Debt Collection in Romania: Recovering Unpaid Debts

Debt Collection in Romania: Recovering Unpaid Debts

Navigating the intricacies of debt collection in Romania requires a comprehensive understanding of the local legal framework and the specific nuances of Romanian law. This article serves as a guide to help creditors understand the debt collection process, explore available options for debt recovery, and ultimately recover their unpaid invoices.

Understanding Debt Collection in Romania

Successfully navigating the debt collection process in Romania demands a clear understanding of both local and international regulations. As an expert legal services provider, we can assist you in understanding the full scope of the legal action you can take. Our goal is to provide the best legal solutions, ensuring effective strategies for debt recovery in Romania. Learn more about creditors’ rights and legal protections in Romania.

What is Debt Collection?

Debt collection is the process of pursuing debtors to pay outstanding debts owed to creditors. This can involve various methods, from sending reminders for unpaid invoices to initiating legal proceedings. The aim of debt collection in Romania is to recover receivables in a timely and cost-effective manner, while adhering to the Civil Procedure Code and other applicable laws. For detailed guidance on the complete debt collection process, visit our comprehensive guide to debt collection in Romania.

The Landscape of Debt in Romania

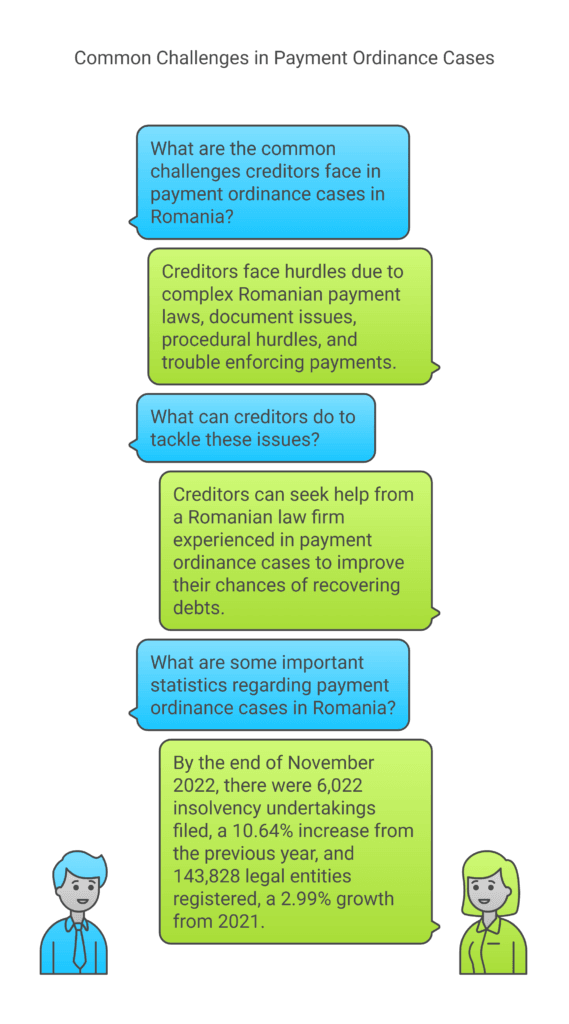

The economic landscape of Romania, like many other nations, faces challenges related to unpaid debts. Understanding the current trends and statistics related to non-payment and insolvency is crucial for both creditors and debtors in Romania. Factors such as economic downturns, business relationship strains, and inefficient payment systems contribute to the prevalence of unpaid invoices in Romania.

Types of Debts: Commercial vs. Personal

In Romania, debts can be broadly categorized into the following types:

- Commercial debts, which typically arise from unpaid invoices between businesses.

- Personal debts, which often involve loans, credit card balances, or other financial obligations of an individual.

The type of debt influences the debt collection process and the available legal action options, requiring tailored strategies from a debt recovery lawyer.

Legal Framework for Debt Recovery

Key Legislation Governing Debt Collection

The debt collection process in Romania is governed by a comprehensive set of laws and regulations designed to protect both creditors and debtors. Key legislation includes the Civil Procedure Code, which outlines the procedures for legal action, including filing a payment order. Understanding these laws is essential for effective debt recovery in Romania and for ensuring compliance throughout the debt collection process. Knowledge of the Romanian Law will help you recover your unpaid invoices. For detailed information on how to bring a case to court in Romania, refer to the European e-Justice Portal.

Role of Debt Recovery Lawyers

A debt recovery lawyer plays a crucial role in navigating the complexities of debt collection in Romania.

Atrium Romanian Law Office is an expert legal services provider based in Romania, specifically in Bucharest. Atrium aims to be the best in handling complex and challenging legal matters. The firm’s team of experienced Romanian lawyers and professionals are equipped to resolve any legal issue in a timely manner. They offer guidance through processes related to commercial transactions, dispute resolution, compliance, and even personal issues. The team are members of the Romanian Bucharest Bar.

These legal professionals provide expert guidance on legal proceedings, represent creditors in Romanian courts, and develop tailored strategies for debt recovery. At Atrium Romanian Law Office, experienced lawyers understand the nuances of Romanian law. This ensures that all legal action taken is both effective and compliant with the Civil Procedure Code, maximizing the chances of recovering outstanding debt.

Understanding the Statute of Limitations

The statute of limitations sets a time limit within which a creditor must initiate legal action to recover an outstanding debt. In Romania, understanding the limitation period for different types of debts is crucial for debt recovery. Once the limitation period expires, the debt becomes unenforceable in Romanian courts. Therefore, it is vital for creditors to act promptly and seek legal advice from a debt recovery lawyer to recover their unpaid invoices before the statute of limitations runs out. For more information on civil procedure requirements, consult the European e-Justice Portal on Romanian Civil Procedure.

Steps to Recover Unpaid Debts

The debt collection process in Romania involves several key steps designed to maximize your chances of successful recovery. Whether through amicable settlement or legal proceedings, understanding each phase is critical. For more details on the complete process, read our article on simplified cross-border debt collection in Romania.

Identifying Outstanding Amounts

The first step in the debt collection process in Romania is to accurately identify and document all outstanding debts. This involves reviewing unpaid invoices, contracts, and any other relevant documentation to determine the total amount owed by the debtor in Romania. Precise record-keeping is essential for initiating legal proceedings and demonstrating the validity of the claim in Romania to the competent court. Expert legal services providers can help you organize and verify your financial records.

Initiating Collection Procedures

Once the outstanding debt is identified, the next step involves initiating formal debt collection procedures. This typically begins with sending a formal demand letter to the debtor in Romania, outlining the unpaid invoices and requesting immediate payment. This initial communication aims to resolve the issue amicably, potentially avoiding costly legal action. If the debtor fails to respond or make payment, further steps such as involving a debt collection agency or a debt recovery lawyer may be necessary to recover their unpaid invoices. Our debt collection lawyer services can handle this entire process for you.

Filing a Payment Order

If amicable attempts to recover unpaid invoices fail, filing a payment order (Ordin de Plata) is a common legal action in Romania. A payment order is a simplified procedure for debt recovery that allows creditors to obtain a court order requiring the debtor in Romania to pay the outstanding debt. This process is particularly effective for straightforward cases where the debt is undisputed. It streamlines the debt collection process through the Romanian courts, offering a faster and more cost-effective route to debt recovery.

Handling Unpaid Invoices in Romania

Best Practices for Invoice Management

Effective invoice management is crucial for preventing unpaid invoices and ensuring smooth debt recovery in Romania. Creditors should implement clear and concise invoicing procedures, including detailed payment terms and due dates. Regular monitoring of outstanding debts and prompt follow-up on overdue invoices can help minimize the risk of non-payment. Maintaining a strong business relationship with debtors through open communication can also facilitate timely payments and prevent disputes.

Strategies for Unpaid Invoices

Creditors in Romania have several options for recovering unpaid invoices. Initially, they can try some direct approaches:

- Sending reminder notices

- Making phone calls

- Offering payment plans

These steps can encourage debtors in Romania to settle their outstanding debt. If these amicable efforts are unsuccessful, engaging a debt collection agency or seeking assistance from a debt recovery lawyer may be necessary to initiate more formal legal action. Expert law firms ensure that all strategies comply with Romanian law.

Using Interim Measures in Debt Recovery

In certain cases, interim measures can be used during the debt collection process in Romania to protect the creditor’s interests. These measures may include freezing the debtor’s assets or obtaining a court order to prevent the transfer of funds. Such actions can provide leverage and increase the likelihood of debt recovery. It is essential to seek legal advice from a debt recovery lawyer before pursuing interim measures to ensure compliance with the Civil Procedure Code. The Romanian Courts oversee such measures. For more details on enforcement procedures, consult the e-Justice Portal on online case processing in Romania.

International Debt Collection in Romania

Challenges in International Debt Recovery

International debt collection in Romania presents unique challenges compared to domestic debt recovery. One significant hurdle is the lack of familiarity with Romanian law and procedures. Consider these common challenges for international business owners:

- Lack of familiarity with Romanian laws

- Potential language barriers

- The complexity of setting up or managing a business in a foreign country

Language barriers, cultural differences, and logistical complexities can also impede the debt collection process. Engaging a law firm with experience in international debt collection is crucial for navigating these challenges and maximizing the chances of recovering outstanding debt from a Romanian debtor.

Legal Considerations for International Creditors

International creditors seeking debt recovery in Romania must carefully consider the applicable legal action. This includes understanding the relevant international treaties and agreements, as well as the specific requirements of Romanian law. For comprehensive guidance on international civil proceedings, refer to Book VII of Romania’s Code of Civil Procedure on International Civil Proceedings.

Atrium Romanian Law Office provides comprehensive legal services in multiple languages, including English, French, and German. The firm offers expertise in various practice areas, including Business law, Data Protection Compliance, and Tax Law, helping international business owners navigate the legal complexities of operating in Romania. Ensuring compliance with the Civil Procedure Code and the statute of limitations is essential for a successful debt collection process.

Resources for International Debt Collection

Several resources are available to assist international creditors with debt recovery in Romania. These include debt collection agencies specializing in international debt collection, law firms with expertise in Romanian law, and government agencies that provide support to foreign businesses. Leveraging these resources can streamline the debt collection process and improve the likelihood of recovering unpaid invoices. Expert legal services providers offer tailored solutions for international debt collection in Romania, ensuring compliance with all relevant regulations.

Conclusion: Effective Strategies for Debt Recovery

Key Takeaways for Creditors

For creditors seeking debt recovery in Romania, several key takeaways can enhance their success. To increase your chances of recovering unpaid debts, it’s crucial to:

- Maintain thorough documentation of all transactions and unpaid invoices.

- Act promptly and be aware of the statute of limitations.

- Understand the Romanian legal framework governing debt collection.

Lastly, consider engaging a law firm with expertise in debt recovery in Romania to navigate the complexities of the legal proceedings and recover unpaid invoices.

Resources and Support for Debt Recovery

Various resources and support systems are available for debt recovery in Romania. Debt collection agencies can assist with the initial stages of debt collection, while debt recovery lawyers provide expert legal action. Government agencies and trade organizations also offer guidance on debt collection processes and insolvency procedures. Leveraging these resources can streamline the debt collection process, helping creditors recover their unpaid invoices effectively.

When to Seek Legal Action

Seeking legal action is advisable when amicable attempts to recover unpaid invoices have failed. If the debtor in Romania is unresponsive or unwilling to pay, initiating legal proceedings becomes necessary. Engaging a debt recovery lawyer ensures that all legal action is taken in compliance with the Civil Procedure Code and Romanian Law. This proactive approach increases the likelihood of debt recovery and protects the creditor’s financial interests against non-payment.

Additional Resources for Debt Collection in Romania

To support your debt recovery efforts, here are authoritative resources, references, and additional information from our blog:

- Debt Collection in Romania: How to Protect Your Interests and Rights as a Creditor – Comprehensive guide on extrajudicial and judicial debt collection procedures, including reminders, demand letters, and court proceedings.

- Creditors Rights in Romania: Legal Protections – Detailed information on creditor rights, insolvency proceedings, enforcement methods, and European debt collection procedures.

- Simplified Cross-Border Debt Collection in Romania – Expert guidance on international debt recovery, EU small claims procedures, and cross-border enforcement strategies.

- Professional Debt Collection Lawyer Services – Information about our debt collection services, case review process, and how we assist clients in recovering outstanding invoices.

- European e-Justice Portal – How to Bring a Case to Court in Romania – Comprehensive information on Romanian civil procedure, court jurisdiction, and filing requirements.

- Romanian Courts Portal – Official portal for accessing court information and case details in Romania.

- Bucharest Bar Association – Official bar association providing access to qualified legal professionals in Bucharest.

- e-Justice Portal – Online Case Processing in Romania – Information on electronic filing, case management, and court communications.