Confiscation of Goods under Romanian Law

Recently, Romania’s Tax Reform Law introduced fines up to RON 30,000 for legal entities involved in illegal activities.

This shows how serious asset forfeiture and property seizure are in Romania.

The country’s criminal code now focuses more on recovering illicit gains through legal confiscation.

In Romania, confiscating goods is not just a punishment.

It’s also a way to keep society safe, as stated in the Code of Criminal Procedure.

If you commit a crime, you could lose your assets forever.

This helps prevent future crimes and protects everyone.

Not only the person who committed the crime can lose property.

If you can’t show where goods came from, you might get fined up to RON 30,000.

For those who do it again, the fines can double to RON 60,000.

They might also have their business shut down for up to 15 days in a year.

Key Takeaways

- Fines up to RON 30,000 for illicit economic activities;

- Confiscation applies to goods used in or resulting from contraventions;

- Failure to produce origin documents can result in hefty fines;

- Repeat offenses lead to increased penalties and business suspension;

- Confiscation is a definitive measure aimed at preventing future crimes;

- The process affects assets and serves as a societal safety measure.

Understanding Legal Framework of Asset Confiscation in Romania

Romania has strong laws for taking away assets to fight corruption.

The country’s penal code explains how to confiscate assets, including those gained unfairly.

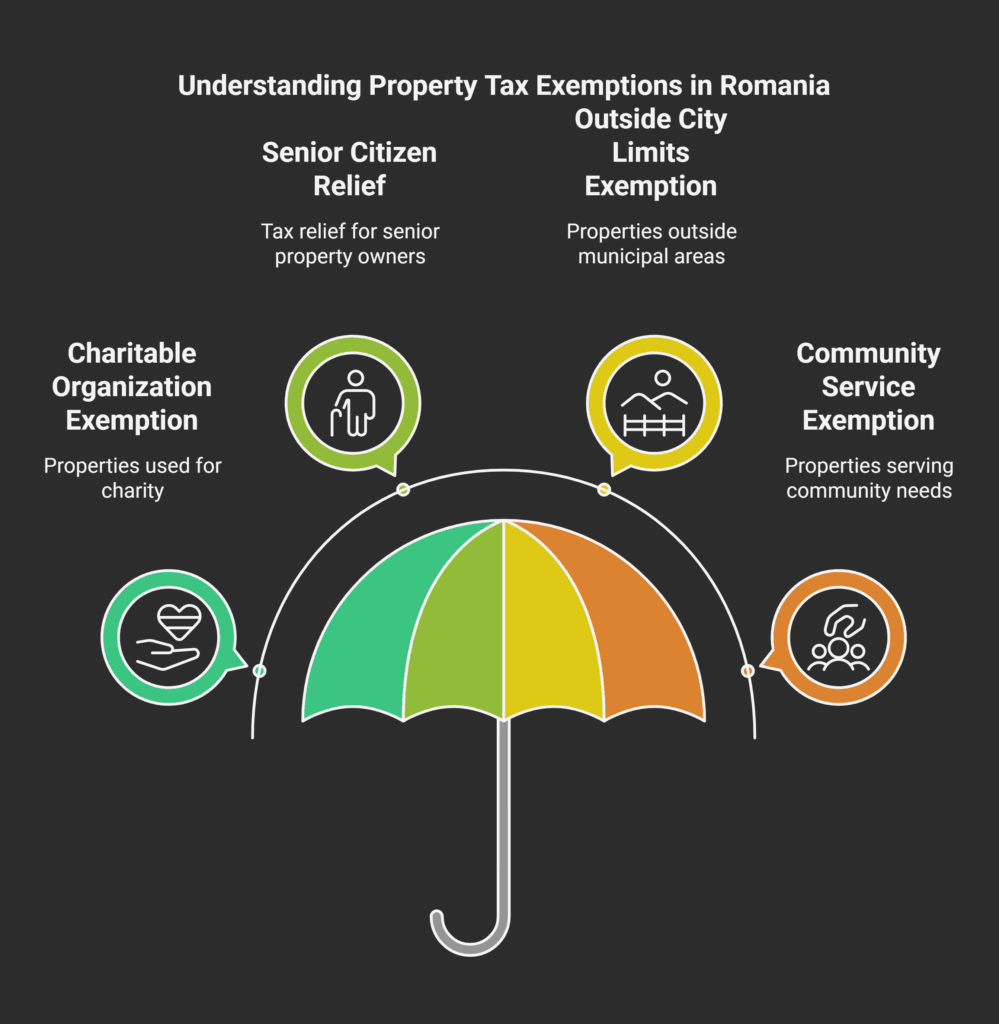

Definition and Types of Confiscation

Romania has two main types of asset confiscation. Special confiscation goes after assets directly tied to crimes.

Extended confiscation takes assets thought to come from illegal sources, even without a clear crime link.

Scope of Romanian Confiscation Laws

Romania’s laws allow for seizing a wide range of assets.

This includes property bought with crime money, income from crimes, and assets that don’t match someone’s legal earnings.

The National Agency for the Management of Seized Assets manages these assets.

Legal Basis and Authority

The laws for confiscating assets in Romania include:

- Code of Criminal Procedure;

- Law no. 144/2007 on the National Integrity Agency.

- United Nations Convention against Corruption (ratified via Law no. 365/2004).

Asset confiscation can happen through criminal or civil court orders.

The Ministry of Justice is key in working with other countries to recover assets.

| Aspect | Details |

|---|

| Central Authority (Investigation Stage) | Prosecution Office of the High Court of Cassation and Justice |

| Central Authority (Trial Stage) | Ministry of Justice, Directorate for International Law and Judicial Cooperation |

| Asset Freezing Duration | Up to 6 months |

| Specific Investigative Techniques Duration | Up to 120 days |

| Asset Management Authority | National Agency for the Management of Seized Assets |

Key Authorities and Institutions Involved in Confiscation

In Romania, several key institutions play crucial roles in the confiscation process.

A Romanian lawyer or Romanian law office can guide you through the complexities of these authorities.

Ministry of Justice Role

The Ministry of Justice’s Directorate for International Law and Judicial Cooperation handles cross-border asset recovery cases.

This department works closely with foreign counterparts to trace and seize criminal assets located abroad.

National Agency for Management of Seized Assets

The National Agency for the Management of Seized Assets (NAMSA) was established by Law 318/2015.

This agency is responsible for managing confiscated assets efficiently.

Between 2016 and 2021, NAMSA conducted over 415 interlocutory sales, generating total revenues of EUR 4,048,676.

Prosecution Office Powers

The Prosecution Office of the High Court of Cassation and Justice plays a vital role during investigation and prosecution stages.

It has the authority to seize assets linked to criminal activities.

In a recent case, prosecutors seized assets totaling EUR 342,667, including real estate, cars, and bank account contents.

| Institution | Role | Key Achievements |

|---|

| Ministry of Justice | International cooperation | Handles cross-border asset recovery |

| NAMSA | Asset management | Generated EUR 4,048,676 from sales |

| Prosecution Office | Asset seizure | Seized EUR 342,667 in one case |

If you need assistance navigating these institutions, consult a lawyer in Romania specializing in asset confiscation cases.

Confiscation of Goods under Romanian Law

Romanian law has three types of legal forfeiture: criminal, contraventional, and civil.

Criminal confiscation is a court-ordered measure for criminal acts.

Contraventional confiscation is a part of main offense sanctions.

Civil asset forfeiture targets unexplained wealth of public officials under Law no. 144/2007.

In 2012, Romania’s Constitutional Court introduced extended confiscation of goods from criminal activities.

This method is very effective in fighting economic crime.

It only applies to assets gained after 2012, thanks to changes in the New Criminal Romanian Code.

Criminal penalties can be very harsh.

For example, a former senator was fined €60 million for fraudulent privatization.

His case took 2,238 days from investigation start to sentencing, showing how complex these cases can be.

Romania’s laws on contraband have been made stronger to tackle non-compliance with the RO e-Transport system.

The penalties get worse with each offense:

| Offense | Natural Persons Fine (RON) | Legal Persons Fine (RON) | Additional Penalty |

|---|

| First | 10,000 – 50,000 | 20,000 – 100,000 | None |

| Second | 10,000 – 50,000 | 20,000 – 100,000 | 15% of undeclared goods value |

| Third | 10,000 – 50,000 | 20,000 – 100,000 | 50% confiscation of undeclared goods value |

| Fourth+ | 10,000 – 50,000 | 20,000 – 100,000 | 100% confiscation of undeclared goods value |

Due process rights are safeguarded through appeals and property return procedures.

The Cooperation and Verification Mechanism (CVM) watches over Romania’s judicial reform and anti-corruption efforts.

It makes sure Romania meets EU standards.

Special Confiscation Procedures

Romania has special rules for taking away criminal assets.

These rules help fight organized crime and corruption.

The country uses three main ways to take assets: criminal asset forfeiture, extended confiscation, and civil asset forfeiture.

Criminal Asset Forfeiture

In Romania, criminal asset forfeiture targets goods linked to crimes.

Authorities can take assets proven to be from illegal activities.

Recent laws have made it easier to seize assets, helping fight organized crime.

Extended Confiscation Measures

Extended confiscation measures let Romania seize more assets.

They apply when someone gets at least 4 years in prison.

If there’s doubt about someone’s wealth, assets can be seized.

This has made more crimes eligible for extended confiscation.

Civil Asset Forfeiture

Civil asset forfeiture in Romania targets unjust wealth of public officials.

It’s based on Law 144/2007. If someone’s wealth is more than 10,000 Euros above their legal income, their assets can be taken.

It’s a key tool against corruption in government.

These special confiscation procedures help Romania fight financial crimes.

By having strong asset forfeiture laws, Romania aims to get back stolen money and stop future crimes.

The success of these efforts keeps growing as Romania follows EU rules.

Asset Tracing and Seizure Process

In Romania, many agencies work together to fight illegal activities.

The National Office for the Prevention and Control of Money Laundering is key in finding assets.

Prosecutors and judges then take over to seize these assets during court cases.

The goal of legal property seizure in Romania is to quickly stop threats from illegal items.

Since 2015, the National Agency for the Management of Seized Assets (ANABI) has been a major player in this area.

ANABI has made big progress in taking away illegal goods.

They have taken control of assets worth about EUR 200 million.

They have also sold or reused assets worth around EUR 6 million.

These include shares, big deposits, industrial equipment, and even virtual currency linked to crime groups.

| Asset Type | Value (EUR) | Outcome |

|---|

| Total Seized Assets | 200 million | Under ANABI management |

| Reused/Sold Assets | 6 million | Funds generated for state |

| Confiscated Building | 3 million | Proposed for public institution use |

ANABI’s work isn’t just local. They also work with other countries.

They even sent 173,802.35 USD to Romania from a project with the USA.

This shows how far-reaching their efforts are.

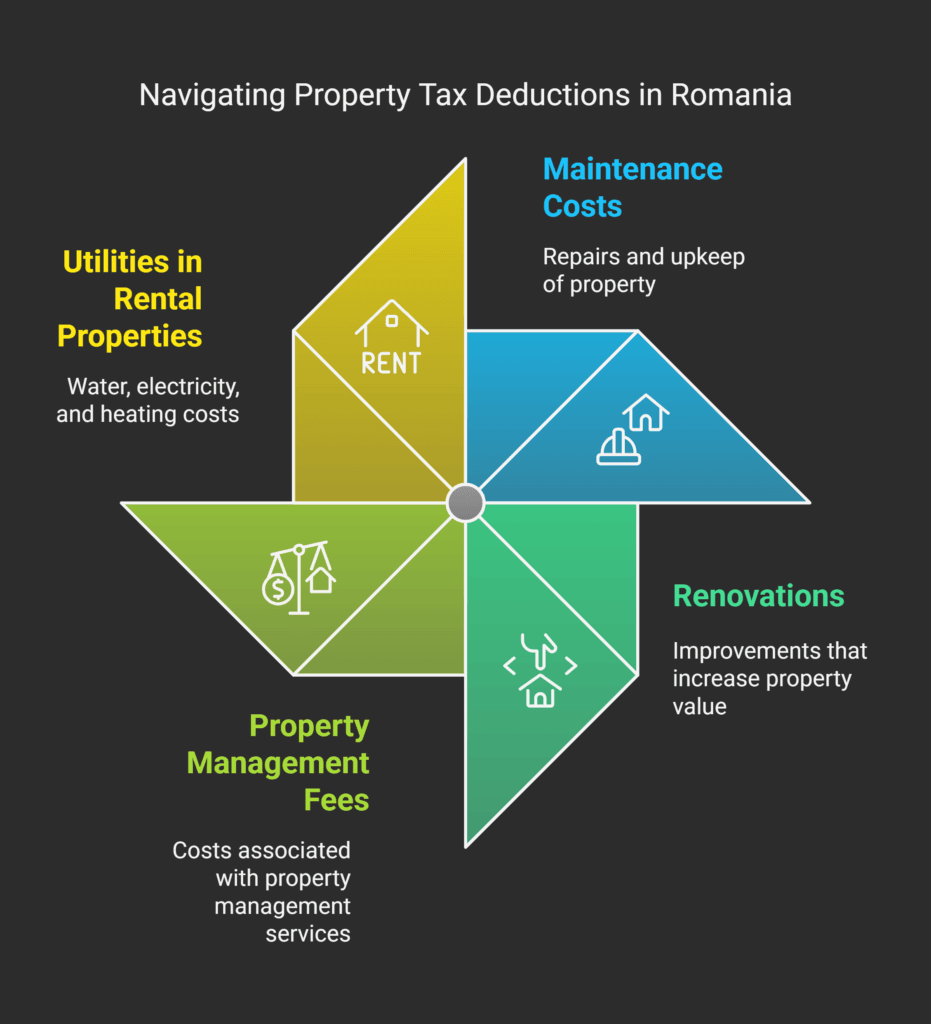

Documentation Requirements and Legal Proceedings

Understanding property seizure in Romania means dealing with complex rules and legal steps.

The National Authority for Consumer Protection (NACP) watches over consumer protection and enforces laws.

Origin Documentation Requirements

Romanian customs have strict rules for goods’ origin documents.

You need invoices, accompanying documents, and customs forms.

The Tax Reform Law has made these rules even stricter.

Traders must show proof of their business practices when asked by the authorities.

Legal Time Limits

Romania’s laws set time limits for legal actions.

Complaints must be solved within 30 days, with a 15-day extra for detailed checks.

Seized assets stay frozen until the confiscation request is settled.

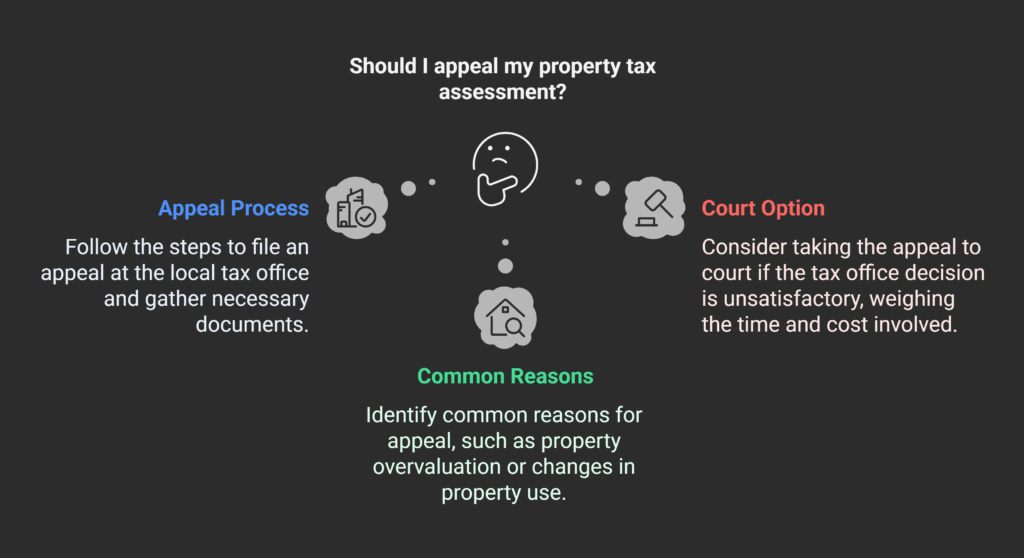

Appeals Process

The appeals process for property seizures depends on the confiscation type.

Romanian law allows for international rogatory commissions in criminal cases.

This includes search and seizure of objects.

The execution of these commissions goes through two steps: considering the application and executing it if approved.

Romanian courts follow their laws when handling international rogatory commission requests.

If asked, they’ll tell the requesting state when and where it will happen.

This ensures fairness and follows Romania’s property seizure rules.

International Cooperation in Asset Recovery

Romania is a key player in the fight against financial crimes worldwide.

It works hard to recover assets linked to crime.

This effort is not just for its own benefit but also for the global community.

Mutual Legal Assistance

The Ministry of Justice in Romania leads in mutual legal assistance.

This system helps countries share information and recover assets together.

It makes it easier to freeze assets and enforce confiscation orders in criminal cases.

Cross-Border Cooperation

Romania is part of important European networks for cooperation.

These include the European Judicial Network (EJN) and Eurojust.

These partnerships help Romanian authorities work with others to track and seize assets linked to crime.

Recognition of Foreign Judgments

Romania’s laws allow it to enforce foreign confiscation orders under certain conditions.

This is crucial when assets in Romania come from crimes committed elsewhere.

It ensures that assets can be seized, even if the original judgment was made abroad.

By working together, Romania boosts its fight against money laundering and financial crime.

It plays a big role in the global effort to combat these issues.

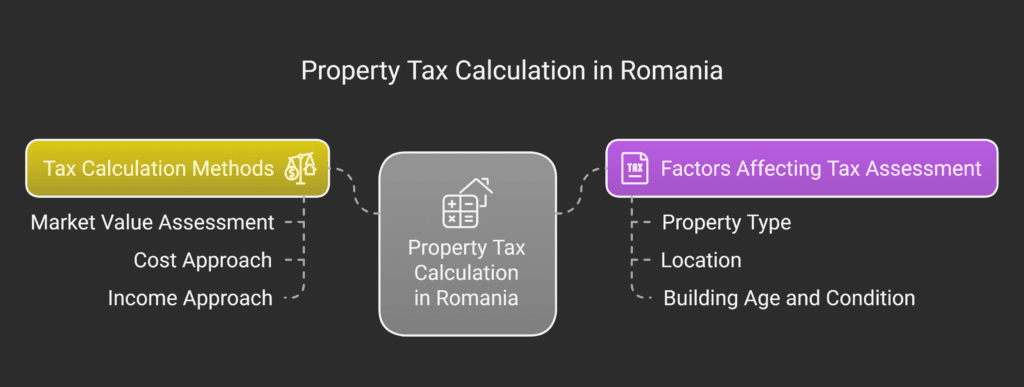

Tax Reform Law Impact on Confiscation

Romania’s tax reform law, Law no. 296/2023, has made big changes.

It aims to fight organized crime better and improve how assets are seized.

New Sanctions Framework

The law now has a strong sanctions system for financial crimes.

It has big fines and can take away assets.

This shows Romania’s serious effort to fight financial crimes and boost anti-corruption.

Illicit Economic Activities Definition

The law now defines illicit economic activity more broadly. It includes unregistered businesses and goods without proper documents.

This lets authorities go after more illegal activities, helping to seize assets from organized crime in Romania.

Penalty Structure

The penalties for breaking the law are tough. Companies can get fined up to RON 30,000.

Also, goods and money from crimes can be taken away.

This strict rule aims to stop illegal actions and make recovering assets more effective.

| Offense | Penalty |

|---|

| Unregistered business operation | Fine up to RON 30,000 |

| Goods without origin documents | Confiscation of goods |

| Money from illicit activities | Confiscation of funds |

These updates show Romania’s dedication to fighting financial crimes like the EU.

By making its laws stronger, Romania hopes to get better at recovering assets.

This will help the EU fight organized crime more effectively.

Asset Management and Disposition

Romania has a system for managing and selling seized property.

The National Agency for the Management of Seized Assets (ANABI) is key in this process.

ANABI takes care of the seized assets, from keeping them safe to selling them.

The Criminal Procedure Code in Romania outlines how to handle seized assets.

It allows for selling some assets before they are officially taken.

This helps keep the value high and saves on storage costs.

Seizing property in Romania is a detailed process.

ANABI makes sure the assets stay valuable during legal battles.

They store them well and might even rent them out to make money.

Romania’s asset management meets EU standards.

A 2014 EU report showed different ways to manage assets.

Romania has adopted many of these ideas, making its asset handling better.

The Law no. 129/2019, which started on July 21st, 2019, made Romania’s asset recovery stronger.

It created a system to fight money laundering and terrorism financing.

This law brings together different groups to handle assets linked to crimes.

Rights and Protections of Property Owners

Romania’s laws on confiscation balance state needs with property rights.

Both civil and criminal asset forfeiture systems protect property owners.

Due Process Rights

You have key due process rights in Romania’s confiscation laws.

These include:

- Right to be informed of confiscation proceedings;

- Opportunity to present evidence and arguments;

- 24-hour period to show documentation before seizure;

- Right to legal representation.

Appeal Mechanisms

If your assets are seized, you can appeal.

The appeal process varies for criminal and civil cases:

| Type | Appeal Timeline | Reviewing Authority |

|---|

| Criminal Confiscation | 10 days from court ruling | Higher Court |

| Civil Asset Forfeiture | 15 days from decision | Civil Court |

Property Return Procedures

If your property was wrongly taken, Romania has ways to return it or offer compensation.

You must claim within 3 years of the confiscation order.

The National Agency for Seized Assets handles the return process.

Knowing your rights helps safeguard your assets.

If you’re facing confiscation in Romania, seek legal advice.

Conclusion

Romania has made big changes in its laws to fight money laundering and crime.

The country now uses criminal, civil, and administrative steps to tackle organized crime.

These laws aim to make it easier to take back stolen assets and increase transparency in finances.

Recently, Romania’s E-transport System has grown to cover all goods moved internationally.

This change, starting in January 2024, removes old limits on mass and value.

Now, operators must give detailed info about their shipments at least three days before.

This move is part of Romania’s push to improve asset recovery and fight fraud.

Breaking smuggling laws in Romania comes with serious penalties.

Fines and jail time are possible, with the exact punishment depending on the case.

The Romanian government is serious about enforcing these laws.

This is shown by recent court cases against tobacco smuggling.

These steps show Romania’s effort to meet EU standards and strengthen its anti-money laundering laws.

FAQ

What is confiscation under Romanian law?

In Romania, confiscation is a legal action taken when someone commits a crime.

It’s aimed at stopping dangerous situations and preventing future crimes.

It involves taking away someone’s assets to benefit society.

This action is permanent and cannot be undone.

It also doesn’t have a time limit.

What are the types of confiscation in Romania?

Romania has two main types of confiscation.

Special confiscation targets items directly linked to crimes.

Extended confiscation allows for the seizure of more assets.

Which institutions are involved in asset confiscation in Romania?

In Romania, several institutions play a role in confiscating assets.

The Ministry of Justice, the National Agency for the Management of Seized Assets (ANABI), and the Prosecution Office are key.

The Ministry handles international cooperation, ANABI manages seized assets, and the Prosecution Office is involved in investigations and prosecutions.

What are the special confiscation procedures in Romania?

Romania has special procedures for confiscation.

These include criminal asset forfeiture, extended confiscation, and civil asset forfeiture.

Criminal asset forfeiture targets items linked to crimes.

Extended confiscation seizes more assets.

Civil asset forfeiture applies to unjustified wealth of public officials over 10,000 Euros.

How does asset tracing and seizure work in Romania?

Asset tracing and seizure in Romania involve several agencies.

The National Office for the Prevention and Control of Money Laundering (NOPCML) helps trace assets.

Seizure can happen during investigations by prosecutors or in court by judges.

The goal is to quickly remove dangerous items from circulation.

What are the documentation requirements for goods in Romania?

Goods in Romania need proper documentation.

This includes origin documents like invoices and customs papers.

The Tax Reform Law has made these requirements stricter.

Without the right documents, goods can be confiscated.

How does Romania engage in international cooperation for asset recovery?

Romania works with other countries to recover assets.

It uses mutual legal assistance and cross-border cooperation.

The Ministry of Justice is the main point of contact for these efforts.

It also joins EU networks like the European Judicial Network (EJN) and Eurojust for cooperation.

What changes did the Tax Reform Law introduce regarding confiscation?

The Tax Reform Law (Law no. 296/2023) brought new rules for confiscation.

It includes harsh fines and confiscation for illegal economic activities.

It covers unregistered businesses and goods without origin documents.

Penalties can be up to RON 30,000 for companies and confiscation of goods and money from crimes.

Who manages seized assets in Romania?

The National Agency for the Management of Seized Assets (ANABI) manages seized assets in Romania.

ANABI takes care of the assets, including their preservation, valuation, and disposal.

What rights do property owners have in confiscation proceedings?

Property owners have rights in confiscation cases.

They can appeal confiscation decisions.

The law allows for appeals in both criminal and civil cases.

If confiscation was wrong, there are ways to get property back or compensation.

The Tax Reform Law also gives a 24-hour window to present documents before confiscation.

What is confiscation under Romanian law?

Confiscation under Romanian law refers to the legal process by which the state seizes and takes ownership of assets or goods that are connected to criminal activities.

This measure is part of the Romanian Criminal Law and is designed to deprive offenders of the proceeds of their crimes.

The Romanian Criminal Code provides for two main types of confiscation: special confiscation and extended confiscation.

What is the difference between special confiscation and extended confiscation in Romania?

Special confiscation applies to specific goods directly linked to a crime, such as instruments used to commit the offence or direct proceeds.

Extended confiscation, introduced to align with EU legislation, allows for the seizure of assets that are not directly linked to the specific crime for which a person is convicted, but are believed to be derived from other criminal activities.

This measure is applicable in cases of serious offences and aims to more effectively fight against corruption and organized crime.

When can extended confiscation be applied in Romania?

Extended confiscation can be applied when a person is convicted of certain serious offences listed in the Romanian Criminal Code, such as corruption, organized crime, or human trafficking.

The court must be convinced that the value of the assets exceeds the lawfully obtained income of the convicted person over a period of up to five years prior to the crime.