Tax Benefits for Startups in Romania: Incentives, Grants, and R&D Deductions

Tax Benefits for Startups in Romania: Incentives, Grants, and R&D Deductions

Did you know Romania has one of Europe’s lowest corporate income tax rates at just 16%?

This is just the beginning of the tax benefits for startups in Romania.

The country is dedicated to supporting entrepreneurship and innovation, offering many opportunities for new businesses.

Romania’s tax system has many startup tax incentives to help businesses grow and attract investors.

There are tax options based on revenue for small businesses and big R&D deductions.

These benefits make Romania a great place for startups, especially in tech and innovation.

Knowing about these benefits is key to growing your business in Romania.

Whether you’re starting a business here or investing from abroad, understanding taxes is crucial.

For advice on using these incentives, contact expert legal counsel at office@theromanianlawyers.com.

Key Takeaways

- Romania offers a competitive 16% corporate tax rate;

- Micro-enterprises can benefit from revenue-based tax rates as low as 1%;

- R&D expenses qualify for an additional 50% tax deduction;

- IT sector enjoys specific tax advantages, including potential VAT exemptions;

- Various EU funding opportunities are available for innovative startups;

- Local tax benefits exist in tech parks and free economic zones.

Overview of Romanian Corporate Taxation System

Romania’s corporate tax system is good for both startups and established businesses.

It aims to attract foreign investment and boost the economy.

Knowing these policies is key for startups wanting to start in Romania.

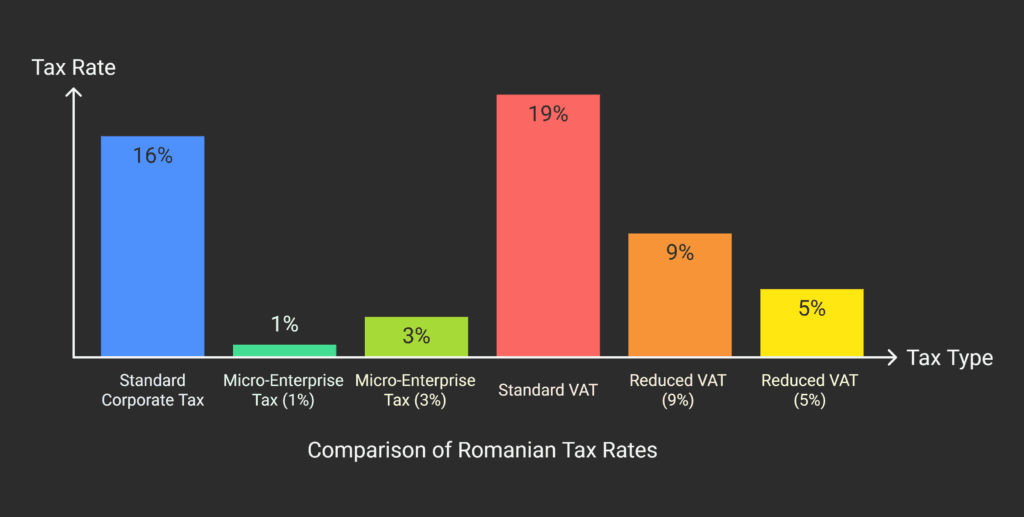

Standard Corporate Tax Rate and Structure

Romania has a flat corporate tax rate of 16%. This is lower than many European countries.

All companies pay this rate, no matter their size or industry. For startups, this makes planning finances easier.

Micro-Enterprise Tax Framework

The micro-enterprise tax is great for Romanian startups.

Companies with less than €500,000 in annual revenue can pay 1% or 3% tax.

This helps startups keep more of their earnings, especially when they’re growing fast.

VAT Regulations and Thresholds

Romania’s VAT system has benefits for startups.

The standard VAT rate is 19%, but there are lower rates for some goods and services.

Startups need to know the VAT registration threshold, which is €88,500 in annual turnover.

If they’re below this, they might not have to pay VAT, which helps with finances.

| Tax Type | Rate | Applicability |

|---|---|---|

| Standard Corporate Tax | 16% | All companies |

| Micro-Enterprise Tax | 1% or 3% | Revenue up to €500,000 |

| Standard VAT | 19% | General goods and services |

| Reduced VAT | 9% or 5% | Specific goods and services |

Romanian tax policies for startups aim to boost entrepreneurship and innovation.

They offer lower tax rates for micro-enterprises and VAT benefits.

This creates a good environment for new businesses to grow and help the economy.

Tax Benefits for Startups in Romania

Romania has a great tax setup for startups.

It offers many benefits to help entrepreneurs grow.

These advantages make Romania a great place for startups to start.

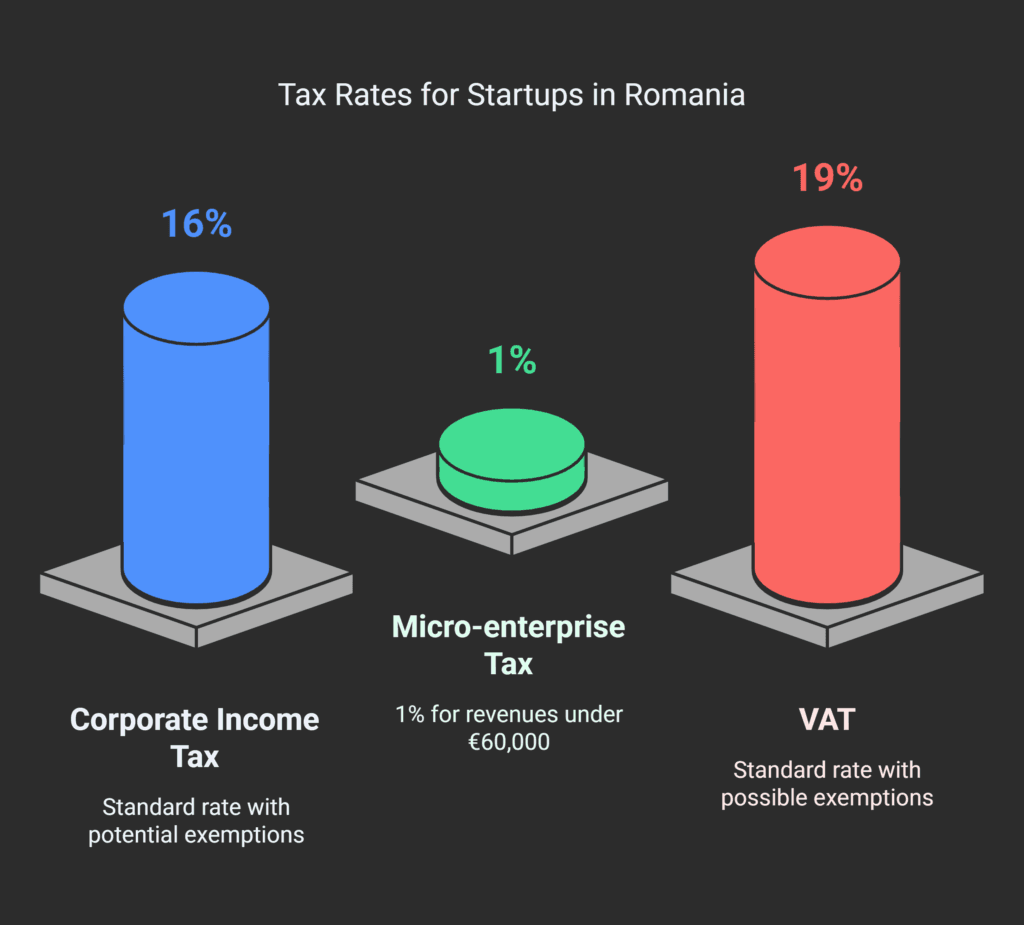

First-Year Tax Advantages

New businesses in Romania get big tax breaks in their first year.

They might not have to pay corporate income tax or pay less.

This lets them put more money into growing and improving.

Revenue-Based Tax Options

Romania has a special tax for small businesses.

If a company makes less than 1 million euros a year, it pays just 1% tax.

This is good for businesses that make a lot but don’t make much profit.

Special Economic Zone Benefits

Startups in special economic zones get even more benefits.

They might pay less tax, get customs duty breaks, and more.

These perks make these zones even more appealing for new businesses.

| Benefit Type | Description | Eligibility |

|---|---|---|

| Corporate Income Tax | 16% standard rate, potential exemptions for startups | All registered businesses |

| Micro-enterprise Tax | 1% on turnover for revenues up to €60,000 | Companies with revenues under €500,000 |

| VAT | 19% standard rate, exemptions available | Based on turnover thresholds |

Romania’s tax benefits, growing startup scene, and EU funding make it great for new businesses.

Cities like Bucharest, Cluj-Napoca, and Timișoara are especially good for startups.

They offer lots of resources and chances for entrepreneurs.

Research and Development Tax Incentives

Romania offers great R&D tax incentives to boost innovation and tech growth.

These incentives make Romania a top spot for startups and tech companies.

They focus on research and development.

50% Extra Deduction on R&D Expenses

Companies investing in R&D can get a 50% extra deduction on eligible expenses.

This R&D tax relief for startups in Romania cuts down the cost of innovation projects.

Eligible costs include salaries for R&D staff, equipment, and materials for research.

Accelerated Depreciation for R&D Equipment

Romania also offers accelerated depreciation for R&D equipment.

This helps startups by reducing taxable income early on.

The rate of depreciation depends on the equipment type and its lifespan.

Innovation-Related Tax Credits

Romania has various innovation tax credits to boost tech advancement.

These credits can be applied to corporate tax, lowering the tax burden.

The credit amount varies based on the project’s nature and scale.

| Tax Incentive | Benefit | Eligibility |

|---|---|---|

| R&D Expense Deduction | 50% extra deduction | All companies with eligible R&D expenses |

| Accelerated Depreciation | Faster write-off of R&D equipment | Companies using equipment for R&D activities |

| Innovation Tax Credits | Reduction in corporate tax liability | Companies engaged in innovative projects |

These tax incentives make Romania a great place for tech startups and innovation companies. By using these benefits, businesses can lower their taxes. This lets them focus more on research and development.

Government Grants and Financial Support Programs

Romania has many government programs to help startups.

The StartUp Nation 2025 program gives non-refundable grants of 250,000 RON.

This helps create two jobs over two years.

It’s part of the broader support for startups in Romania.

Seed funding tax deductions in Romania are also supported by EU funds.

The Innovation Romania program has 106.7 million EUR for startups and SMEs.

Micro-enterprises in Bucharest-Ilfov can get grants from €25,000 to €300,000.

Venture investment tax credits in Romania get a boost from programs like SME Eco-Tech.

It has a budget of 53,924,286 CHF. Grants up to 50,000 CHF cover 40% of eligible costs.

This support is for sustainability and digital projects.

| Program | Budget | Grant Amount | Focus Area |

|---|---|---|---|

| StartUp Nation 2025 | 295,750,000 EUR | 250,000 RON | Job Creation |

| Innovation Romania | 106.7 million EUR | Varies | Innovation |

| SME Eco-Tech | 53,924,286 CHF | Up to 50,000 CHF | Sustainability |

| PNRR | 28.5 billion EUR | Varies | Digital & Green Transition |

IT Sector-Specific Tax Advantages

Romania offers great tax benefits for tech startups and software companies.

These benefits make it a top spot for digital innovation and IT growth.

Software Development Tax Exemptions

Romania has tax breaks for software companies.

They don’t have to pay corporate tax if they make enough from software.

Companies need to make at least 10,000 EUR per employee each year.

New startups get a break.

They don’t have to meet the revenue rule for their first two years.

Tech Industry Employee Benefits

There are tax perks for tech employees in Romania too.

Until recently, IT pros got a 10% tax break. Jobs like database admins, IT managers, and software engineers were eligible.

Both Romanian and foreign workers could get this benefit.

They just had to meet certain education standards.

Digital Innovation Incentives

Romania is serious about digital innovation.

It offers many incentives to grow its digital economy.

This economy is still behind the EU’s average.

Only 31% of Romanians have basic digital skills, compared to the EU’s 56%.

These incentives are key to closing this gap.

The government is really pushing for digital innovation in Romania.

Despite being last in the 2021 Digital Economy and Society Index, Romania does well in some areas.

For example, its fixed very high capacity network coverage is 76%, higher than the EU’s 59%.

Investment and Capital Gains Tax Benefits

Romania offers great tax breaks for startup investments.

The corporate income tax rate is 16%, but there are incentives to lower this for new companies.

Angel investor tax breaks in Romania make early funding more attractive, helping startups grow.

Capital gains tax in Romania is 16%, which is good compared to the EU.

Sometimes, dividend income can be tax-free, boosting investor returns.

New companies in Romania can use fiscal losses for up to 7 years.

This lets startups use future profits to cover early losses, giving them financial breathing room.

Romania has about 87 tax treaties to avoid double taxation.

This makes it a great place for foreign investors.

These treaties can reduce withholding taxes and offer other financial perks for international deals.

| Tax Benefit | Rate/Provision |

|---|---|

| Standard Corporate Income Tax | 16% |

| Capital Gains Tax | 16% |

| Micro-company Tax (Revenue ≤ €60,000) | 1% |

| Micro-company Tax (Revenue > €60,000) | 3% |

| Loss Carry-forward | Up to 7 years |

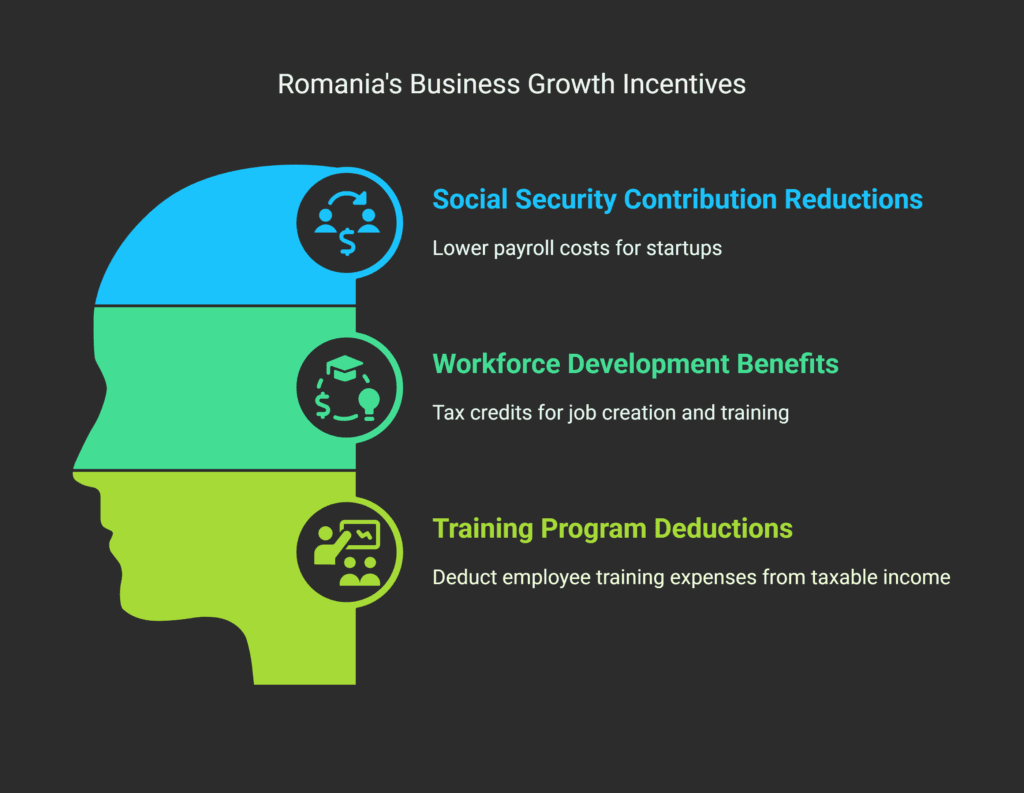

Employment-Related Tax Incentives for New Businesses

Romania has great payroll tax incentives for startups and new businesses.

These incentives help boost employment and support workforce development.

Let’s look at the main employment-related tax benefits for entrepreneurs in Romania.

Social Security Contribution Reductions

Startups in Romania can enjoy lower social security contributions.

This helps new businesses cut their payroll costs and invest more in growth.

The exact reduction depends on company size and industry sector.

Workforce Development Benefits

Romania offers benefits to encourage hiring and training new employees.

There are tax credits for job creation and deductions for employee training.

These incentives help startups build strong teams while keeping costs down.

Training Program Deductions

Investing in your workforce is key for business success.

Romania has deductions for training programs to support this.

Startups can deduct training expenses from their taxable income.

This encourages continuous learning and skill development.

| Employment-Related Tax Incentive | Benefit |

|---|---|

| Social Security Contribution Reductions | Lower payroll costs for startups |

| Workforce Development Benefits | Tax credits for job creation and training |

| Training Program Deductions | Deduct employee training expenses from taxable income |

These employment-related tax incentives in Romania make it great for startups to grow their teams.

By using these benefits, new businesses can cut costs, attract skilled workers, and encourage innovation.

Regional Development Incentives and Local Tax Benefits

Romania has many incentives and tax benefits to draw new businesses and boost the economy.

These benefits vary by region, helping entrepreneurs get the most out of their finances.

The Romanian government gives tax breaks to new businesses in key areas.

These breaks can cut down on taxes, letting startups focus more on growing and innovating.

Local governments also offer extra perks to bring businesses to their areas, like lower property taxes.

When picking a place for your startup in Romania, look into the local incentives.

Some places have lower tax rates or tax exemptions.

These can greatly help your company’s finances, especially when you’re just starting out.

- Standard corporate income tax rate: 16%;

- Micro-enterprise tax rates: 1% or 3% (based on annual turnover);

- VAT rates: 19% standard, 9% and 5% reduced rates.

To make the most of these incentives in Romania, compare what different places offer.

Think about things like infrastructure, the local workforce, and how close you are to markets.

Choosing the right location can help your business grow strong from the start.

European Union Funding and Tax Advantages

Romania’s EU membership brings big benefits.

It offers financial help and tax breaks for startups.

This mix of EU grants and Romanian tax laws makes starting a business easier.

EU Grant Programs Integration

Romanian startups can get into various EU grant programs Romania.

Horizon Europe supports research and innovation. Startups working on digital and green projects can get help from structural funds.

These programs often come with tax breaks.

This makes them even more attractive for new businesses.

Cross-Border Tax Benefits

Romania’s tax benefits are a big plus for startups.

With Romania joining the Schengen Area, travel and trade will get easier.

This will help businesses grow across the EU.

Romania’s 16% corporate tax rate is also good.

It’s lower than the EU average of 21%.

European Investment Initiatives

European investment in Romania is key for startups.

Romania will get almost 80 billion euros from the EU Resilience Fund.

This money will go to projects like infrastructure, digitalization, and green initiatives.

Startups that fit these areas can get a lot of funding.

| Funding Source | Focus Area | Potential Benefits |

|---|---|---|

| Horizon Europe | Research and Innovation | Grants, Tax Incentives |

| EU Structural Funds | Digital Transformation, Sustainability | Financial Support, Tax Benefits |

| EU Resilience Fund | Infrastructure, Digitalization, Green Projects | Large-scale Funding, Growth Opportunities |

Conclusion

Romania’s startup scene is booming, with VC funding hitting €101.7M in 2022.

This is a 54.3% jump from 2021.

The country is now the 5th biggest in CEE for VC funding.

This shows how attractive Romania is for entrepreneurs.

Romania has many tax perks for startups.

For example, there’s a 50% extra deduction on R&D expenses.

There are also tax breaks for software development.

The corporate tax rate is 16%, and personal tax is 10%, both of which are low in the EU.

A Romanian tax specialist can guide you through these benefits.

They help your startup get the most out of these advantages.

Romania’s location and growing economy make it great for new businesses.

It has a good tax environment too. If you’re looking into IT or regional incentives, a Romanian tax lawyer can offer great advice.

For more on Romanian tax law and startup benefits, email a lawyer in romania at office@theromanianlawyers.com.

Romania is working to cut its budget deficit and introduce new tax reforms.

Keeping up with these changes is key.

A trusted Romanian law office can help you stay on top of regulations.

With the right help, your startup can do well in Romania’s lively business world.

FAQ

What is the standard corporate tax rate in Romania?

In Romania, the standard corporate tax rate is 16%.

This rate is quite competitive when compared to other European countries.

How does the micro-enterprise tax framework benefit startups in Romania?

The micro-enterprise tax framework in Romania offers lower tax rates based on turnover.

This is very beneficial for small businesses and startups in their early stages.

Are there any first-year tax advantages for new businesses in Romania?

Yes, Romania provides tax benefits for new companies in their first year.

These benefits may include exemptions or reductions in corporate income tax.

What R&D tax incentives are available for startups in Romania?

Romania offers several R&D tax incentives for startups.

These include a 50% extra deduction on R&D expenses and accelerated depreciation for R&D equipment.

There are also innovation-related tax credits to encourage research and development.

Are there any government grants available for startups in Romania?

Yes, Romania has various government grants and financial support programs.

These include state aid schemes and EU-funded programs to support startups and innovative businesses.

What tax benefits are available for the IT sector in Romania?

The IT sector in Romania enjoys several tax benefits.

These include income tax exemptions for IT professionals and corporate tax exemptions for software development companies that meet specific criteria.

Are there any tax incentives for reinvesting profits in Romania?

Yes, Romania offers exemptions for reinvested profits.

This allows startups to grow while reducing their tax burden.

What employment-related tax incentives are available for new businesses in Romania?

New businesses in Romania can benefit from several employment-related tax incentives.

These include reductions in social security contributions, tax credits for hiring and training new employees, and deductions for training programs.

Are there regional tax benefits for startups in Romania?

Yes, Romania offers regional development incentives and local tax benefits.

These may include reduced tax rates, exemptions, or other fiscal advantages depending on the startup’s location.

How can Romanian startups benefit from European Union funding?

Romanian startups can access various EU grant programs.

They can also leverage cross-border tax benefits and take advantage of European investment initiatives.

These can provide significant financial and tax advantages.