Romanian laws on Electronic Signatures 2025

Romanian laws on electronic signatures 2025

Are you thinking about using an electronic signature in Romania?

You might be wondering about the laws and how to follow them.

The use of digital signatures is growing, and knowing the rules is key for both people and businesses.

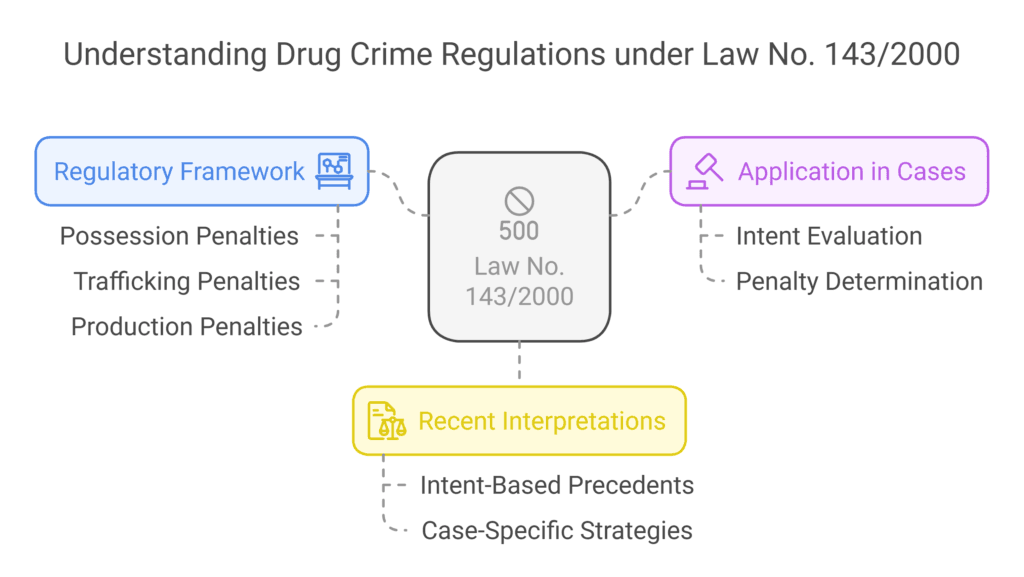

Romania follows the European Union’s eIDAS Regulation and its own laws, like Law no. 455/2001 and Government Emergency Ordinance no. 38/2020.

So, how do you use e-signature Romania wisely for your needs?

It’s important to understand the legal landscape.

Key Takeaways

- The legal framework for electronic signatures in Romania includes EU Regulation no. 910/2014 and national laws such as Law no. 455/2001 and Government Emergency Ordinance no. 38/2020.

- Qualified electronic signatures have the same legal value as handwritten signatures for legal acts requiring written form, such as individual employment contracts and tax returns, and can be obtained through electronic signature software Romania.

- Advanced electronic signatures are legally recognized in relationships with public authorities and institutions in Romania, and can be used in conjunction with digital signature Romania.

- The cost of obtaining an electronic signature certificate in Romania ranges from 5 Euro to 110 Euro, depending on the validity period, making it an accessible option for those looking to use e-signature Romania.

- Simple electronic signatures will have the same legal effects as handwritten signatures for transactions valued at less than half the gross minimum wage, approximately 1,500 RON, and can be used with electronic signature software Romania.

- Documents signed with a simple electronic signature will be legally valid if acknowledged by the other signer through fulfillment of obligations, such as delivery of products, and can be facilitated through digital signature Romania.

- The new Electronic Signature and Trust Services Law (No. 214/2024) aims to enhance the use of electronic signatures in business transactions, aligning Romania’s legal framework with EU standards, and promoting the use of e-signature Romania.

Understanding Electronic Signatures in Romania

Exploring electronic signatures in Romania is key.

It’s important to know the legal terms and types of signatures.

Romania’s laws now match the EU’s Digital Single Market rules.

This makes it easier to do business across borders.

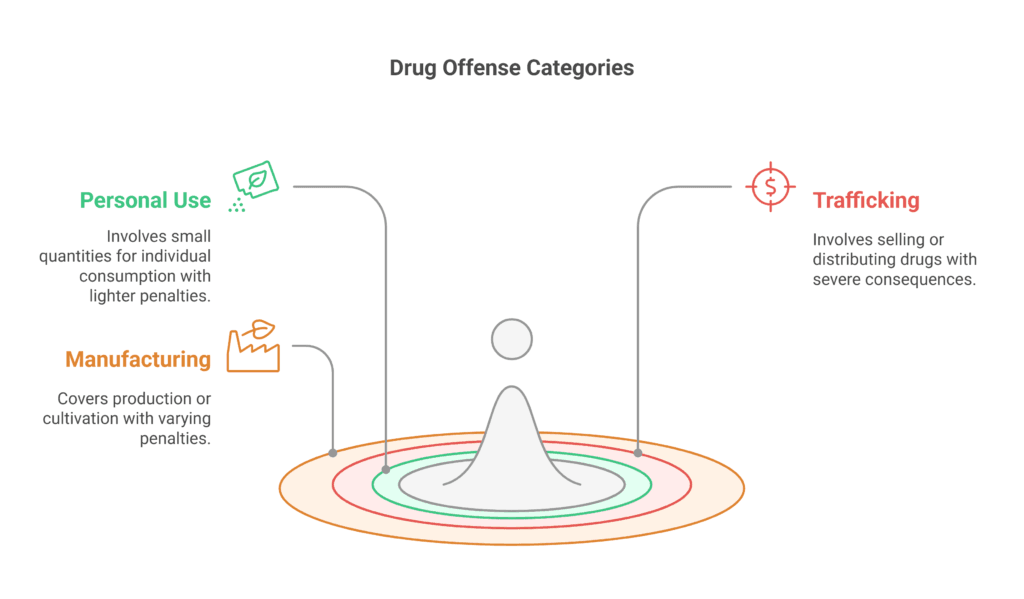

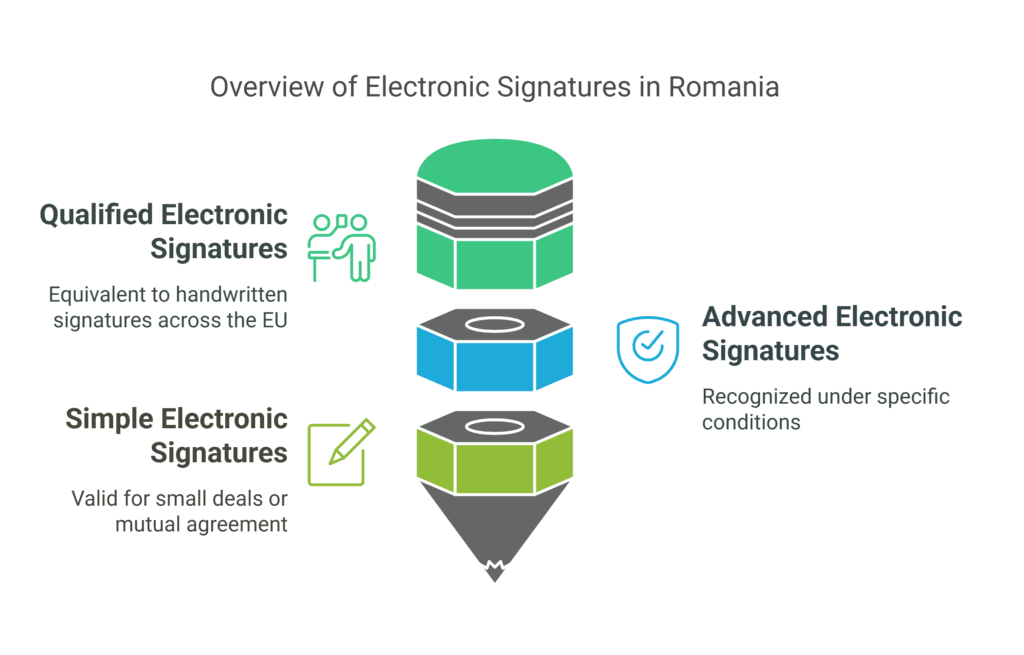

The country recognizes three main types of electronic signatures.

These are Simple, Advanced, and Qualified Electronic Signatures.

A qualified electronic signature is as good as a handwritten one in court.

Advanced electronic signatures are also recognized, but only under certain conditions.

Simple electronic signatures are allowed for smaller deals or when both parties agree.

Here are some important points about using electronic signatures in Romania:

- Qualified Electronic Signatures have the same legal value as a holographic signature across all EU Member States.

- Advanced Electronic Signatures can produce legal effects equivalent to a handwritten signature under certain conditions.

- Simple Electronic Signatures have probative value equivalent to a handwritten signature under specific conditions.

Knowing about the different electronic signatures and their legal standing is vital.

This ensures you use them correctly and follow Romanian law.

The laws aim to make administrative tasks easier, like accepting digital documents signed with a qualified electronic signature.

The Legal Validity of E-Signatures Under Romanian Law

When you think about using electronic signatures, knowing the law in Romania is key.

The eIDAS Regulation says electronic signatures are as good as handwritten ones.

In Romania, Law no. 214/2024 makes advanced electronic signatures as valid as handwritten ones under certain rules.

Understanding the law on e-signatures in Romania is very important.

For example, Law 208/2021 made it easier to use electronic signatures in work contracts.

It removed the need for a time stamp and electronic seal.

This change makes it simpler for companies to use digital signatures.

In Romania, electronic records can be used in court, thanks to the Civil Procedure Code.

The eIDAS regulation also plays a big role.

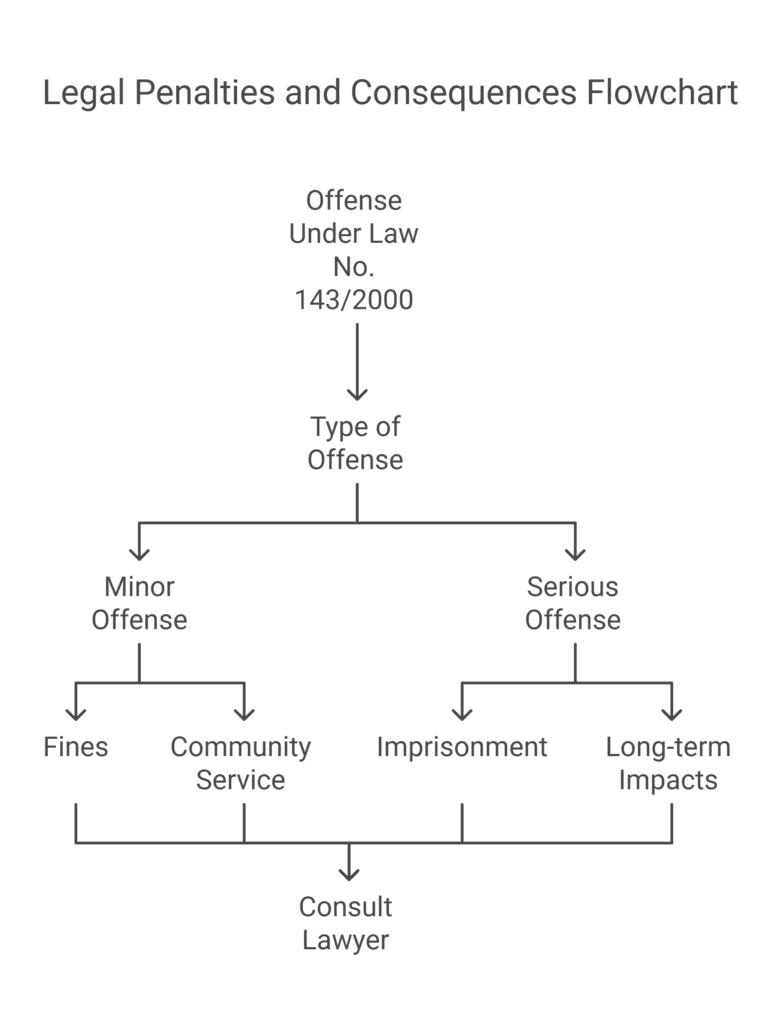

It talks about three types of electronic signatures: simple, advanced, and qualified.

Knowing when each is legally binding is key to making sure your digital documents are valid.

Here are some important points about e-signatures in Romania:

- Qualified electronic signatures are as good as handwritten ones.

- Advanced electronic signatures can be as valid as handwritten ones under certain conditions.

- Simple electronic signatures work for many documents, like business and consumer agreements.

In summary, the rules on electronic signatures in Romania are detailed and need careful thought.

By knowing the laws and regulations, you can make sure your digital documents are legally sound and can be used in court.

Technical Requirements for Implementation

When you start using electronic signatures in Romania, you need to think about the technical side.

This means picking the right electronic signature software Romania, making sure your hardware works, and getting the right certifications.

The process of setting up electronic signatures in Romania needs careful planning to fit your company’s needs.

First, you have to pick an e-signature solution Romania that fits your business.

You’ll look at different digital signature technologies Romania and think about security, how easy it is to use, and if it works with your current systems.

Also, your hardware must be compatible with the electronic signature software Romania you choose.

Important things to consider when setting up electronic signatures in Romania include:

- Certification needs for qualified electronic signatures

- What software you need for creating and checking signatures

- What hardware you need for safe signature making and keeping

By looking at these technical needs and picking the right electronic signature software Romania, you can make sure the setup is smooth and safe.

It will also meet your business needs and follow the rules.

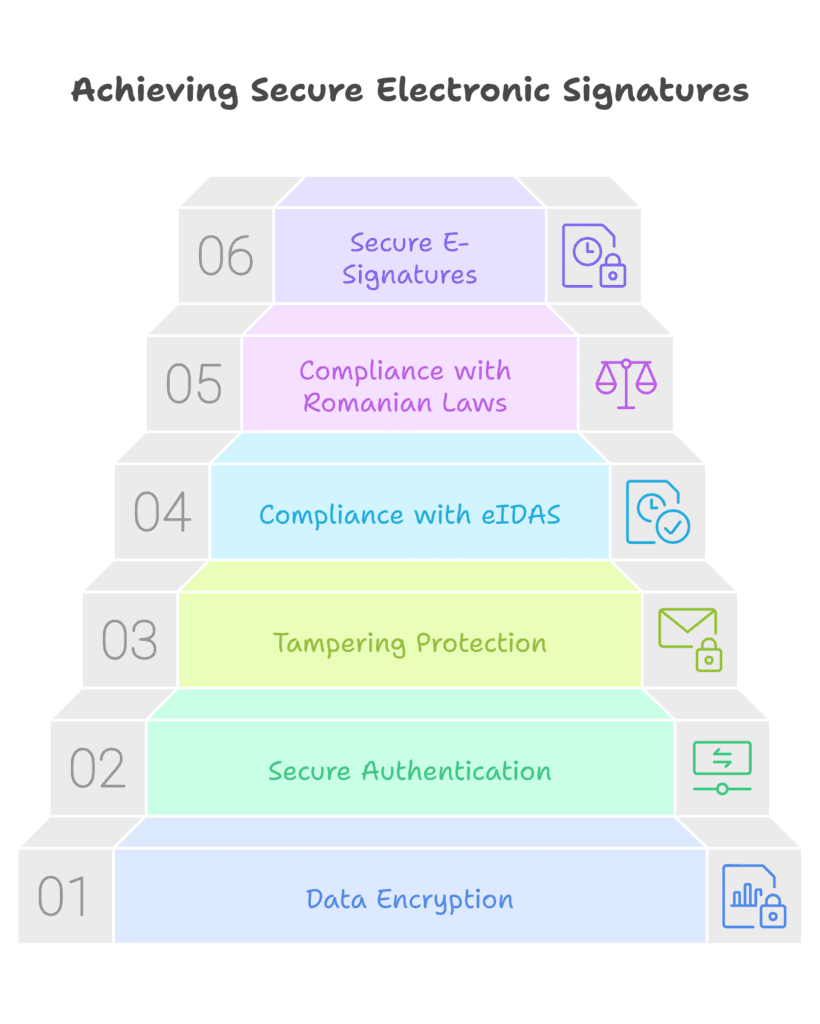

Security Measures and Compliance Standards

To keep electronic signatures in Romania safe, strong security steps and following digital signature rules are key.

This means using data encryption, secure ways to check who you are, and stopping tampering.

Keeping e-signatures safe is vital to stop unauthorized access and keep the signature’s integrity.

Using electronic signatures in Romania means you must follow certain standards.

You need to stick to the eIDAS Regulation and Romanian laws like Law No. 214/2024.

These rules help make sure your electronic signatures are legal and accepted.

Some important security steps include:

- Data encryption to protect sensitive information;

- Secure authentication processes to verify the identity of signers;

- Protection against tampering to prevent unauthorized changes to documents.

By taking these steps and following digital signature rules in Romania, you can keep your electronic signatures safe.

This is important for businesses and people who use electronic signatures in Romania.

It helps avoid disputes and makes sure signatures are legally binding.

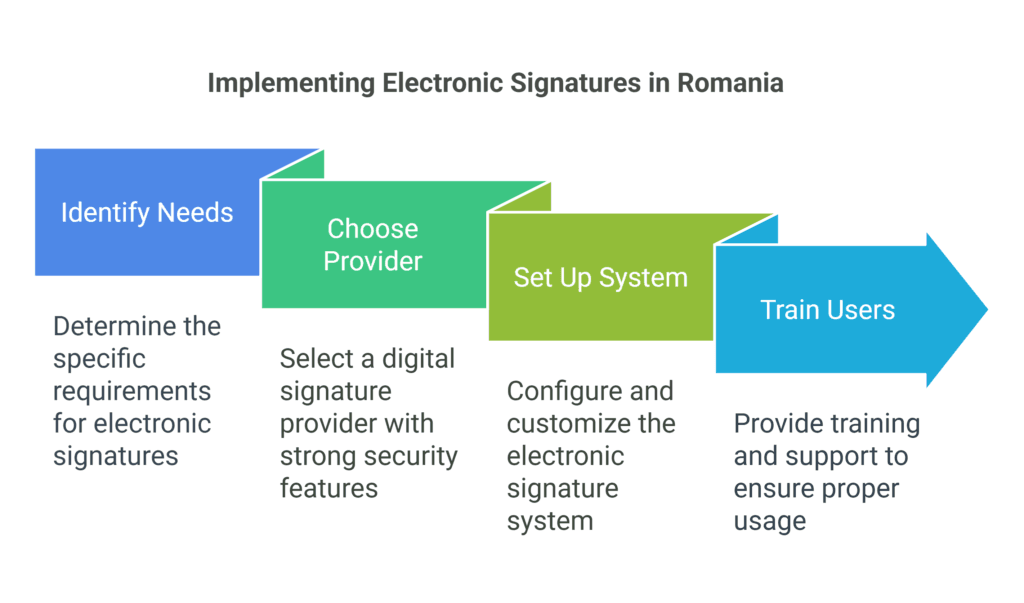

Step-by-Step Guide to Implementing Electronic Signatures

Getting started with electronic signatures is easy if you know the steps.

Romanian businesses can use an electronic signature guide for a smooth transition.

First, pick an e-signature setup that fits your needs.

Think about the documents you’ll sign, the security level, and how many users will use it.

Choosing a digital signature provider in Romania is key. Look for one that offers strong security features like multi-factor authentication and encryption.

Also, make sure they follow important laws like the eIDAS Regulation and the ESIGN Act.

After picking a provider, set up the system.

You might need to customize workflows, create user accounts, and link it with other apps.

A good guide should show you how to do these things clearly.

Lastly, train your users well to make sure they use the digital signatures right.

You can make tutorials, host webinars, or offer personal support.

By following these steps and using a trusted electronic signature solution, Romanian businesses can make signing documents faster and more efficient.

| Electronic Signature Solution | Features | Benefits |

|---|---|---|

| DocuSign | Multi-factor authentication, encryption, audit trails | Improved security, increased efficiency, reduced costs |

| Juro | Customizable workflows, integrations with existing software | Streamlined document signing, improved collaboration, reduced errors |

Business Applications and Use Cases

In Romania, electronic signatures are used in many ways, helping businesses a lot.

They make processes faster, more efficient, and cheaper.

For example, they’re great for signing contracts, invoices, and work documents.

Digital signatures offer a safe and dependable way to sign papers online.

They help businesses work better, cut down on paper, and make customers happier.

They’re useful in HR, sales, buying, and legal areas.

Here are some examples of electronic signature use cases in Romania:

- Contract signing and management;

- Invoice and payment processing;

- Employment document signing and verification;

- Procurement and supply chain management.

Using electronic signatures, Romanian businesses can enjoy many benefits.

They get more done, save money, and keep things secure.

With the right tools, companies can improve their work, customer service, and stay ahead in the market.

Best Practices for Electronic Signature Usage

Using electronic signatures in your business needs careful steps.

In Romania, it’s key to prepare documents well, check who signs them, and keep records.

This makes sure your electronic signatures are legal and follow the rules.

Make sure documents are clear and correct before signing them.

This avoids problems later.

Also, it’s important to check who signs to stop fraud. Digital signature verification Romania helps with this.

Keeping good records of electronic signatures is also important.

Store them safely and easily to find them when needed.

Following these steps helps use electronic signatures safely and legally in your business.

Some important things to think about when using electronic signatures in Romania are:

- Following e-signature guidelines Romania;

- Using digital signature verification Romania to avoid fraud;

- Keeping accurate records of electronic signatures Romania.

By following these best practices and thinking about these points, you can use electronic signatures well and safely.

This keeps your business in line with electronic signature best practices Romania.

Legal Support and Consultation

Dealing with legal matters about electronic signatures in Romania can be complex.

It’s wise to talk to a legal expert.

They can guide you through the legal framework.

For example, lawyers in Romania, like those at tel. no. (004) 0765366887, offer legal advice.

Romanian lawyers specializing in electronic signatures can explain the legal side.

Our team of corporate Romanian Lawyers can advise on using electronic signatures in your business.

This ensures you follow the law and protects your business.

When looking for legal help with electronic signatures in Romania, consider a few things.

You need to understand the legal rules and follow them.

Also, make sure your electronic signatures are valid and enforceable.

This protects your business and reduces risks.

By talking to electronic signature lawyers in Romania, you make sure you’re using electronic signatures correctly.

You’ll also know you’re following the law.

This gives you peace of mind and safeguards your business.

Conclusion

As Romania’s laws change to allow electronic signatures, you’ll see them used more often.

Laws like Law No. 214/2024 make digital signing easy and safe.

No more just using handwritten signatures – electronic signatures are now legal and bring many benefits.

Whether you work in business, government, or are just a citizen, knowing about e-signature future in Romania is key.

Watch for new tech, laws, and tips to keep your digital signature right and useful.

With law backing and more people going digital, electronic signature will be a big part of our lives.

FAQ

What constitutes an electronic signature in Romania?

In Romania, an electronic signature is data linked to other data.

It’s used by the signer to sign.

What are the different types of electronic signatures recognized under Romanian law?

Romania recognizes three types of electronic signatures.

These are simple, advanced, and qualified electronic signatures.

What is the legal framework governing the use of electronic signatures in Romania?

The eIDAS Regulation (EU) No 910/2014 and the Romanian Law no. 455/2001 govern electronic signatures in Romania.

Under what conditions are electronic signatures considered legally binding in Romania?

Electronic signatures are legally binding if they meet certain conditions.

They must be uniquely linked to the signer, identify the signer, and be created under the signer’s control.

What are the technical requirements for implementing electronic signatures in Romania?

To implement electronic signatures, Romania requires specific software and hardware.

You also need certifications from authorized providers.

What security measures and compliance standards must be met when using electronic signatures in Romania?

Organizations must protect data and ensure secure authentication.

They must also follow EU and Romanian regulations to keep signatures valid and secure.

How can businesses in Romania implement electronic signatures effectively?

Businesses should follow a step-by-step guide.

This includes choosing the right solution, setting up infrastructure, and training users on electronic signatures.

What are the common business applications and use cases for electronic signatures in Romania?

Electronic signatures are used in various business areas.

These include human resources, sales, procurement, and legal documents.

They make processes smoother and secure.

What are the best practices for using electronic signatures in Romania?

Best practices include preparing documents well, verifying signatories, and keeping records.

This ensures electronic signatures are used securely and compliantly.

When should businesses in Romania seek legal support for electronic signature matters?

Businesses should seek legal advice for complex legal documents or disputes.

This ensures they follow the laws and regulations.

What is the current legal framework for electronic signatures in Romania as of 2025?

As of 2025, Romania follows the legal framework established by the eIDAS Regulation, which is a regulation by the European Union that provides a standard for electronic signatures across member states.

This framework classifies electronic signatures into three main types: simple electronic signatures, advanced electronic signatures, and qualified electronic signatures.

Each type has different levels of security, legal recognition, and requirements for electronic identification and trust services.

The qualified electronic signature is the only type that has the same legal effect as a handwritten signature, thereby ensuring the highest level of trust for electronic transactions in the internal market.

What are the different types of electronic signatures recognized in Romania?

In Romania, there are three types of electronic signatures recognized under the electronic signature law: simple electronic signatures, advanced electronic signatures, and qualified electronic signatures.

A simple electronic signature is the most basic form and can be as simple as a scanned image of a handwritten signature.

An advanced electronic signature provides a higher level of security and requires a signature creation device that is uniquely linked to the signer.

The qualified electronic signature, which requires a qualified certificate for electronic signatures.

Is the only type that is legally equivalent to a handwritten signature and is often used for high-stakes transactions, such as legal agreements or financial contracts.

What is a qualified electronic signature and how does it differ from other types?

A qualified electronic signature is a specific type of advanced electronic signature that is backed by a qualified certificate for electronic signatures issued by a trusted service provider.

This type of signature provides the highest level of legal assurance and security, ensuring that the signer’s identity is verified and that the signature cannot be repudiated.

In contrast, a simple electronic signature does not have such robust verification and can be easily disputed.