Criminal Defense Attorney for Drug Charges in Romania

When faced with serious accusations for criminal defense drug charges Romania , do you know what steps to take to protect your rights?

Many people underestimate the complexity of legal systems, especially when dealing with high-stakes cases.

Acting quickly and decisively can make all the difference in the outcome.

Understanding your rights is crucial.

You deserve expert guidance to navigate the criminal legal process effectively.

Our team is dedicated to providing the support you need to safeguard your freedom and ensure fair treatment.

If you find yourself in a challenging situation, don’t wait.

Immediate legal advice is essential.

Call us at (004) 0765366887 for a consultation.

We’re here to help you understand the law and take the right steps forward.

Key Takeaways

- Act quickly to protect your rights in serious legal situations.

- Expert guidance is essential for navigating complex legal processes.

- Understanding the law can significantly impact your case’s outcome.

- Immediate legal advice ensures you take the right steps from the start.

- Our team of Romanian Lawyers is dedicated to safeguarding your freedom and rights.

Overview of Drug Laws in Romania

Romania’s drug laws are strict, and knowing their specifics can significantly impact your legal strategy.

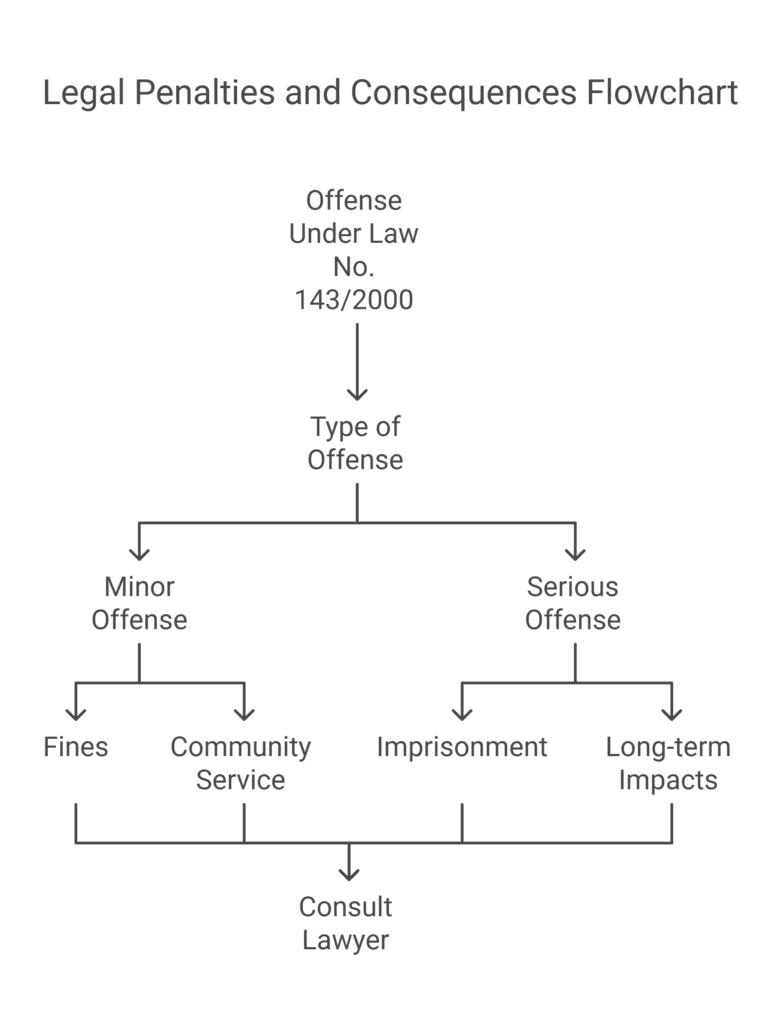

The primary legislation governing these offenses is Law No. 143/2000.

This law outlines the definitions, penalties, and procedures related to controlled substances.

Key Provisions of Law No. 143/2000

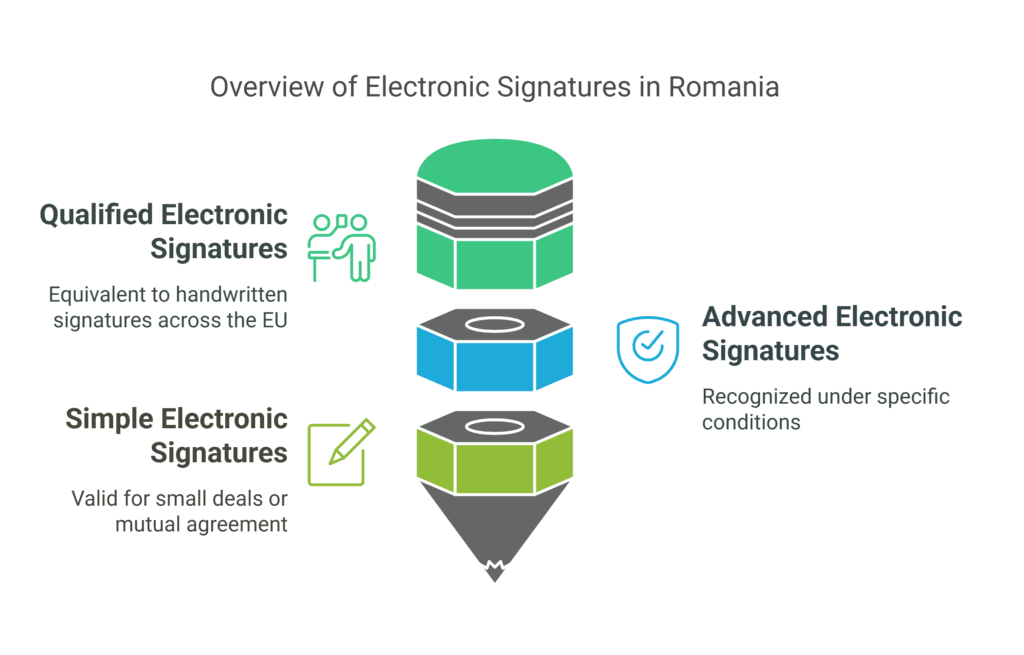

Law No. 143/2000 classifies controlled substances into three categories based on their potential for abuse and medical use.

The law defines illegal activities such as possession, trafficking, and production.

It also sets clear guidelines for law enforcement and judicial procedures.

- Definitions: The law specifies what constitutes a controlled substance, including cannabis, cocaine, and synthetic drugs.

- Scope: It covers both personal use and large-scale trafficking, with varying degrees of penalties.

- Enforcement: Law enforcement agencies are empowered to investigate and prosecute violations effectively.

Penalties and Consequences

Penalties under Law No. 143/2000 range from fines to imprisonment, depending on the severity of the offense.

For example, possession can lead to 6 months to 3 years in prison, while trafficking may result in sentences of 2 to 12 years.

These penalties are designed to deter illegal activities and protect public safety.

- Fines: Monetary penalties are imposed for minor offenses, often accompanied by community service.

- Imprisonment: Serious violations, such as trafficking, carry long-term prison sentences.

- Long-term Impacts: A conviction can affect employment, travel, and personal reputation.

Understanding these laws and their enforcement is crucial.

Local legal nuances can influence case outcomes, making it essential to work with a knowledgeable lawyer in Romania or Romanian Law firm.

Their expertise ensures you navigate the system effectively and protect your rights.

Understanding Drug Charges in Romania

Navigating the legal landscape of drug-related activities requires a clear understanding of the charges you may face.

The types of offenses vary widely, and each carries distinct legal consequences.

Knowing these differences is crucial for building a strong defense.

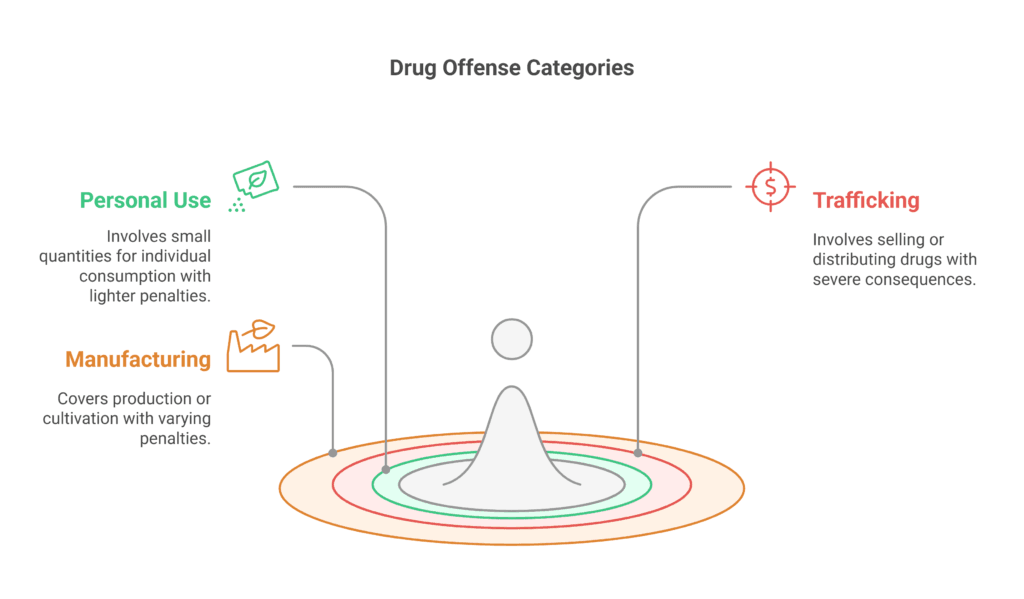

Drug offenses are categorized based on the nature of the activity.

Personal use, trafficking, and manufacturing are the most common charges.

Each category has specific legal implications and understanding them can help you prepare for your case.

Types of Drug Offenses

Personal use charges typically involve possession of small quantities for individual consumption.

Trafficking, on the other hand, involves the sale or distribution of controlled substances.

Manufacturing charges apply to the production or cultivation of illegal drugs.

- Personal Use: Often involves smaller quantities and may result in lighter penalties.

- Trafficking: Includes selling, delivering, or transporting illegal substances, leading to severe consequences.

- Manufacturing: Covers the production or cultivation of drugs, with penalties varying based on the substance and scale.

Prosecution trends in Romania show a focus on trafficking and large-scale operations.

Authorities prioritize these cases due to their impact on public safety.

Understanding these trends can help you anticipate the legal challenges you may face.

Each type of offense requires a tailored defense strategy.

Whether you’re dealing with personal use or trafficking charges, knowing the nuances of criminal law is essential.

This knowledge ensures you can navigate the system effectively and protect your rights.

When You Need a Criminal Defense Lawyer

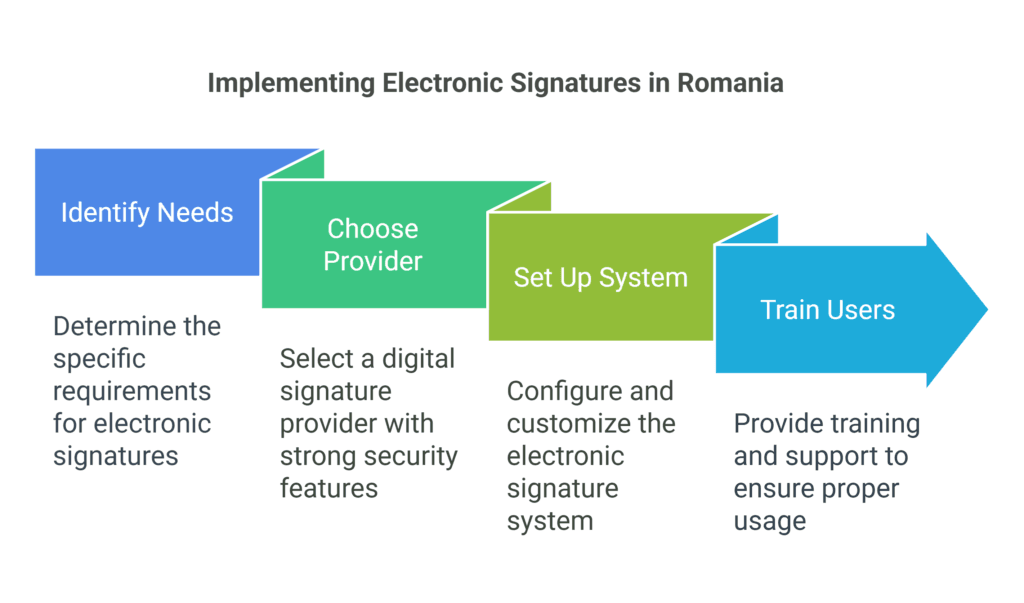

Legal challenges can arise unexpectedly and knowing when to seek professional help is critical.

Recognizing the signs that you need legal representation can save you from long-term consequences.

Early action ensures you’re prepared to face the complexities of the legal system.

Indicators You Should Seek Help

Certain situations clearly signal the need for legal intervention.

If you’re being questioned by law enforcement, it’s time to consult a professional.

Even minor accusations can escalate quickly without proper guidance.

- Questioning by Authorities: Being interviewed or detained is a clear sign to seek help.

- Formal Charges: Once charges are filed, immediate legal advice is essential.

- Complex Cases: If your case involves multiple parties or serious allegations, expert support is crucial.

Benefits of Early Legal Consultation

Consulting a Romanian lawyer early can significantly improve your case’s outcome.

They can help you understand your rights and build a strong defense strategy.

Delays in seeking help can complicate your situation and limit your options.

- Protecting Your Rights: Early intervention ensures your rights are safeguarded from the start.

- Strategic Planning: A lawyer can help you anticipate challenges and prepare accordingly.

- Local Expertise: Working with a professional familiar with Bucharest’s legal system can be a game-changer.

Don’t wait until it’s too late.

Seeking legal advice early can make all the difference in navigating the complexities of the legal system.

Protect your future by acting decisively and consulting a trusted professional.

Criminal defense attorney for drug charges Romania

Facing legal challenges related to controlled substances requires immediate and expert guidance.

A specialized Romanian law firm can make all the difference in navigating these complex situations.

Their experience ensures you’re prepared for the evolving legal landscape each year brings.

Every year, new legal trends and challenges emerge.

A trusted law firm stays updated on these changes, providing you with the most effective strategies.

Their deep understanding of current laws ensures your case is handled with precision and care.

Timely legal intervention is crucial. Recent trends in Romania highlight the importance of acting quickly.

A professional law firm can help you understand your options and protect your rights from the start.

Here’s why choosing the right law firm matters:

- They offer expert advice tailored to your unique situation.

- Their strategic planning ensures you’re prepared for every step of the process.

- Client success stories demonstrate their ability to deliver results.

Don’t face these challenges alone.

Partnering with a specialized Romanian law firm ensures you have the support and expertise needed to navigate the legal system effectively.

Act now to protect your future.

Local Legal Framework and Law no. 143/2000

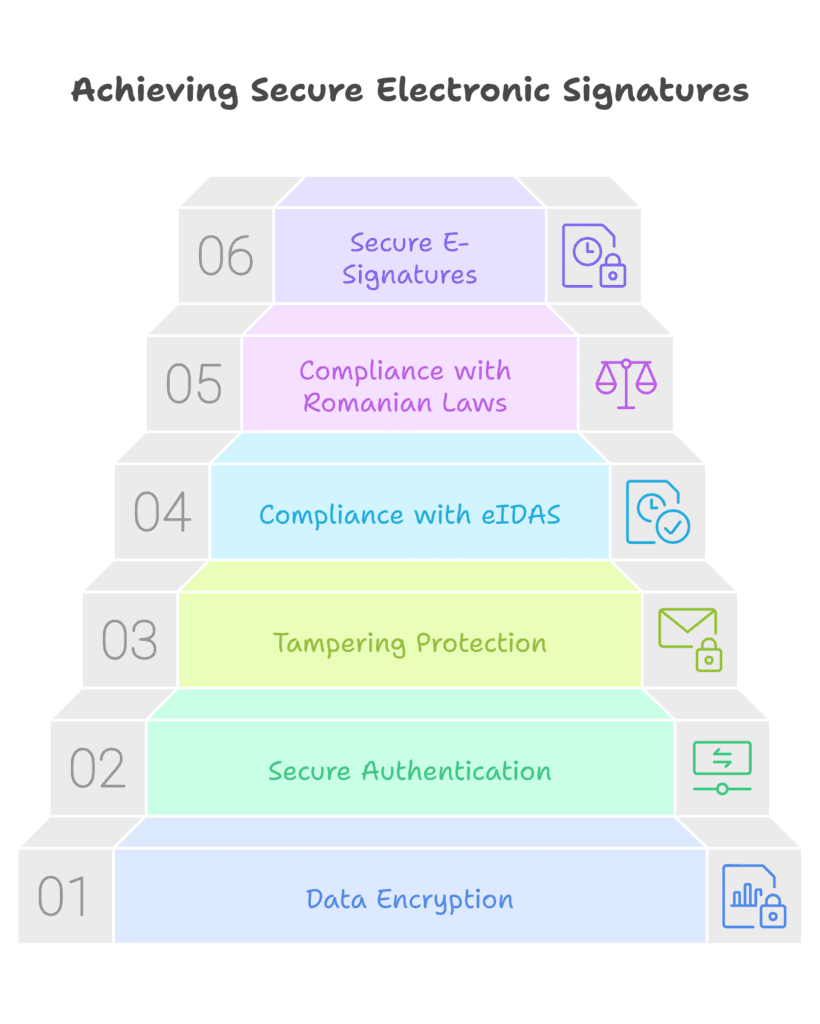

Understanding the local legal framework is essential for navigating drug-related cases.

Law No. 143/2000 serves as the cornerstone of Romania’s approach to controlled substances.

This legislation outlines the rules and penalties for various offenses, ensuring a structured legal process.

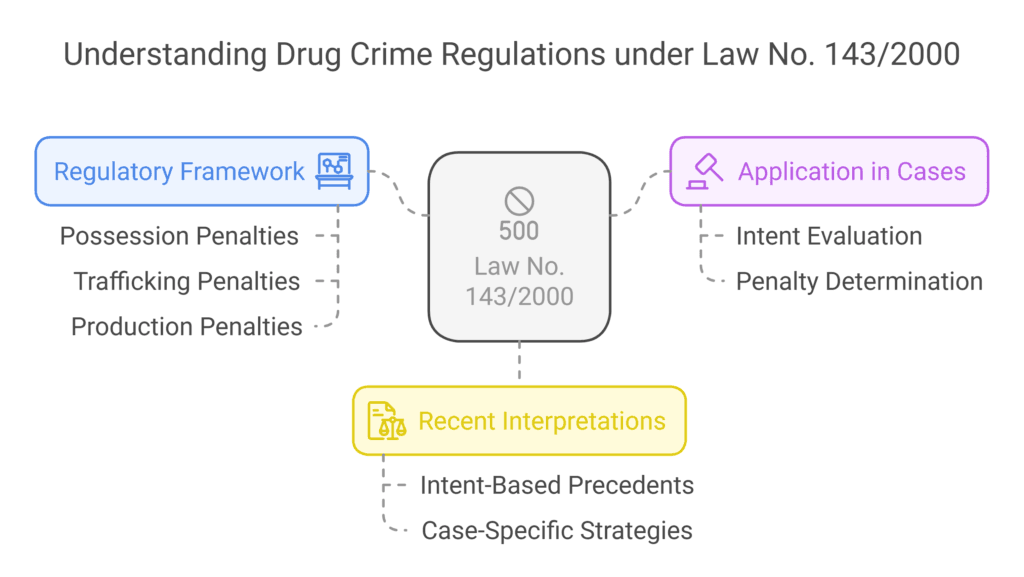

Regulations Specific to Drug Crimes

Law No. 143/2000 categorizes drug offenses based on severity and intent.

It distinguishes between personal use, trafficking, and production, each with specific legal consequences.

This framework ensures that penalties are proportional to the offense.

Recent cases have shaped how this law is applied.

For example, courts have emphasized the importance of intent in determining penalties.

This interpretation highlights the need for a tailored legal strategy in every case.

- Regulatory Framework: The law defines controlled substances and outlines penalties for possession, trafficking, and production.

- Application in Cases: Courts use this law to assess intent and determine appropriate penalties.

- Recent Interpretations: Legal precedents have influenced how the law is enforced, particularly in cases involving intent.

A lawyer’s experience is invaluable in navigating these complexities.

They can help you understand how the law applies to your situation and build a strong defense.

Without expert guidance, you risk facing severe consequences.

Failing to comply with regulatory measures can lead to significant penalties.

These include fines, imprisonment, and long-term impacts on your personal and professional life.

Acting quickly and seeking legal advice can help mitigate these risks.

How a Professional Defense Team Can Help You

Having a skilled legal team by your side can significantly improve your case’s outcome.

A professional defense team of lawyers in Bucharest, Romania ensures your rights are protected throughout the legal process.

They provide personalized strategies tailored to your unique situation, helping you navigate the complexities of the court system effectively.

Tailored Legal Strategies

Every case is different, and a professional team understands this.

They analyze the details of your situation to create a defense strategy that fits your needs.

This personalized approach ensures that every aspect of your case is addressed, from evidence review to witness preparation.

Strategic planning is a key component of their work.

They anticipate potential challenges and prepare accordingly, ensuring you’re ready for every step of the process.

This proactive approach can make a significant difference in the outcome of your case.

Representing You as an Individual

A professional team recognizes the importance of treating you as a person, not just a case.

They prioritize your rights and work tirelessly to ensure you’re treated fairly.

This individual focus helps build trust and ensures your voice is heard throughout the legal process.

Their expertise in handling complex cases is invaluable.

Specializing in drug-related litigation, they understand the nuances of the law and how to apply them effectively.

This specialization ensures you receive the best possible representation.

Collaboration and Efficiency

A cohesive team works together to cover every aspect of your defense.

Collaboration ensures that no detail is overlooked, and every angle is explored.

This teamwork enhances the efficiency of your defense, saving time and resources while maximizing results.

| Advantage | Benefit |

|---|

| Personalized Strategies | Tailored to your unique situation |

| Strategic Planning | Anticipates challenges and prepares accordingly |

| Individual Representation | Focuses on your rights and fair treatment |

| Specialized Expertise | Handles complex cases with precision |

| Team Collaboration | Ensures no detail is overlooked |

Partnering with a professional defense team ensures you have the support and expertise needed to navigate the legal system effectively.

Their dedication to your case can make all the difference in achieving a favorable outcome.

Strategies for Navigating Drug Charges Cases

Effective strategies can make a significant difference in handling legal challenges related to controlled substances.

Knowing how to build a strong defense and negotiate effectively ensures you’re prepared for every step of the process.

These strategies not only protect your rights but also improve the overall service you receive.

Building a Strong Defense

A strong defense starts with understanding the details of your case.

Gather all relevant evidence and ensure it’s presented clearly.

This includes witness statements, documentation, and any other materials that support your position.

Work closely with your legal team to identify weaknesses in the prosecution’s case.

Challenging evidence or questioning its validity can significantly impact the outcome.

A well-prepared defense ensures your rights are safeguarded throughout the process.

Negotiating Plea Deals

Negotiating a plea deal can be a strategic option in certain situations.

This involves working with prosecutors to reach an agreement that reduces penalties or charges.

It’s essential to understand the terms and ensure they align with your best interests.

Your legal team can guide you through the negotiation process, ensuring you receive fair treatment.

This approach often results in a more favorable outcome, saving time and resources while maintaining the quality of service you deserve.

- Gather Evidence: Collect all relevant materials to support your case.

- Challenge Weaknesses: Identify and address flaws in the prosecution’s arguments.

- Negotiate Fairly: Work with prosecutors to reach a beneficial agreement.

- Protect Your Rights: Ensure your legal rights are upheld at every stage.

- Strategic Planning: Tailor your approach to the specifics of your case for the best results.

Common Defenses in Drug Crime Cases

Understanding common defense strategies can be a game-changer in legal battles.

When facing accusations, knowing how to challenge evidence effectively can turn the tide in your favor.

A well-prepared approach ensures your rights are protected and strengthens your position.

Challenging Evidence and Testimonies

One of the most effective strategies is contesting the evidence presented against you.

This includes questioning the validity of forensic analysis or highlighting procedural errors.

For example, if evidence was obtained through an unlawful search, it can be excluded from the case.

Disputed testimonies can also be challenged.

Cross-examining witnesses to uncover inconsistencies or biases can weaken the prosecution’s argument.

In recent cases in Bucharest, such tactics have led to favorable outcomes for the accused.

- Forensic Evidence: Analyze the methods used to ensure accuracy and legality.

- Procedural Errors: Identify mistakes in how evidence was collected or handled.

- Witness Credibility: Scrutinize testimonies for inconsistencies or biases.

Another key aspect is leveraging expert witnesses.

Their insights can provide a deeper understanding of complex evidence, such as lab results or technical data.

This approach has been instrumental in several successful cases in Romania.

Finally, detailed case analysis is essential.

Reviewing every aspect of the case helps identify weaknesses in the prosecution’s argument.

This thorough approach ensures no detail is overlooked, strengthening your defense.

Steps to Take Immediately if Arrested

Being arrested can be overwhelming, but knowing the right steps can make a significant difference.

Acting quickly and strategically ensures your rights are protected and sets the foundation for a strong case.

Here’s what you need to do:

Securing Legal Representation

The first step is to contact a qualified team of professionals.

Legal representation is essential to navigate the complexities of the system.

A skilled team can guide you through the process, ensuring your rights are upheld.

In Bucharest and surrounding areas, specialized legal professionals are available to assist.

They understand local laws and can provide tailored advice.

Immediate consultation ensures you’re prepared for every step of the legal process.

Communicating with Law Enforcement

When dealing with authorities, remain calm and assertive.

You have the right to remain silent and request a lawyer.

Avoid making statements without legal counsel present.

This protects you from potential misunderstandings or misrepresentations.

If detained, ensure you’re aware of your rights.

For example, detention periods cannot exceed 72 hours for adults.

A lawyer must be appointed within one hour of arrest.

Knowing these details helps you stay informed and prepared.

Long-Term Benefits of Early Action

Taking immediate action safeguards your future.

Early legal intervention can lead to better outcomes, such as reduced penalties or dismissed charges.

It also ensures you’re treated fairly throughout the process.

- Contact a Lawyer: Secure professional help without delay.

- Know Your Rights: Stay informed about legal protections.

- Communicate Wisely: Avoid statements without legal advice.

- Act Quickly: Early intervention improves case outcomes.

- Local Expertise: Work with professionals familiar with your area.

By following these steps, you can protect your rights and build a strong defense.

Immediate action ensures you’re prepared for the challenges ahead.

Importance of Evidence and Case Preparation

The foundation of a strong legal strategy lies in meticulous evidence gathering and case preparation.

Thorough preparation ensures your defense is robust and well-supported.

It also helps your legal team build a compelling narrative that can influence the outcome of your case.

Collecting evidence is a pivotal step in your defense.

This includes gathering documents, witness statements, and any other materials that support your position.

Organized documentation allows your team to present a clear and coherent case, increasing your chances of success.

Your cooperation as a client is essential.

Providing accurate information and timely responses helps your legal team work efficiently.

This collaboration ensures no detail is overlooked, strengthening your defense strategy.

Well-prepared cases often lead to more successful negotiations.

When your team has all the necessary information, they can present a strong argument, potentially reducing penalties or charges.

This approach also ensures you’re ready for courtroom presentations, where every detail matters.

| Step | Benefit |

|---|

| Evidence Collection | Builds a strong foundation for your defense |

| Organized Documentation | Ensures clarity and coherence in your case |

| Client Cooperation | Expedites the preparation process |

| Strategic Planning | Improves negotiation and courtroom outcomes |

In legal practice, preparation is key.

It not only safeguards your rights but also enhances the quality of representation you receive.

By focusing on these steps, you can navigate the legal system with confidence and achieve the best possible outcome.

Insights from Leading Criminal Law Practitioners

Gaining insights from top legal experts can transform your approach to complex cases.

The experience and knowledge of seasoned practitioners provide a solid foundation for building confidence in your legal representation.

Here, we share the expertise of two leading professionals in the field.

Experience from Mihaela Botezatu, Romanian Lawyer

Mihaela Botezatu, Head of the Criminal Law Department at our Romanian Law Office, brings decades of experience to the table.

Her expertise in handling intricate cases has earned him a reputation as a trusted advisor.

Mihaela deep understanding of the Romanian legal system ensures clients receive tailored strategies for their unique situations.

With a focus on complex litigation, Mihaela has successfully navigated high-stakes cases.

Her academic contributions and practical insights make him a sought-after professional in the field.

Clients benefit from his strategic planning and commitment to safeguarding their rights.

Expert Views from Mihaela Botezatu

Mihaela`s ability to analyze complex evidence and craft compelling arguments has led to numerous successful outcomes for her clients.

Here’s why their expertise matters:

- Decades of experience in handling high-stakes cases.

- Deep understanding of the Romanian legal system.

- Tailored strategies for unique client needs.

- Proven track record of successful outcomes.

- Commitment to safeguarding client rights and interests.

Partnering with a reputable law office ensures you have access to top-tier professionals like ours.

Legal Representation in Bucharest and Beyond

Navigating the legal system in Bucharest requires a deep understanding of local procedures and expertise.

Whether you’re dealing with personal matters or complex business disputes, having the right legal support is crucial.

Local representation ensures you’re prepared for every step of the process, from filing documents to courtroom appearances.

Bucharest’s legal environment is unique, with specific rules and practices that can influence your case.

Working with a local office provides you with insights into these nuances.

Their familiarity with the system helps streamline proceedings and reduces potential delays.

Navigating Local Courts and Procedures

Understanding local court procedures is essential for a smooth legal experience.

In Bucharest, cases often follow a structured timeline, and missing deadlines can have serious consequences.

A local office ensures you meet all requirements and present your case effectively.

Here’s what to expect during legal proceedings:

- Initial Filings: Proper documentation is submitted to initiate the case.

- Hearings: Scheduled appearances where arguments are presented.

- Judgments: Final decisions are made based on evidence and arguments.

Local expertise simplifies these steps, ensuring you’re well-prepared for each stage.

Their knowledge of local judges and procedures can also provide a strategic advantage.

Benefits of Working with an Established Law Office

Partnering with a well-established office offers numerous advantages.

Their experience in handling diverse cases, from business disputes to personal matters, ensures you receive comprehensive support.

They bring a wealth of knowledge and resources to your case.

Here’s why local representation matters:

| Advantage | Benefit |

|---|

| Local Expertise | Deep understanding of Bucharest’s legal system |

| Efficient Processes | Streamlined procedures to save time and resources |

| Strategic Insights | Knowledge of local judges and court practices |

| Comprehensive Support | Handles all aspects of your case with precision |

Leveraging local connections ensures swift resolutions and expert guidance.

Whether you’re in Bucharest or beyond, having a trusted Romanian Law Firm by your side makes all the difference.

Alternative Programs and Plea Negotiations

Exploring alternative sentencing options can provide a path to reduced penalties and a fresh start.

In certain cases, programs like community service or rehabilitation may be available as alternatives to imprisonment.

These options not only help you avoid jail time but also offer opportunities for personal growth and reintegration into society.

Community Service and Rehabilitation Options

Community service and rehabilitation programs are designed to address the root causes of legal issues.

These programs focus on education, skill-building, and personal development.

By participating, you demonstrate a commitment to positive change, which can influence the outcome of your case.

In some instances, courts may consider these programs as part of a plea agreement.

This approach benefits both the individual and the community, offering a constructive resolution to legal challenges.

Negotiating Lesser Charges

Negotiating with prosecutors can lead to reduced charges or penalties.

A skilled attorney can advocate on your behalf, presenting evidence and arguments to support a favorable outcome.

This process often involves discussing alternative sentencing options, such as community service or rehabilitation.

Successful negotiations require a thorough understanding of the legal field and strong communication skills.

Your legal team will work to ensure your rights are protected while striving for the best possible resolution.

- Alternative Programs: Explore options like community service or rehabilitation to avoid imprisonment.

- Negotiation Tactics: Work with an experienced attorney to secure reduced charges or penalties.

- Personal Commitment: Demonstrate a willingness to change through participation in these programs.

- Legal Expertise: Rely on professionals familiar with the legal field to guide you through the process.

By understanding these alternatives and working with a skilled attorney, you can navigate the legal system more effectively.

These options not only reduce penalties but also provide a chance for a brighter future.

Understanding the Court Process in Drug-related Cases

Navigating the court system can feel overwhelming, but understanding the process can ease your journey.

When facing legal challenges, knowing what to expect at each stage is crucial.

This guide will walk you through the steps, from initial hearings to trial proceedings, ensuring you’re prepared for every matter.

Walkthrough of Court Procedures

The court process begins with the initial hearing, where charges are formally presented.

During this stage, your legal partner will review the evidence and advise you on the best course of action.

This is a critical step, as it sets the tone for the rest of the proceedings.

Next, pre-trial motions may be filed to address any procedural issues or evidence disputes.

Your lawyer in Romania will ensure your rights are protected and challenge any inadmissible evidence.

This phase can significantly influence the case’s outcome.

The trial itself involves presenting evidence, cross-examining witnesses, and making legal arguments.

Having a skilled legal partner by your side ensures every detail is addressed, from witness preparation to courtroom strategy.

Their expertise can make a substantial difference in the final verdict.

Impact of Procedural Steps

Each step in the court process can have a profound impact on your case.

For example, a successful pre-trial motion can weaken the prosecution’s argument, while a well-prepared defense can sway the judge or jury.

Understanding these nuances is essential for a favorable outcome.

Here’s what to focus on:

- Initial Hearings: Ensure charges are accurate and evidence is properly reviewed.

- Pre-Trial Motions: Address procedural issues and challenge inadmissible evidence.

- Trial Preparation: Work closely with your legal team to build a strong defense.

- Courtroom Strategy: Present your case effectively to influence the verdict.

By staying informed and working with a trusted Romanian Law Office, you can navigate the court system with confidence.

Preparation and understanding are key to managing every matter efficiently and achieving the best possible outcome.

Experience and Expertise of Our Criminal Defense Team

Our legal team’s proven track record ensures you’re in capable hands when it matters most.

With decades of combined experience, we’ve successfully handled a wide range of cases, from minor disputes to complex legal challenges.

Our dedication to achieving justice sets us apart, providing you with the confidence and support you need.

Spotlight on Our Top Professionals

Our team includes highly skilled professionals with specialized expertise in various areas of law.

Recognized by top publications and legal organizations, our attorneys bring a wealth of knowledge to every case.

Their commitment to excellence ensures you receive the best possible representation.

We pride ourselves on our ability to adapt to the unique needs of each client.

Whether it’s a straightforward matter or a complex case, our team is equipped to handle it with precision and care.

This adaptability is key to our success in achieving favorable outcomes.

Case Studies and Success Stories

Our portfolio includes numerous success stories that highlight our ability to deliver results.

For example, we’ve successfully defended clients in high-stakes cases, securing reduced penalties and even dismissals.

These outcomes reflect our team’s dedication and strategic approach.

One notable case involved a client facing serious allegations.

Through meticulous preparation and a tailored defense strategy, we achieved a positive resolution.

This case underscores our commitment to justice and our ability to navigate even the most challenging situations.

Here’s what sets our team apart:

- Extensive Experience: Decades of combined knowledge in handling a wide range of cases.

- Proven Results: A track record of successful outcomes in complex legal matters.

- Team Collaboration: A cohesive team that works together to ensure every detail is addressed.

- Personalized Solutions: Tailored strategies that meet the unique needs of each client.

When you choose our team, you’re choosing a group of professionals dedicated to your success.

We combine expertise, teamwork, and a commitment to justice to provide you with the best possible legal representation.

Conclusion

Taking the right steps now can shape the outcome of your legal situation.

Understanding the level of complexity in these cases is crucial.

Immediate action ensures your rights are protected and strengthens your position.

Navigating legal challenges requires expert guidance.

A skilled team of Romanian Lawyers can help you address the issue effectively, providing tailored strategies for your unique case.

Their experience ensures you’re prepared for every step of the process.

Don’t wait to seek professional help.

Delays can complicate your situation and limit your options.

Call us at (004) 0765366887 for a consultation or write us an e-mail at office@theromanianlawyers.com.

Our team is ready to assist you in resolving your issue with confidence and care.

Act now to secure the support you need.

Quality legal representation can make all the difference in achieving a favorable outcome.

Let us help you navigate this challenging time with expertise and dedication.

FAQ

What are the key provisions of Law No. 143/2000 in Romania?

Law No. 143/2000 outlines the legal framework for drug-related offenses in Romania.

It defines illegal substances, possession limits, and trafficking regulations.

The law also specifies penalties based on the severity of the crime.

What types of drug offenses are recognized in Romania?

Romania categorizes drug offenses into possession, trafficking, and production.

Each type carries distinct penalties, depending on factors like quantity, intent, and prior convictions.

When should you seek legal help for drug charges?

You should consult a lawyer immediately if you’re arrested or charged.

Early legal advice can help protect your rights, build a strong case, and explore potential defenses.

How can a professional legal team assist you in drug-related cases?

A skilled team can craft tailored strategies, challenge evidence, and negotiate plea deals.

They ensure your case is handled effectively, from investigation to court proceedings.

What are common defenses in drug crime cases?

Common defenses include challenging the legality of searches, disputing evidence authenticity, and proving lack of intent.

Your lawyer in Romania will identify the best approach based on your case details.

What steps should you take if arrested for a drug offense?

Remain calm, exercise your right to remain silent, and request legal representation immediately.

Avoid discussing the case until your Romanian lawyer is present to guide you.

How important is evidence in drug-related cases?

Evidence is critical in determining the outcome of your case.

Proper collection, analysis, and presentation can strengthen your defense or challenge the prosecution’s claims.

What are the benefits of plea negotiations in drug cases?

Plea negotiations can lead to reduced charges, lighter sentences, or alternative programs like community service.

Your lawyer in Bucharest can negotiate terms that minimize the impact on your life.

What should you expect during the court process for drug charges?

The process includes arraignment, pre-trial motions, trial, and sentencing.

Understanding each stage helps you prepare and work effectively with your legal team.

How does local expertise in Bucharest benefit your case?

Lawyers familiar with Bucharest courts and procedures can navigate the system efficiently.

Their local knowledge ensures your case is handled with precision and insight.