolving conflicts.

If mediation fails, you may need to pursue court proceedings.

Consulting with a specialist in probate and estate planning is key for understanding your rights and the best course of action.

Court Procedures

Court procedures for inheritance disputes in Romania involve filing a claim with the competent court.

The court can intervene to pronounce the opening of inheritance and resolve disputes between heirs.

It’s important to maintain detailed records of all communications and decisions related to the estate, as these can be key in court proceedings.

If you’re facing inheritance disputes in Romania, seeking professional legal assistance is essential.

Contact our team of lawyers in Bucharest for expert guidance in navigating the complexities of Romanian inheritance law and resolving disputes effectively.

Property Transfer and Registration

Handling property transfer in Romania can be tricky.

There are several ways to transfer assets, like agreements or court decisions.

Knowing these options is key for a smooth process.

Legal succession follows Romanian law if there’s no will.

Testamentary succession follows the will of the deceased.

Both need careful legal handling.

The Romanian Law Firm Atrium Romanian Lawyers advises getting a real estate lawyer. Our team of Romanian lawyers guide through property acquisition and transfer.

We make sure everything follows the law and help with reports.

Important points for property registration in Romania include:

- Heir Certificates from the old Civil Code need the succession author’s property title for first-time land book registration.

- New Civil Code Heir Certificates serve as property titles themselves.

- Registration rejections can occur due to missing Land Book Extracts or unpaid property transfer fees.

- Certificates of Heir must be issued by Romanian Public Notaries.

- Successors are registered as joint owners with shared quotas in land books.

Remember, the official language for submissions in public institutions is Romanian.

This affects how foreign documents are processed in property transfer Romania cases.

| Acquisition Method | Description |

|---|

| Agreement | Mutual consent between parties |

| Legal Inheritance | Distribution according to law |

| Testamentary Inheritance | Distribution as per will |

| Accession | Natural or artificial attachment |

| Usucaption | 30-year possession minimum |

| Court Decisions | Legal rulings on ownership |

Special Rules for Agricultural Land Inheritance

In Romania, inheriting agricultural land has its own set of rules.

The country’s land registry and rules on foreign ownership play a big role.

It’s important to know these rules to make the inheritance process smooth.

Land Registry Requirements

To inherit agricultural land in Romania, you must register it with the land registry.

You’ll need to provide certain documents to prove the transfer of ownership.

The registry keeps detailed records of the property, like its size and location.

Foreign Ownership Restrictions

Romania has rules on who can own agricultural land.

If you’re not from Romania, inheriting farmland might be harder.

The goal is to protect local farming interests.

Foreigners and companies need to meet specific conditions to own land in Romania.

Here are some important things to remember about agricultural land inheritance in Romania:

- Heirs must register inherited land within specific timeframes;

- Non-EU citizens face stricter regulations on agricultural land ownership;

- Unclaimed agricultural land may revert to local authorities after a set period.

Understanding these rules is key.

You’ll need to pay close attention to legal details and deadlines.

Getting help from a professional Romanian Lawyer can make sure you follow Romania’s inheritance laws for agricultural land.

Rights of Surviving Spouses

In Romania, surviving spouse rights are key in marital inheritance.

The Romanian Civil Code has rules for spousal inheritance rights.

These rules make sure widows and widowers are treated fairly.

Surviving spouses in Romania get a share of the estate.

This share depends on the number of other heirs.

They inherit alongside the deceased’s relatives, based on kinship and inheritance rules.

If there are children, the surviving spouse gets a quarter of the estate.

Without descendants, the spouse’s share can grow.

It might reach half the estate when inheriting with the deceased’s parents.

| Scenario | Surviving Spouse’s Share | Other Heirs’ Share |

|---|

| With children | 1/4 of estate | 3/4 divided among children |

| With parents, no children | 1/2 of estate | 1/2 to parents |

| No children or parents | 3/4 of estate | 1/4 to other relatives |

Marital inheritance in Romania also gives special rights to surviving spouses.

They can live in the marital home for a year after their spouse’s death.

This is true even if other heirs want to claim it.

It’s important to understand spousal inheritance rights in Romania for estate planning.

Couples might make wills or prenuptial agreements.

These help clarify how assets will be divided and protect their partner’s interests after death.

Time Limits and Deadlines

Knowing the time limits in Romanian inheritance law is key for heirs.

The inheritance acceptance period in Romania is very important.

Heirs must choose to accept or renounce their inheritance within a certain time.

Acceptance Period

In Romania, heirs have a short time to accept their inheritance.

This time is usually one year from when the person who died passed away.

You must tell the court you want to accept the inheritance during this time.

If you don’t, you might lose your right to the estate.

Renunciation Terms

If you decide to give up your inheritance in Romania, you must do it within one year.

You need to make a formal statement in front of a notary public.

After renouncing, you can’t claim your inheritance rights again.

Statute of Limitations

The time limit for inheritance claims in Romania is three years.

This means you have three years from the date of death to take legal action for your inheritance.

But, some situations might change this time, so it’s wise to talk to a lawyer.

It’s very important to meet these deadlines.

Missing them can mean losing your inheritance rights.

If you’re dealing with Romanian inheritance law, getting help from a Romanian legal expert can make sure you follow all the rules and deadlines.

Professional Legal Assistance

Understanding inheritance laws in Romania can be tough.

That’s why getting legal help is key.

Inheritance lawyers in Romania guide you through the complex process, making sure your rights are looked after.

A law firm in Romania focuses on inheritance law.

They help with making wills, preparing documents, and representing you in legal proceedings.

They know both Romanian and EU laws, including human rights and the Charter of Fundamental Rights.

The Romanian Law Firm Atrium Romanian Lawyers offers full support in the inheritance process.

We are experts in:

- Drafting and contesting wills;

- Handling cross-border inheritance issues;

- Resolving inheritance disputes;

- Managing property transfers and registration.

Getting professional legal help can prevent problems and make the inheritance process smoother.

For expert advice, email office@theromanianlawyers.com.

Remember, good legal advice is vital for protecting your inheritance rights and solving disputes fairly.

Conclusion

Understanding the Romanian inheritance process is key.

The Civil Code outlines the rules for succession and estate distribution.

Knowing these basics is essential for estate planning in Romania.

The process includes several steps, like opening succession and transferring property.

It’s important to recognize legal heirs and follow testament rules.

Also, remember you have one year to accept or decline an inheritance.

Estate planning in Romania is more than just making a will.

It involves understanding taxes, cross-border issues, and rules for agricultural land.

Getting legal help is vital.

It helps avoid disputes and ensures your legacy is protected.

FAQ

What are the main types of succession under Romanian law?

Romanian law has two main types of succession.

The first is testamentary succession, which is based on a valid will.

The second is intestate succession, where assets are divided by law if there’s no will.

Who qualifies as a legal heir in Romania?

In Romania, legal heirs are based on their relationship to the deceased.

They are divided into classes.

This includes spouses, descendants, ascendants, and collateral relatives.

Closer relations get priority.

What is the reserved portion in Romanian inheritance law?

The reserved portion is a protected part of the estate.

It must go to certain heirs, usually close family.

This part can’t be freely given away by the testator in their will.

How long do heirs have to accept or renounce an inheritance in Romania?

Heirs have one year from the succession’s start to accept or renounce an inheritance in Romania.

It’s important to meet this deadline to keep inheritance rights.

Is there an inheritance tax in Romania?

Romania doesn’t have a specific inheritance tax.

But, there might be other taxes and fees when transferring inherited assets.

For example, property transfer taxes.

How does the EU Succession Regulation apply to inheritance cases in Romania?

As an EU member, Romania follows the EU Succession Regulation.

This regulation lets EU citizens choose the law of their nationality for their succession.

It makes handling cross-border inheritance simpler.

What role do public notaries play in the Romanian inheritance process?

Public notaries are key in Romanian inheritance.

They manage notarial proceedings, verify documents, and ensure assets are distributed correctly.

This is based on the will or intestate rules.

How are inheritance disputes typically resolved in Romania?

In Romania, inheritance disputes can be solved through mediation or court.

The choice depends on the dispute’s nature and if the parties want to negotiate.

Are there special rules for inheriting agricultural land in Romania?

Yes, there are special rules for agricultural land in Romania.

These include specific land registry rules and restrictions on foreign ownership.

These rules can make inheriting agricultural land complex.

What rights do surviving spouses have in Romanian inheritance law?

Surviving spouses in Romania have strong rights.

They get a share of the estate, which changes based on other heirs.

Sometimes, they have priority over others.

How can I get professional legal assistance for inheritance matters in Romania?

For help with Romanian inheritance, contact our law firm that specializes in this area.

You can reach out to office@theromanianlawyers.com for expert advice and services.

What are the succession rules in Romania and how does Romanian law govern inheritance?

In Romania, succession is governed by the Civil Code which sets out a comprehensive framework for inheritance.

According to Romanian law, there are two types of succession:

-legal succession (when there is no will) and

-testamentary inheritance (when there is a valid will).

Romanian inheritance laws establish a hierarchy of heirs who are entitled to inherit, with priority given to close family members.

The inheritance procedure in Romania follows specific rules where the deceased’s assets are transferred to their legal heirs or beneficiaries named in the will.

Romanian succession law recognizes four classes of heirs:

- descendants (children, grandchildren),

- privileged ascendants and privileged collaterals (parents, siblings),

- ordinary ascendants (grandparents), and ordinary collaterals (uncles, aunts, cousins).

The first existing class excludes the subsequent ones.

It’s important to note that inheritance in Romania is governed by the principle of universal succession, meaning heirs inherit both assets and liabilities.

The Romanian inheritance system also provides for reserved portions (legitim) of the estate that must go to certain heirs regardless of the deceased’s wishes, thus limiting the freedom to dispose of one’s property through a will.

Is there an inheritance tax in Romania and how is it calculated?

One of the most favorable aspects of inheritance in Romania is that there is effectively no inheritance tax as understood in many other countries.

Instead, heirs are required to pay a notary fee and a property transfer tax when finalizing the inheritance process.

The notary fee is calculated based on the value of the estate and typically ranges from 0.5% to 1% of the estate’s value, with some fixed fees for lower-value estates.

Additionally, there is a 1% tax for the transfer of real estate properties within the 2 year term.